[ad_1]

Right here’s how a lot share of the overall circulating provide the ten largest Ethereum whales maintain, in accordance with on-chain knowledge.

Ethereum’s Prime 10 Addresses Have Solely Continued To Develop Their Holdings Not too long ago

In a brand new put up on X, the on-chain analytics agency Santiment has revealed how a lot share of the overall provide is held by the ten largest Ethereum wallets proper now.

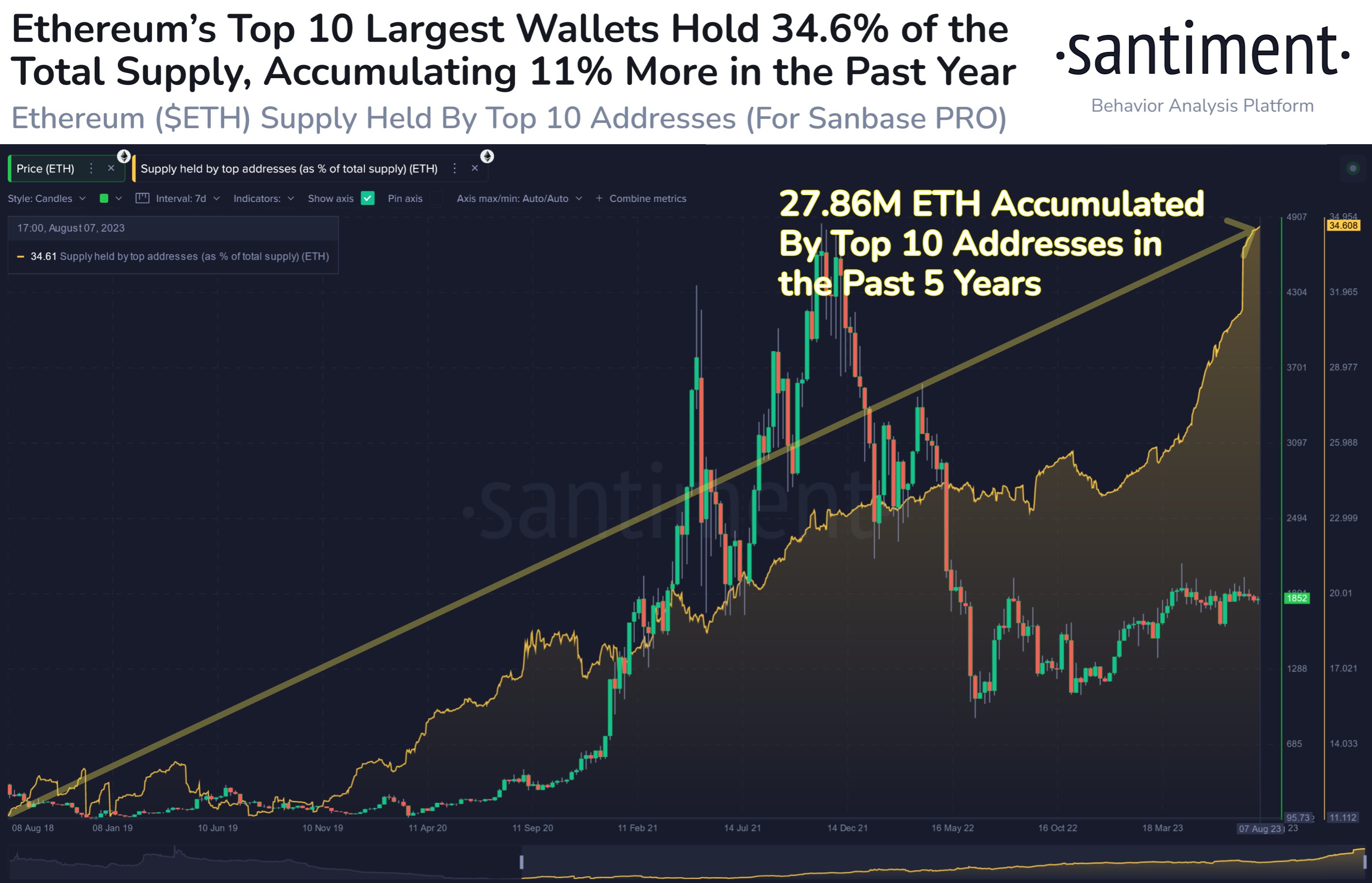

Right here is the chart that shows this metric, in addition to the way it has modified in the course of the previous few years:

Appears to be like like the worth of the metric has been going up in latest months | Supply: Santiment on X

As displayed within the above graph, the proportion of the overall circulating provide held by these whales was solely 11.2% round 5 years in the past. Since then, nonetheless, they’ve consistently expanded their holdings and now maintain 34.6% of the provision.

At present, 34.6% of the provision signifies that they maintain 27.86 million ETH, which is equal to about $51.6 billion. 5 years in the past, the ETH provide seems to have been extra unfold out among the many buyers, however now it appears to be frequently getting extra focused on these ten largest gamers within the sector.

