[ad_1]

That is an opinion editorial by Daniel Hinton, the top of finance and operations for sFOX, a bitcoin prime dealer and custodian, and Steve Jeffress, creator of Bitcoin UTXO set visualizer UTXO.reside.

We now know learn how to infer the every day worth of bitcoin inside 1% by wanting solely on the unspent transaction output (UTXO) set.

With this, we are able to construct decentralized functions that depend on the UTXO set — slightly than on trusted third-party oracles — for the USD worth utilized in discreet log contracts (DLCs) and good contracts.

The probabilities for decentralized functions on Bitcoin utilizing this “UTXOracle” are huge.

When You Need To Know ‘The’ Worth Of Bitcoin, The place Do You Look?

There is no such thing as a single worth of bitcoin. Each second of the day, there are millions of exchanges, brokers, OTC desks, fee firms and different market contributors around the globe quoting the worth of bitcoin — and none of them is all the time appropriate.

On this article, we are going to discover a brand new approach of decoding the Bitcoin UTXO set that precisely displays a bitcoin worth at every block peak and has the potential to function the muse for a brand new period of trust-minimized, decentralized finance on Bitcoin.

What trust-minimized instruments may you construct if you happen to may calculate an correct worth for bitcoin at every block peak, utilizing solely your Bitcoin full node and an open-source mannequin?

- DLC derivatives (choices, futures, perpetual futures)

- On-chain lending markets

- Peer-to-peer marketplaces

- Bitcoin-backed USD stablecoins on Lightning

- Steady-value USD accounts denominated in bitcoin

- Any use case that requires a USD element

Any certainly one of these ideas, efficiently carried out on the Bitcoin blockchain in a trust-minimized approach, may ship super worth to each Bitcoiners — using bitcoin for its superior financial properties — and contributors within the Bitcoin ecosystem who want to stay partially tied to USD however need to make the most of Bitcoin as their settlement community.

On-Chain Transactions Encapsulate The World Sign Of Financial Weight

In the course of the 2016 to 2017 “Blocksize Wars,” the deserves of not solely working a fully-validating Bitcoin node, however conducting financial exercise utilizing your node, had been convincingly argued in serving to the community keep away from a significant fork that might have delayed Bitcoin’s success.

For functions of our present dialogue, it may be mentioned that this tumultuous time in Bitcoin’s historical past emphasised that, in the identical approach that somebody can run 1 million “full nodes” on a cloud server that sign for a specific “improve” however not affect the community of financial actors in any approach if they aren’t actively settling transactions, centralized exchanges can produce quantity and worth statistics that, in actuality, don’t carry financial weight, and which aren’t mirrored within the UTXOs which might be settled onto the Bitcoin blockchain.

You possibly can briefly give the looks of getting extra bitcoin than you do inside a closed system like an alternate, however so long as there’s a credible risk of withdrawal for settlement to the Bitcoin base layer, any mispricing inside the closed system will ultimately resolve itself again to equilibrium with the exterior market.

For instance, when Mt. Gox was insolvent in 2013 to 2014, but before it officially collapsed, the reported price of bitcoin on the platform was markedly different from other exchanges as a result of the truth that Mt. Gox didn’t have practically as a lot bitcoin because it claimed. Consequently, it wanted to entice new customers to deposit to the alternate in an effort to fulfill withdrawals from present clients. Throughout the Mt. Gox system, the worth may very well be manipulated, however when customers tried to arbitrage the worth again to the market, Mt. Gox collapsed.

In distinction, the Bitcoin blockchain is the toughest ledger on this planet to deprave. It represents all the historical past of financial settlement exercise to have occurred and is the ultimate arbiter of fact with regard to the standing of all bitcoin in existence.

Transactions that matter are settled on the Bitcoin blockchain, not in closed methods. Closing settlement is what issues.

UTXOs Are Created And Destroyed Every Time You Transfer Bitcoin

Folks have a tough time greedy Bitcoin, because it’s unattainable for them to take a bodily coin out of their pocket, level to it, and say, “This can be a bitcoin.”

