[ad_1]

The Bitcoin worth is at the moment in an unsure scenario. After BTC broke beneath the one-month buying and selling vary between $29.800 and $31.500, the bulls have to date did not recapture this space. A primary try failed on Wednesday at $29.725, a second effort on Thursday at $29.600.

However, the bears at the moment additionally fail to push the value beneath the important assist at $29.000. Through which course the subsequent motion will go is, as at all times, pure hypothesis, however information can provide indications.

Bullish Sign 1: Lowering BTC Provide On Exchanges

Famend crypto analyst Ali Martinez shared an intriguing bullish chart, revealing that solely 2.25 million BTC are at the moment held in recognized crypto alternate wallets. That is the bottom Bitcoin provide on buying and selling platforms since January 2018.

The info means that traders and long-term holders are refraining from promoting and are as a substitute selecting to maintain their BTC off exchanges. This “hodling” habits signifies a optimistic sentiment BTC holders.

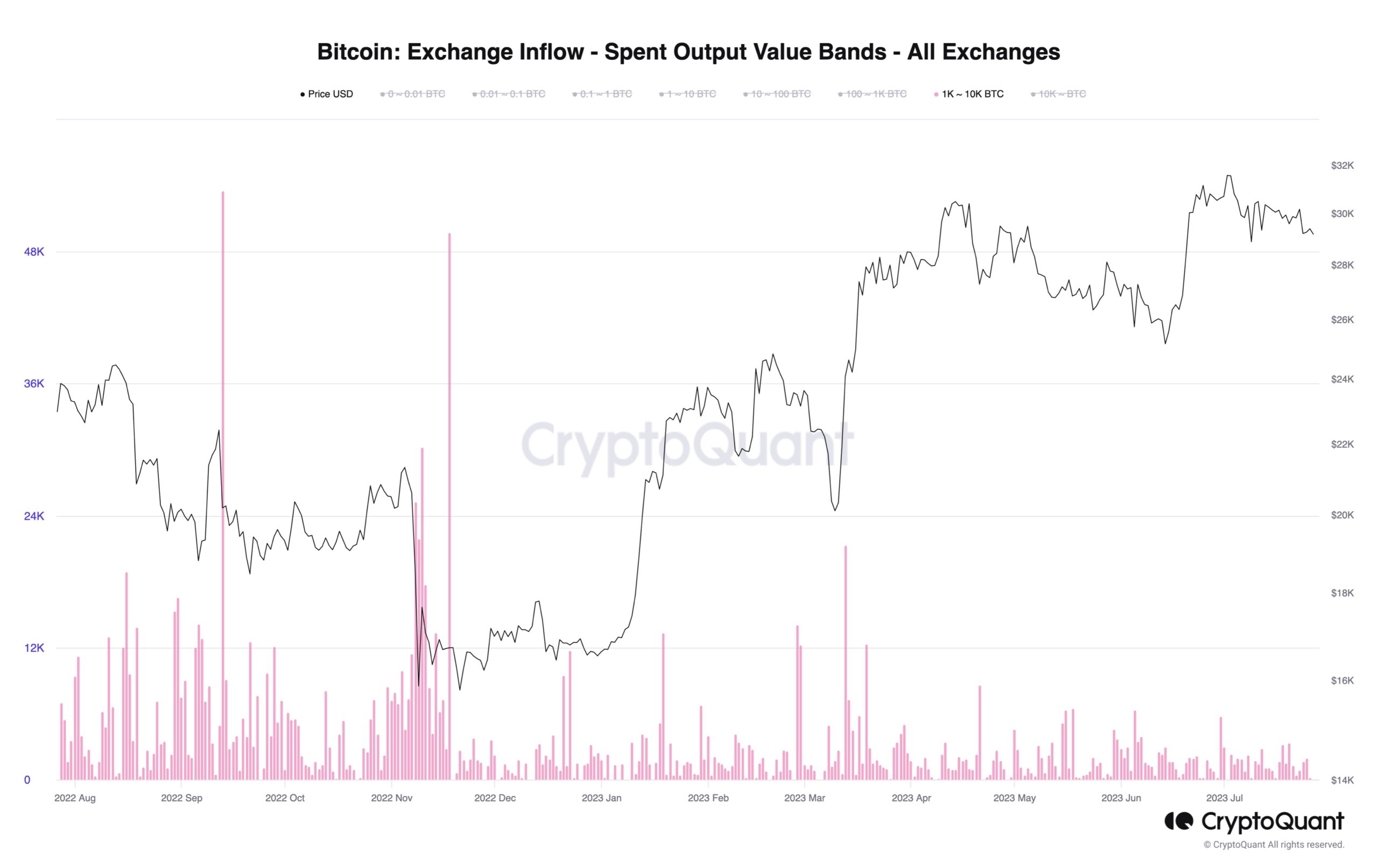

Bullish Sign 2: Lack Of Inflows From Bitcoin Whales

Head of Analysis at CryptoQuant, Julio Moreno, identified one other bullish signal when he shared a chart displaying an absence of inflows from massive traders with 1,000 to 10,000 BTC (aka Bitcoin whales) into exchanges. Moreno said, “”Not likely seeing Bitcoin whale inflows into exchanges.”

