[ad_1]

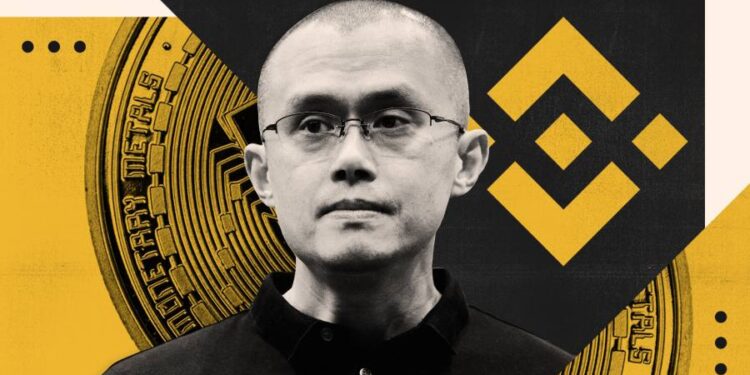

As 2022 drew to an in depth, Binance co-founder and chief government Changpeng Zhao appeared to have the world at his toes.

Sam Bankman-Fried, co-founder of Binance’s largest rival FTX, went to Zhao in November final 12 months hoping the Binance chief would bail out his personal alternate. Zhao declined, sealing FTX’s destiny. On November 10, someday earlier than his crypto empire filed for chapter, Bankman-Fried tweeted his competitor: “Effectively performed; you gained.”

The collapse of its largest rival left Binance the undisputed chief in digital belongings, controlling greater than half of the fast-evolving cryptocurrency market by the top of 2022.

If Binance might journey out the regulatory onslaught that adopted the FTX implosion, it could be the go-to venue for buying and selling crypto tokens, and Zhao might set up himself because the “acceptable face” of crypto, a piece of economic markets that many nonetheless regard because the Wild West.

“Many individuals checked out Sam Bankman-Fried to be the chief of the business and put it aside within the face of regulators,” says Charley Cooper, a former chief of employees on the Commodity Futures Buying and selling Fee. “When [FTX] collapsed, all people turned to Zhao because the potential future saviour for the business.”

However whereas the costs of main cryptocurrencies like bitcoin stabilised in greenback phrases after FTX’s collapse, Binance has struggled. Its dimension meant it grew to become a transparent goal for regulators and lawmakers searching for to make sure the broader monetary markets would by no means be contaminated by a crypto alternate that had turn into “too large to fail”.

Within the US alone, monetary watchdogs have accused Binance of illegally serving American clients, inappropriately controlling shoppers’ belongings, and disregarding compliance and anti-money laundering requirements.

Binance’s dimension isn’t only a drawback for regulators. Crypto evangelists concern its success is an existential drawback for an business that champions decentralised finance the place nobody actor or entity holds an excessive amount of sway.

“Binance’s struggles underscore a elementary problem confronted by the crypto business,” says Charles Storry, head of progress on the DeFi mission and on-chain index fund supplier Phuture. “The strain between main centralised entities . . . versus the business’s unique ambition of a brand new type of finance constructed on the tenets of decentralisation, transparency and an equal enjoying area.”

Binance mentioned it believed “wholesome competitors” was good for the business and it was targeted on rising the business “general”.

However whether or not and the way its future is resolved will assist decide if crypto turns into part of mainstream finance, or stays a distinct segment business beloved by these wishing to separate cash from the equipment of state.

Development in any respect prices

In an inner textual content message despatched in late 2017, shortly after the start of his crypto alternate, Zhao issued a rallying name to his staff: “All the things you do must be geared toward rising our market share,” he mentioned.

“Different issues like revenue, revenue, consolation, and so forth. come second. When you’ve got two issues you are able to do now, ask your self, which one shall be extra useful to our market share, and try this first,” he added.

What occurred to the exchanges: FTX

Founder and chief government: Sam Bankman-Fried

FTX’s collapse in November final 12 months adopted a surge of buyer withdrawals, which have been prompted by issues over its monetary well being.

Binance mentioned that “as with all start-up, the primary precedence was to increase the enterprise as shortly as doable” however that “today, we see Binance as a really small a part of a a lot bigger monetary ecosystem”.

A Canadian citizen who was born in China, Zhao studied pc science and reduce his tooth on buying and selling software program, together with for the Tokyo Inventory Change, earlier than pivoting to crypto in 2013. Within the years that adopted, the person higher identified in crypto circles by the moniker “CZ” grew to become a family identify on this planet of digital belongings.

Below his management Binance shortly grew to become the world’s largest crypto alternate. By January 2018, solely six months into its existence, Binance had a 26 per cent market share and inside a 12 months of its inception its workforce spanned not less than 27 international locations, based on inner firm paperwork seen by the Monetary Occasions.

Like many younger tech corporations, it had an aggressive progress tradition. “We need to spend 2 per cent of time making choices, and 98 per cent of time doing them,” Zhao mentioned throughout an inner assembly in Binance’s Shanghai workplace a recording of which has been seen by the FT. “Our aggressive benefit to this point is as a result of we do issues, we execute, we get shit completed. It’s all about getting shit completed.”

