[ad_1]

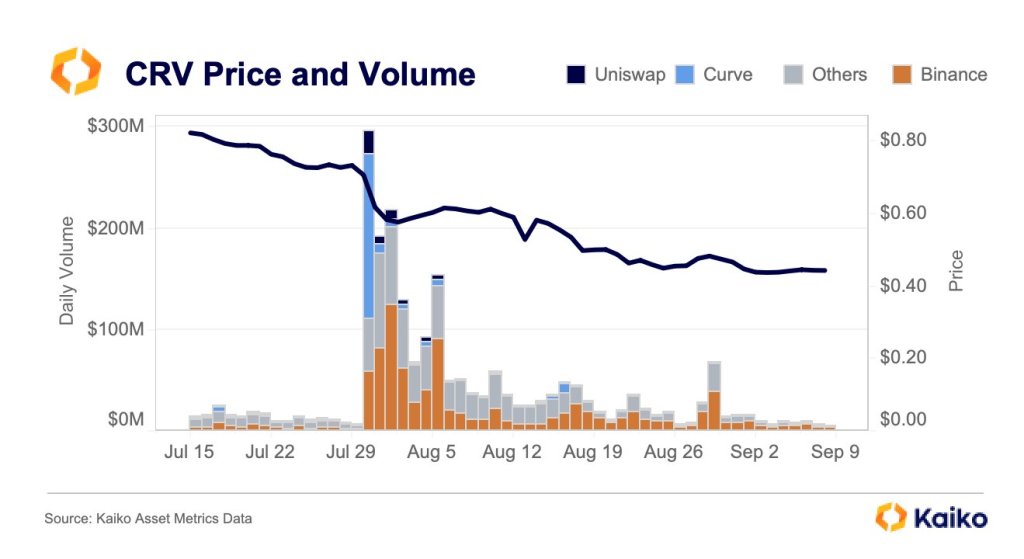

Buying and selling volumes related to CRV, the governance token of Curve, a stablecoin decentralized trade (DEX), is down 97% barely two months after it was hacked in late July 2023. Based on Kaiko, CRV’s buying and selling quantity in centralized exchanges, particularly Binance, the place the token is actively traded, fell from almost $300 million in late July to $7 million as of September 12.

Trackers show that CRV is on the market for buying and selling in a number of centralized and decentralized exchanges, together with Binance, Uniswap, and Curve. Nevertheless, contemplating the recognition and liquidity standing of Binance, most CRV buying and selling was focused on the world’s well-liked crypto trade.

As an example, Binance’s share of CRV buying and selling is about 20% when writing, whereas Bitbox is subsequent with a dominance of round 7%.

Curve’s TVL, Value, And Buying and selling Volumes Collapse

In crypto, a drop in buying and selling quantity usually signifies waning curiosity in a digital asset or common warning practiced by buyers. With falling quantity, the asset’s liquidity takes a success as merchants or buyers choose out, even liquidating the coin as they select stability and refuge. Generally, they’ll undertake a wait-and-see method, evaluating how the token will react in gentle of adjusting market circumstances.

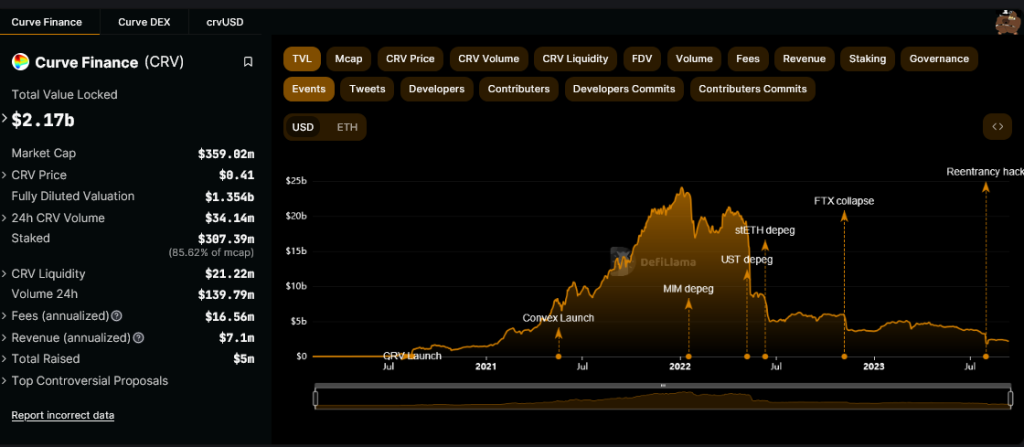

Based on DeFiLlama, Curve has a complete worth locked (TVL) of roughly $2.17 billion, down from $3.25 billion when the protocol was hacked. The decline in TVL and buying and selling volumes comes amid the final lull within the decentralized finance (DeFi) scene.

The drop in CRV valuation and buying and selling volumes was worsened by the July exploit, which noticed the protocol lose over $50 million price of property. Though Curve recovered most of these funds, the impact of the exploit known as into query the final state of safety.

The Hack And Erogov’s CRV Disposal

Within the July hack, malicious actors exploited varied Curve stablecoin swimming pools utilizing older variations of Vyper, a programming language used to create good contracts on Ethereum. All Curve’s swimming pools are automated, and this function allowed hackers to empty a number of swimming pools via a re-entrancy assault.

CRV reacted to this hack by dropping, falling sharply on July 30 from round $0.74 to $0.48. It has since exceeded halved, crashing to $0.40, a brand new 2023 low.

Throughout this time, Curve’s CEO, Michael Egorov, needed to promote CRV holdings he had used to again his loans by way of over-the-counter (OTC) to entities and people equivalent to Justin Solar when costs began falling. Egorov had taken out loans on Aave and Frax Finance secured by CRV.

Characteristic picture from Canva, chart from TradingView

[ad_2]

Source link