Moreover, the identical development is noticed amongst smaller traders, indicating a reluctance to deposit BTC into centralized exchanges. Commenting on the alternate deposit transactions (7-day SMA) chart, Moreno added, “certainly, appears no person desires to deposit into centralized exchanges.”

Such habits means that important holders and establishments are holding onto their BTC property, probably anticipating future worth will increase.

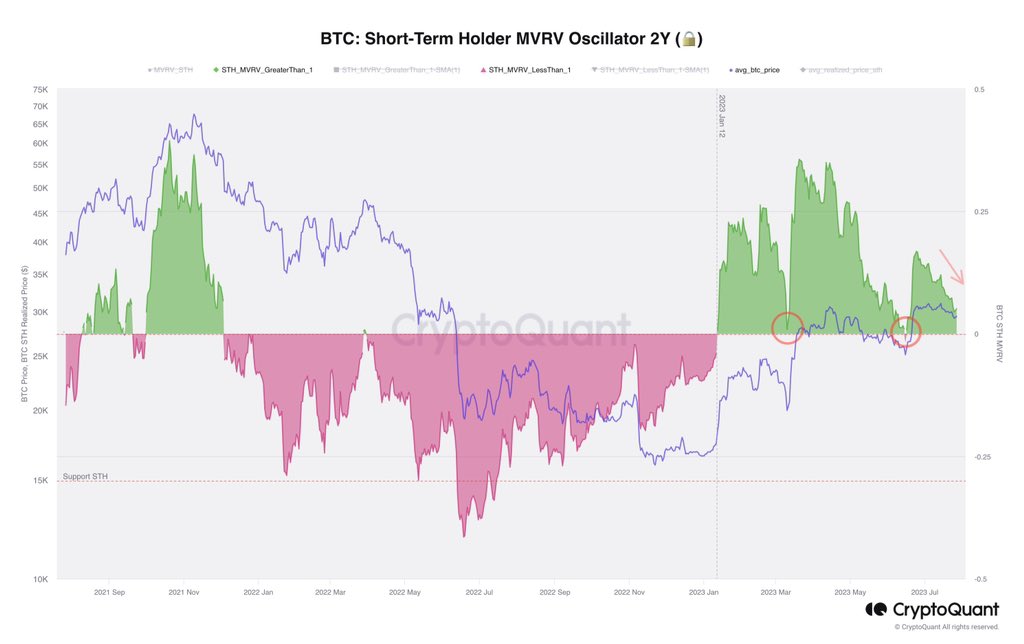

Bearish Sign: Brief-Time period Holder (STH) MVRV Metric

On-chain analyst Axel Adler Jr. addressed the short-term holder (STH) MVRV metric, saying: “STH MVRV is actively falling and we might even see one thing just like what occurred within the two earlier corrections.” The chart proven by Adler reveals that the STH MVRV fell both near 0 and even beneath in the course of the lows of the sharp Bitcoin worth corrections in mid-March and mid-June.

Presently, the STH MVRV continues to be considerably elevated, so a final pullback within the Bitcoin worth triggered by brief time period holder promoting could also be obligatory for the MVRV to reset to 0.

Adler additionally remarked that there isn’t a considerable Influx to futures exchanges in the mean time like there was in March and June. “Don’t count on a pointy breakthrough upwards or downwards,” added Adler.

BTC Binance Spot Liquidity Evaluation

Analyst @52kskew shared a complete evaluation of BTC Binance spot liquidity, highlighting an attention-grabbing commentary. The bid liquidity (bids > asks) and spot asks moved decrease in the direction of worth as a consequence of low volatility. He added, “observe the distinction in quantity resulting in earlier selloff & present falling quantity & minimal decline.”

Given the bid liquidity between $29,000 and $28,500, this space could possibly be the purpose for patrons to step in if BTC experiences a pullback. In a bullish state of affairs, spot shopping for would happen on this space, adopted by a rotation out of shorts. New longs get opened and worth migrates in the direction of spot provide close to $30,000. In a dump state of affairs, worth grinds by spot bid liquidity and compelled promoting happens, says Skew.

Potential Impression of Financial Knowledge On Bitcoin

As well as, it’s essential to control macroeconomic elements that might affect Bitcoin’s worth. The discharge of the Private Consumption Expenditures Worth Index (PCE) at 8:30 am EST in the present day is of explicit significance.

Throughout Wednesday’s FOMC press convention, Fed Chairman Jerome Powell confused the significance of core inflation, which is proving sticky. Due to this fact, the Core PCE particularly, must proceed falling to alleviate the Fed’s inflation considerations. If the 4.2% expectation for core PCE is exceeded, a bullish response from Bitcoin will be anticipated.

At press time, the Bitcoin worth stood at $29,210.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link