An onboarding doc, seen by the FT, reads: “When you simply sit there ready for another person to come back and let you know what must be completed, you could possibly be ready for a very long time. Truly, normally not too lengthy, as somebody is probably going going to come back and let you know to get off the workforce.”

Binance didn’t reply on to questions on Zhao’s assertion or the onboarding doc, referring as an alternative to a weblog put up in regards to the firm’s rules and tradition.

Zhao constructed up a loyal following that defends him towards “FUD”, business parlance for “concern, uncertainty and doubt”. A key a part of this following are the so-called Binance Angels, described by the corporate as “volunteers” who assist the Binance group and advance the crypto trigger.

An individual accustomed to the operation says Binance Angels are literally an integral a part of the working of the corporate. “They might translate for us, arrange native occasions, assist us perceive the legal guidelines, handle communications and assist order native firm merchandise,” the particular person provides.

The corporate instructed the FT its “Angels” have been passionate ambassadors that supported the Binance group in numerous methods.

Binance’s early years have been additionally outlined by the high-profile excesses that usually characterise optimistic start-ups searching for to alter the world. In the summertime of 2018, Zhao accompanied each Binance worker on the time on a visit to Thailand to mark the corporate’s first 12 months.

In footage of the journey seen by the FT, Zhao stood on a seaside lined with yachts amongst roughly 100 Binance staff who unveiled an indication marking the milestone.

Binance mentioned its dimension now precluded such occasions. “When the corporate was smaller, it was simpler to do journeys like this.”

Its speedy progress within the crypto scene was shrouded in company secrecy. In the summertime of 2018, a safety warning instructed staff to restrict their social networks to first-degree acquaintances, flip off geotagging on digital gadgets and keep away from broadcasting private info to uncontrolled audiences.

“Reserve your social media house for household and buddies. Test that there are not any suspicious folks in your Fb, Twitter, LinkedIn, and Instagram accounts,” the warning learn.

Binance mentioned it had made clear to employees that non-public social media profiles created “the next threat for focused phishing and different social engineering assaults.”

What occurred to the exchanges: Coinbase

Co-founder and chief government: Brian Armstrong

Nasdaq-listed Coinbase has additionally run into hassle with regulators within the US. The SEC sued the alternate in June this 12 months, alleging it violated securities legislation. Coinbase denies the allegations.

He Yi, Binance’s lesser-known co-founder, as soon as described the corporate in an inner textual content message as “the 007 organisation”. A Binance spokesperson mentioned that “as with something, context is the whole lot”.

One former Binance worker says the corporate’s becoming a member of course of included “a particular slide that instructed you that in case you posted on social media that you simply have been a Binance worker, you’d get fired”. The corporate denied this declare.

“Working for a authorities company is the one factor I can consider the place you can not actually say the place you’re working — at a monetary establishment, it by no means occurs,” the particular person provides. An onboarding doc instructed these becoming a member of the corporate to “set up a VPN on all gadgets, computer systems or cellphone”. Binance instructed the FT it thought-about safety “crucial” and VPNs add a layer of safety for a cellular employees.

Regulators circle

Binance’s early and speedy progress was aided by the haze of regulatory uncertainty that surrounded the brand new phenomenon of cryptocurrency. Describing himself as “pushed by freedom,” Zhao declared to a gaggle of staff through the Shanghai assembly that he didn’t like “loads of guidelines” and exploited a degree of definitional controversy that is still on the epicentre of the crypto business to today.

“What’s a cryptocurrency? Is it a safety, is it a commodity, is it one thing else?” he mentioned throughout the identical assembly. “I disregard loads of the totally different nation’s interpretations of that, although a few of them could also be considered legislation.”

Requested about these feedback, a Binance spokesperson mentioned the corporate recognises it “made errors” in its early days however that following heavy funding in expertise, processes, and expertise “we’re a really totally different firm as we speak with regards to compliance.”

The younger crypto start-up bumped into regulatory hassle simply months after its inception when Beijing banned preliminary coin choices, describing the issuance and sale of tokens as “unapproved and unlawful public financing”. The transfer successfully ended any chance of the alternate working legally within the nation.

Binance then expanded into Japan, albeit and not using a licence from regulators there. Staff have been instructed in an inner communications channel to not use a Binance e mail tackle when speaking with exterior entities within the nation.

The corporate says it has “taken steps to make sure the very best ranges of compliance” in Japan and bought a licensed alternate there in November.

What occurred to the exchanges: Celsius

Co-founder and chief government: Alex Mashinsky

As soon as one of many world’s largest crypto lending platforms, Celsius filed for chapter final summer time when the digital belongings market fell into disaster.

Three years after Binance’s seaside vacation in Thailand, the Thai Securities and Change Fee filed a felony grievance towards the alternate for allegedly working a digital asset enterprise there and not using a licence. Binance mentioned a three way partnership, Gulf Binance, has now been licensed and controlled in Thailand.