From the chart, it’s seen that a big chunk of this accumulation has come this 12 months alone, as these holders have ramped up their shopping for. By way of the numbers, they’ve bought 11% of the provision throughout the previous 12 months.

Just a few days again, the market intelligence platform IntoTheBlock revealed how wealth distribution differs between Bitcoin, Dogecoin, and Ethereum. For BTC, about 80% of the provision is held by 0.32% of the addresses (which embody Satoshi’s dormant wallets).

For ETH and DOGE, then again, the same share of the provision is managed by simply 0.01% and 0.014% of the addresses, respectively. All three of the cryptocurrencies seem imbalanced in how their wealth is distributed, however BTC remains to be higher off than these two.

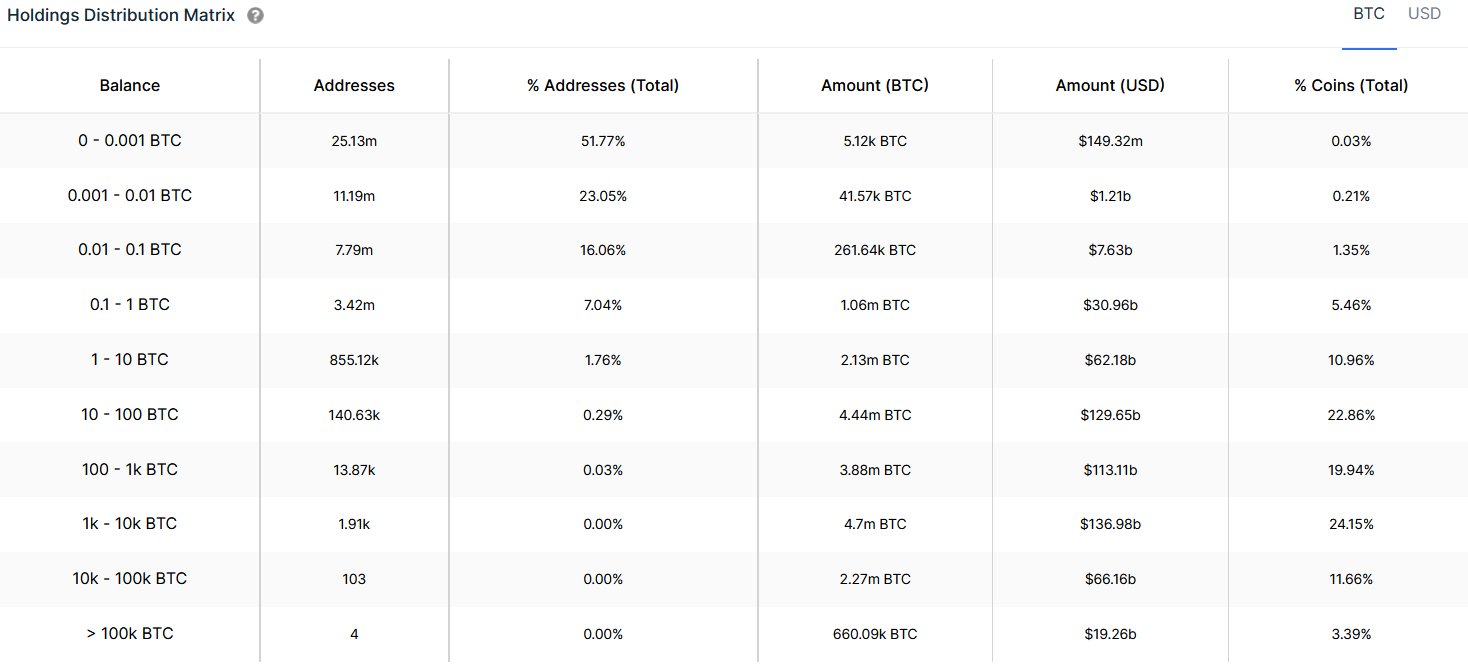

IntoTheBlock additionally broke down the Bitcoin provide knowledge for the completely different pockets ranges in one other latest put up on X:

The quantity of BTC that every cohort holds within the sector | Supply: IntoTheBlock on X

From the desk, it’s seen that the biggest cohort with buyers proudly owning upwards of 100,000 BTC has 4 wallets and these addresses management 3.39% of the provision. The subsequent largest group, the ten,000-100,000 BTC vary, has 103 buyers who maintain 11.66% of the provision.

The highest 10 addresses for BTC would come with the 4 largest wallets, plus the highest six from the subsequent group. However even when all 103 addresses of the subsequent group are included with the highest 4, the overall provide held by these buyers would nonetheless simply be 15.05%, as soon as once more showcasing how the Bitcoin provide is extra decentralized than Ethereum.

Usually, the provision being focused on a couple of holders isn’t very best for the market’s stability, because it signifies that only some palms can transfer their cash round to induce volatility within the worth.

ETH Value

On the time of writing, Ethereum is buying and selling round $1,800, up 1% within the final week.

ETH has been transferring sideways within the final couple of days | Supply: ETHUSD on TradingView

Featured picture from Jievani Weerasinghe on Unsplash.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link