One analogy I’ve gravitated towards when describing a certain quantity of bitcoin in an individual’s possession is visualizing a person invoice in a bodily pockets. These payments can signify any quantity and are solely good for one use. So, if you could spend $3, and solely have a $100 invoice, you possibly can’t rip off a nook of the invoice. You would wish to spend all the $100 invoice and get your change again. In Bitcoin parlance, every of those payments is a UTXO. Any time you ship bitcoin, you might be spending (and destroying) not less than one UTXO whereas concurrently creating not less than one new one. Should you run any model of the Bitcoin software program, at any cut-off date you possibly can rely up all of the bitcoin contained in present UTXOs to find out precisely how a lot bitcoin at the moment exists.

The truth is, when used collectively, the Bitcoin blockchain and UTXO set are completely correct in figuring out the historical past and present state of the Bitcoin community. This never-before-seen functionality in a decentralized system helped the 19 million bitcoin currently in existence develop to be price several hundred billion dollars.

The Bitcoin software program makes use of models of bitcoin (satoshis) for its inside accounting. Whereas it might be apparent that 1 bitcoin equals 1 bitcoin, this additionally signifies that when somebody desires to “ship $100 of bitcoin,” the contributors on this transaction have to agree on the worth of bitcoin on the time of the transaction to understand how a lot bitcoin this corresponds to.

On Common, 15% Of All Bitcoin Transactions Are In Spherical USD Values

Do you know that many individuals transact bitcoin in spherical USD quantities? Curiously, as a result of that is such a typical incidence, there are clearly-recognizable patterns that exist within the UTXO set that can be utilized to carefully infer the worth of bitcoin at any level up to now or current (see the chart under).

Think about that you’re shopping for bitcoin at an ATM (or shopping for a present card on-line). Will you purchase $100 price or $39.27 price?

Spherical USD values starting from $1 as much as a number of thousand {dollars} are quite common denominations within the Bitcoin blockchain. The truth is, since 2014, there was a rising on-chain footprint of those round-USD-value bitcoin transactions which on some days can account for as much as 25% of every day outputs created.

The USA has by far the largest installed base of Bitcoin ATMs globally. U.S. Bitcoin ATM operators have grown dramatically since 2019 and the Bitcoin UTXO set vividly shows this market’s development as extra individuals select to carry or not less than transact in bitcoin over USD.

Additionally, as seen with purchasers at sFOX, Bitcoin ATM flows are fabricated from practically all buyer buys (placing money into an ATM and receiving bitcoin), so the on-chain footprint of this exercise consolidates indicators at spherical USD values. Different giant bitcoin markets, corresponding to present playing cards, peer-to-peer exchanges, and plenty of different, much less frequent use instances, additionally contribute to this sample of USD-denominated bitcoin utilization.

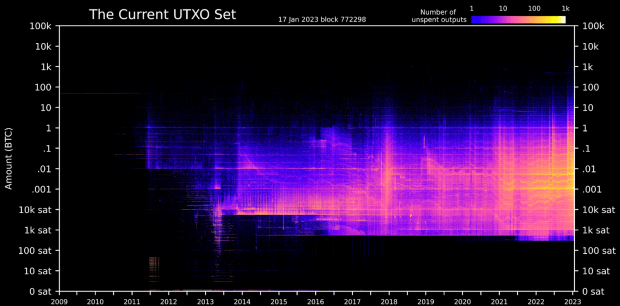

The Bitcoin UTXO Set As Of Block 772,298

There is just one bitcoin UTXO set at any given block peak. This image depicts all the, roughly 70 million UTXOs that comprise all 19 million bitcoin in existence, as of block 772,298.

With Bitcoin being really permissionless, anybody working a fully-validating Bitcoin node has this very same knowledge on their laptop and might independently replicate this very same dataset for this cut-off date. A reside model of this visualization may be seen and interacted with at utxo.live.

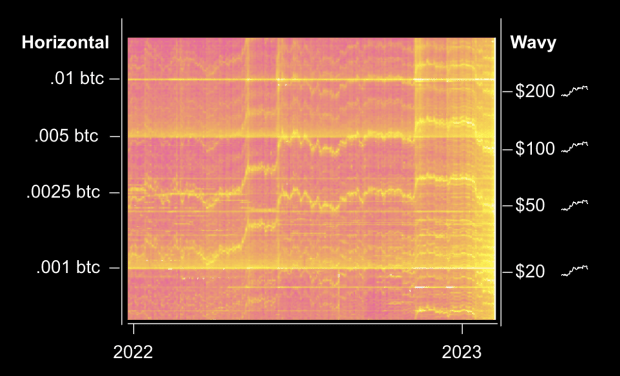

Zooming into the 2022 part of the chart highlights that there are constant patterns within the UTXO set. We’ll deal with two such patterns: Horizontal strains and wavy strains.