As Binance grew, so too did the record of regulators who clashed with crypto’s fastest-growing store. In August 2021 the UK’s Monetary Conduct Authority mentioned it was “not succesful” of correctly supervising Binance after the corporate allegedly failed to answer primary queries.

One month later, the Financial Authority of Singapore positioned Binance on an investor alert record, warning customers the alternate was not regulated or licensed within the city-state. Regulators within the Netherlands additionally got here after Binance, fining the alternate greater than €3mn final 12 months.

“We felt like rebels upending the monetary system and getting chased out of nations,” says a former Binance worker. The corporate responded that whereas rising quickly “we made some preliminary mis-steps which have now been rectified”.

Binance’s run-ins with monetary watchdogs made it troublesome for the corporate to determine a everlasting base and Zhao usually claimed the corporate had no formal head workplace.

However in Could 2022, regulators in France allowed one of many alternate’s subsidiaries to behave as a registered digital belongings service supplier. Zhao mentioned the nation would not less than function its regional headquarters.

“In the course of the time once I was going to the workplace in Paris, it was clear it was crucial workplace [for Binance],” says one former worker. “Zhao wasn’t actually coming to the workplace however on quite a lot of events he was in Paris . . . type of advertising and marketing their workplace in Paris. They made it actually apparent,” the particular person provides.

However in June this 12 months, French police opened an investigation into the alternate over allegations it illegally marketed its companies to customers and didn’t perform enough checks to forestall cash laundering. Binance says it operates legally in France and is co-operating with the authorities there.

Onslaught in America

Binance’s post-FTX honeymoon on the summit of the crypto business didn’t final lengthy. Initially of 2023, the Securities and Change Fee opposed Binance’s deliberate $1bn acquisition of the belongings of bankrupt cryptocurrency lender Voyager. The deal was later deserted.

In February, the New York Division of Monetary Companies ordered a halt to the issuance of BUSD, a Binance-branded crypto token designed to trace the worth of the US greenback, which as soon as accounted for roughly two-fifths of Binance’s buying and selling quantity.

In March, the Commodity Futures Buying and selling Fee sued the crypto alternate, alleging it illegally accessed US clients and that a lot of the corporate’s reported buying and selling quantity and profitability got here from “in depth solicitation of and entry to” US clients.

In its lawsuit towards the alternate, the CFTC alleged a Binance government in 2020 mentioned that sure clients, together with some from Russia, have been “right here for crime”. An worker allegedly replied to their colleague: “We see the dangerous, however we shut two eyes.” Binance beforehand described the lawsuit as “sudden and disappointing”.

Three months later the Securities and Change Fee, which regulates inventory and bond markets within the US, filed 13 civil prices towards Binance-related corporations, together with its American arm Binance US, in addition to Zhao himself.

Gary Gensler, the SEC chair, accused Binance of partaking in “an in depth internet of deception, conflicts of curiosity, lack of disclosure, and calculated evasion of the legislation”.

Binance’s offshore buying and selling platform mentioned on the time that it was upset and disheartened by the SEC motion, whereas its US affiliate referred to as the go well with “baseless”.

As official scrutiny of Binance has intensified, its share of the crypto spot market has fallen to 40 per cent, based on the newest knowledge, after six consecutive months of decline.

Binance’s persevering with regulatory struggles have additionally been mirrored within the calls for positioned on its employees. Some really feel the group’s gung-ho tradition has been changed by one thing extra cut-throat.

“We all know that Binance will not be for everybody,” the corporate responded. “We even wrote a weblog about causes to not be a part of Binance. Tradition match is essential.”

“Though they need to present Binance is a group . . . it’s probably not an organization the place you’re feeling revered or valued,” says a former worker. One other departed staffer says: “I used to be instructed I’d been let go, and instantly after that I acquired a message from human assets saying they have been sending somebody to choose up my laptop computer and cellphone.”

Binance mentioned it disagreed strongly with the characterisation that “staff don’t really feel revered or valued” however added that it restricted threat by acquiring firm gadgets from staff who have been leaving.

This summer time, the corporate deliberate a spherical of job cuts impacting what was, on the time, its roughly 8,000-strong workforce. The alternate mentioned the cuts have been “not a case of proper sizing”, however one particular person accustomed to the matter responded by saying “it doesn’t take a genius” to know that market forces might immediate the corporate to refocus its assets.

Going through regulatory intervention and shedding market share, a weakened Binance is now not only a drawback for Zhao. A complete sector that had craved a interval of stability has as an alternative obtained extra turmoil. For Cooper, the previous CFTC government, this was not shocking.

“The concept essentially the most scrutinised crypto firm was going to be the saviour of a newly scrutinised business was foolish,” he says.

“When you’re on this business for the lengthy recreation, and also you’re looking for the regular long-term gamers, you’ll discover that Binance is something however.”

[ad_2]

Source link