[ad_1]

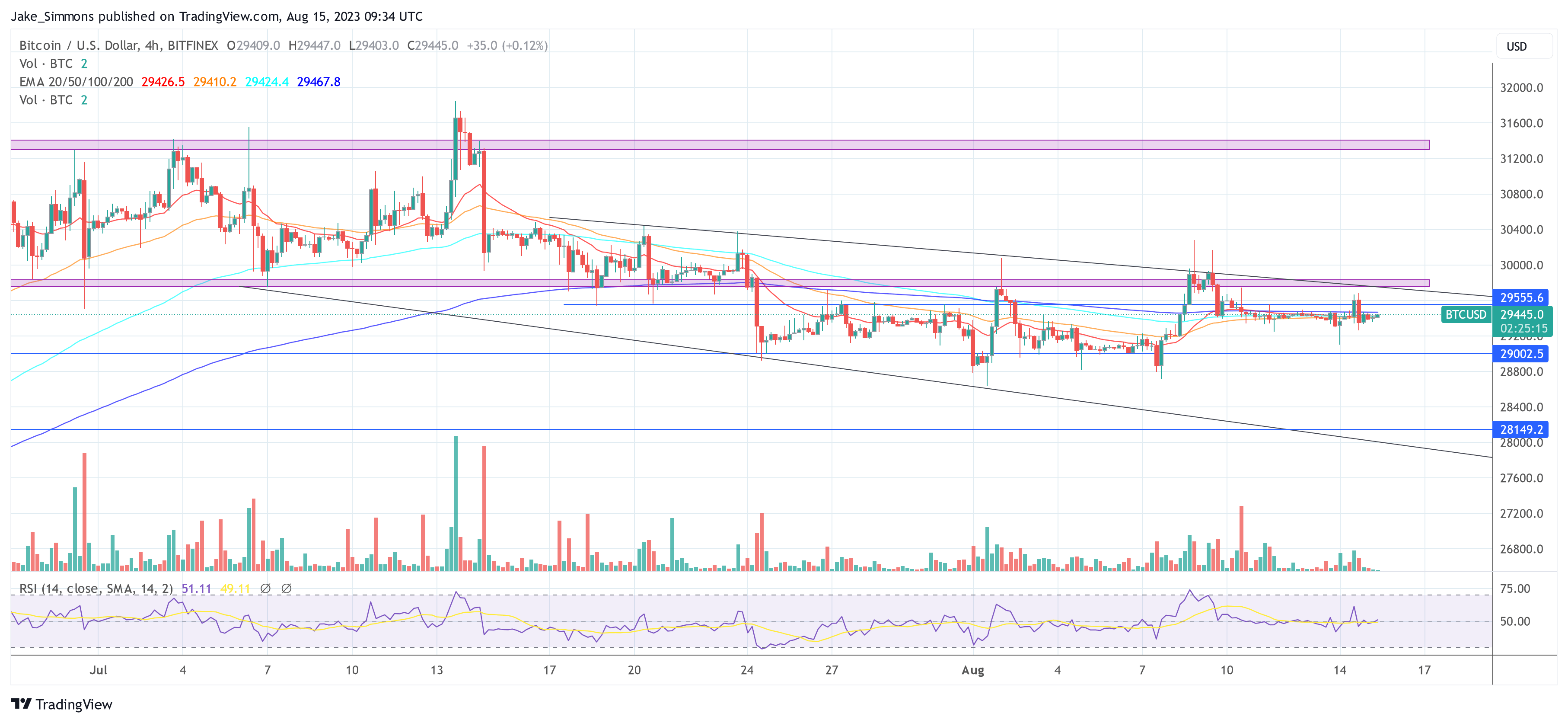

In at the moment’s micro update from Capriole, founder Charles Edwards introduced a compelling evaluation that attracts parallels between the present low volatility of Bitcoin and its historic conduct in 2016. With Bitcoin’s value stagnating across the $29,000 mark, consultants are carefully looking forward to indicators of a possible bullish breakout.

“Bitcoin’s value stays at $29K, in a sideways consolidation that has created one of many absolute lowest volatility intervals in Bitcoin’s 14 yr historical past,” Edwards states. This extended interval of low volatility is harking back to 2016, suggesting {that a} vital value motion might be imminent.

Bitcoin Breakout Imminent?

Whereas the technicals point out a bearish breakdown from the $30,000 mark, the absence of a downward momentum gives a glimmer of hope for bullish traders. “If value was going to break down, we’d often have seen that comply with by by now,” the report notes. Nonetheless, for a extra concrete bullish sentiment, “a detailed again above $30K on the day by day timeframe is required on the minimal as a technical affirmation of a failed breakdown.”

On the basic entrance, Bitcoin’s on-chain information continues to contract, albeit at a decelerating fee. The upcoming choices on several Bitcoin ETF approvals might doubtlessly disrupt the present low volatility section. “An approval might trigger a break from the present low volatility vary. Finest to not pre-empt this although, as these choices typically get pushed. Confirmations are key to mitigate threat,” Edwards cautions.

Diving deeper into the technicals, the report highlighted two key observations:

Since 2010, Bitcoin’s historic volatility has solely been decrease than at the moment in 2016. Suggesting an enormous value transfer is on the horizon when volatility enlargement (reversion to the imply) happens.

Bitcoin’s $30K breakdown has (thus far) did not comply with by… An in depth again into the Wyckoff construction at $30K would signify a failed breakdown and subsequently be a really constructive technical sign.

BTC On-Chain Indicators Are Impartial

Capriole’s Bitcoin Macro Index, a complete device that amalgamates over 40 Bitcoin on-chain, macro market, and equities metrics right into a machine studying mannequin, at present scores at -0.36, indicating “Contraction”. This implies that whereas the short-term outlook stays impartial, the long-term perspective seems bullish. Remarkably, this technique takes long-only positions in Bitcoin. In slowdowns and contractions, money is held.

“The Macro Index at the moment stays in a interval of relative worth (under zero), suggesting respectable long-term worth for multi-year horizon traders,” the report elucidated.

A noteworthy addition to Capriole’s evaluation toolkit is the “Bitcoin Manufacturing Value” mannequin, which evaluates the price of mining a Bitcoin based mostly on world common electrical consumption. Presently, this mannequin signifies that Bitcoin is buying and selling inside a long-term worth area, with the report speculating, “I might be stunned if this holds into 2024.”

In conclusion, the evaluation from Capriole paints an image of potential long-term worth amidst the present bearish technicals. Drawing parallels with 2016, the report means that Bitcoin’s present low volatility section might be a precursor to a bullish breakout.

“All else equal, Bitcoin is sort of a seaside ball submerged underwater. Nonetheless, we stay in a technical breakdown. We don’t understand how lengthy that hand will maintain the ball underwater for. Prudent risk-management will await a technical affirmation earlier than appearing.”

With the cyclical nature of Bitcoin’s enlargement and contraction cycles, solely time will inform if historical past will certainly repeat itself; particularly with the backdrop of a completely totally different macro setting. At press time, the BTC value remained stagnant, buying and selling at $29,445.

Featured picture from André François McKenzie / Unsplash, chart from TradingView.com

[ad_2]

Source link