Horizontal strains (the flat strains) signify:

- UTXOs denominated in spherical values of bitcoin (e.g., 0.001, 0.005, 0.01, 1, and so forth.)

- Flat at any USD worth as a result of sending 1 btc all the time equals 1 btc

Wavy strains:

- Signify groupings of UTXOs denominated in spherical USD values ($1, $20, $50, $100, $200, $500, $1,000, and so forth.)

- Are very wavy, but parallel to one another as a result of individuals ship in lots of USD denominations and these denominations all transfer in proportion to one another because the BTC/USD worth adjustments

- Transfer inversely to cost. BTC/USD worth will increase trigger the wavy strains to slope down because it takes much less BTC to equal a USD worth as worth strikes up and vice versa.

Making Sense Of The Strains

The truth that horizontal strains exist isn’t all that spectacular. Folks transacting in bitcoin typically transact in spherical quantities of bitcoin.

However the truth that the wavy strains exist clearly and persistently is an enormous deal. It signifies that, given an open-source mannequin, this might assist deliver in regards to the means to:

- Independently calculate the worth of bitcoin utilizing solely your full node at any block peak

- Develop real DeFi functions with out the necessity for (or with out sole reliance upon) trusted third-party worth oracles

The UTXOracle Worth Mannequin Has Native Logic Checks

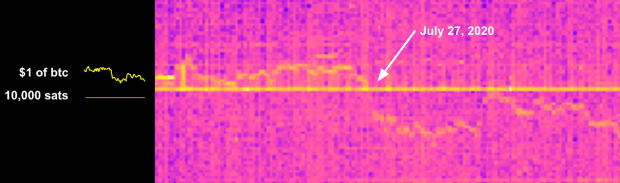

How are you going to simply take a look at the speculation that the wavy strains signify motion of bitcoin denominated in USD? Merely decide a date when you recognize the BTC/USD worth crossed a spherical USD worth and see if the horizontal and wavy strains cross.

One such case is July 27, 2020. Bitcoin was recovering from the March 2020 mayhem and crossed over $10,000 per BTC.

The picture under exhibits the wavy line (USD) crossing down under the horizontal line (BTC) on the similar time that the worth rose above $10,000 per BTC. This specific picture is the ten,000 sat (0.0001 BTC) line, however the identical sample exists at many different BTC denominations as you progress up the UTXO chart.

Nonetheless don’t see it? Zoom in and discover a high-resolution picture at utxo.live.

Clearly, the wavy strains on the chart present transactions denominated in USD.

This has huge ramifications, because the wavy line sample exists in various levels in each block, and is extraordinarily constant over rolling intervals corresponding to each 144 blocks (roughly 24 hours).

The UTXOracle USD Bitcoin Worth Is Fairly Correct

Seeing the horizontal and variable strains cross at spherical USD values is sweet, however a majority of the time, the strains should not very shut to 1 one other. We’d like a strategy to prime a pricing mannequin from these crossing factors that may infer an correct, present worth at any block peak after the mannequin is primed.

Enter the UTXOracle mannequin.

On this preliminary mannequin, an enter date of July 27, 2020, a day when bitcoin rose above $10,000, is used to prime the mannequin to a finest match for that day’s worth. Utilizing solely this single day’s UTXOs, and an enter of that single day’s volume-weighted common worth (VWAP), we’re in a position to create a mannequin that, when used with a future date’s UTXO set adjustments, infers the every day worth of bitcoin with exceptional accuracy from at the present time ahead, using solely the Bitcoin UTXO set with no reference to any exterior worth knowledge after July 27, 2020.

The crimson line is the every day VWAP from sFOX, an aggregator whose worth encompasses the stuffed trades from dozens of exchanges and OTC desks.

The blue line is the UTXOracle every day worth calculation based mostly on every day’s UTXO adjustments.

For the measurement interval of July 2020 to January 2023, the mannequin performs exceptionally effectively, with every day median and every day common variances between the precise VWAP and the UTXOracle worth of 0.65% and 1.04%, respectively, each of that are inside the regular vary of charges charged for bitcoin purchases at retail exchanges.

It’s been mentioned that each one fashions are mistaken, however some fashions are helpful. One key distinction between the UTXOracle mannequin and different fashions that output a bitcoin worth is that the UTXOracle mannequin doesn’t search to foretell a future worth. It merely makes an attempt to deduce an correct present worth based mostly on current blocks and corresponding adjustments within the UTXO set. Provided that the present mannequin has additionally not been high-quality tuned for a finest match and easily makes use of a single primer date for its enter, the mannequin is clearly mistaken — hopefully it may be helpful.

The UTXOracle Mannequin Has Commerce-Offs

If Bitcoin has taught me something, it’s that trade-offs exist. The UTXOracle mannequin isn’t any totally different.

The Bitcoin UTXO set is a ravishing, dwelling monument to the human spirit however attempt as we could, any mannequin created from it won’t absolutely encapsulate the whole thing of the underlying exercise which it represents. A map can’t be as correct because the territory it represents.

The UTXOracle mannequin depends on a number of ideas to operate appropriately:

- Bitcoin UTXO knowledge (free and widely-available knowledge accessed by working a full node)

- Bitcoin worth knowledge to establish a time or collection of occasions upon which to prime the mannequin (based mostly on free and widely-available knowledge)

- A mannequin to use the primer date(s) typically to any date (there are lots of methods to optimize this)

- A approach for customers of the UTXOracle output worth to make the most of the worth in DeFi functions (this wants vital effort to develop)

Folks could create UTXOs at quantities that may mimic the worth being one other stage than actuality.

On centralized venues, people have been known to “spoof” large buy or sell orders in an order e book to make it appear as if there’s a giant purchaser or vendor available in the market, solely to later take away these purchase/promote orders with out truly having any trades stuffed. This will truly transfer markets on centralized venues, however you can’t spoof UTXOs. They both exist in a mined block or they don’t.

It takes a very long time to create a pretend worth sign and it’s apparent when somebody tries to take action.

Presently, it appears as if utilizing a every day UTXOracle sign, slightly than a single block interval, achieves a worth correct sufficient to make use of in follow. This method has the additional advantage of vastly rising the price of assault in mimicking or censoring transactions which might be most helpful in producing the UTXOracle worth at any sure time.

Even when somebody created many UTXOs at ranges mimicking a distinct bitcoin worth, there is no such thing as a mechanism to take away the actual transactions that replicate the correct worth. At finest, an attacker would create a further set of wavy strains.

UTXOs are costly to pretend. There is no such thing as a such factor as “spam” within the Bitcoin blockchain. There are solely transactions that pay a charge to be included in a block. Which means that blockchain knowledge is dear to provide or censor and there’s a actual price of capital in creating UTXOs to pretend a worth sign.

Present mannequin accuracy diminishes after about two years, as is seen within the chart. In follow, it’s doubtless {that a} mannequin will should be recalibrated after some time frame. Altering the mannequin to consider totally different UTXO patterns carries a lot much less danger than altering consensus guidelines in Bitcoin. Until contributors are transacting in multi-year choices/futures contracts on chain, that is doubtless not a significant barrier to make use of.

The present mannequin doesn’t cope with excessive volatility effectively. Mempool variations and worth volatility create conditions the place the UTXOracle worth can briefly range from the centralized alternate worth by greater than 10%. Whereas this may doubtless be improved upon with a extra complete mannequin it does spotlight a possible critical limitation of the sensible use of the mannequin.

Then there may be the AI echo chamber downside: If the mannequin may be very profitable, it might develop into much less efficient. In a world the place many individuals are settling financial exercise utilizing the worth inferred by a UTXOracle mannequin, there might be many further UTXOs settled in spherical USD values. These UTXOs could diminish the mannequin’s accuracy or distort it in different methods much like how a large-language mannequin (LLM) educated on LLM-generated content material won’t match the effectiveness of 1 educated on human-generated content material.

Utilizing A UTXOracle Mannequin In Apply

Adore it or hate it, you recognize the phrase “Ordinal.” Ordinals taught me that folks can coalesce round a technique of decoding the UTXO set that’s technically external to Bitcoin, however which may be solidified on the social layer as a further protocol on prime of Bitcoin.

It’s my hope {that a} sufficiently-accurate UTXOracle mannequin might be produced by somebody which can enable individuals to make use of that model of the mannequin as a schelling level in constructing decentralized functions on Bitcoin.

It’s my additional hope that Bitcoiners can develop a technique of utilizing these a number of competing fashions in a trust-minimized strategy to develop how Bitcoin is ready to deliver monetary peace to the world.

A profitable implementation can be one through which:

- Mannequin inputs are publicly recognized and outcomes are verifiable

- DLC contributors can contest fraudulent outcomes by calculating their very own worth utilizing the mannequin inputs. (A chic resolution to this situation stays an unsolved problem.)

And one through which any of those safety fashions is feasible:

- Peer to look: Two or extra abnormal contributors can make the most of the UTXOracle mannequin with out third events

- Verifiable, centralized oracle attestations: A centralized oracle indicators a message with a specific UTXOracle pricing mannequin that the oracle will use and contributors are in a position to confirm outcomes and punish wrongdoing

- UTXOracle as a quorum member: Use the UTXOracle worth as a logic test in a conventional, centralized oracle mannequin or in a two-of-three or three-of-five multi-oracle setup

UTXOracle Use Instances

DLC Derivatives (Choices, Futures, Perpetual Futures)

This is able to allow customers to purchase or promote contracts in an open market the place outcomes are administered by contributors utilizing a UTXOracle worth.

For instance: Alice deposits an quantity of bitcoin to a DLC-governed handle. Bob pays Alice an quantity of bitcoin denominated in USD (as evidenced by the UTXOracle worth). On the time of settlement, Alice or Bob could produce a signature from an oracle testifying to the worth calculated below the UTXOracle mannequin to find out the settlement stream of funds as expired or exercised.

On-Chain Lending Markets

Customers can borrow or lend in an open market the place the mortgage life cycle is run by contributors utilizing a UTXOracle worth.

For instance: I’ve 1 BTC (at a $100,000 worth) and need to take a partial mortgage of $30,000 with out promoting my bitcoin. I can coordinate with a market-maker to deposit my 1 BTC and the market maker’s 0.3 BTC (at a worth of $30,000) to an handle ruled by a DLC. Upon funding, I could spend the 0.3 BTC for my desired use case.

Regular Mortgage Reimbursement

On this use case, the borrower has the choice to signal a transaction granting the market maker $30,000 in worth of the unique 1 BTC or to deposit $30,000 in worth (as evidenced by the UTXOracle worth) and withdraw the unique 1 BTC.

Upon liquidation, if the worth of the 1 BTC within the DLC-governed handle falls to someplace close to $30,000 (as evidenced by the UTXOracle worth), the market maker can sweep out all the 1 BTC to liquidate the mortgage and recoup their principal.

StableSats

The UTXOracle mannequin additionally provides an fascinating use case round “stablesats,” referring to bitcoin-backed USD stablecoins or stable-value USD accounts denominated in bitcoin on Lightning.

As an illustration, think about that you just need to maintain $1,000 price of bitcoin for the subsequent month. You don’t want to or can not maintain the $1,000 in money, at a financial institution, in Ethereum- or Tron-based stablecoins or on an alternate. You can enter into an settlement with a market maker on the Lightning Community to stream the every day internet worth change in worth to you. You’ll have the ability to independently validate that the proper quantities are being paid through the use of the UTXOracle mannequin you agreed to. On the finish of the month you’ll have a distinct quantity of bitcoin in your Lightning channel, however it is going to be price $1,000.

Peer-To-Peer Marketplaces

As a vendor in a web-based market, it’s at the moment tough to cost gadgets in bitcoin as a result of volatility in addition to the truth that your bills are doubtless in USD. However accepting funds in USD means accepting chargeback danger, fraud and the charges and complexity inherent in fashionable fee methods. Pricing merchandise in USD, however having the flexibleness to just accept a USD worth in bitcoin by way of the UTXOracle mannequin, may encourage extra bitcoin-denominated commerce.

The Subsequent Steps For UTXOracle

As outlined on this article, I consider the UTXOracle mannequin may very well be a strong device in advancing Bitcoin use instances and lengthening monetary freedom to extra of the world. Whereas it has trade-offs, I consider it represents an thrilling frontier that may enhance upon present options that require extra belief in third events.

In case you are excited in regards to the prospect of UTXOracle, I encourage you to hitch the dialogue on Telegram and Twitter.

This can be a visitor put up by Daniel Hinton and Steve Jeffress. Opinions expressed are totally their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

[ad_2]

Source link