[ad_1]

Famend crypto analyst EGRAG Crypto has unveiled a recent XRP worth prediction, introducing the neighborhood to a less-known indicator, the “Common Sentiment Oscillator” or ASO. Commenting on its significance, EGRAG explained on Twitter right now: “Thrilling ASO Replace Alert! Take a look at the put up from September ninth to witness the spectacular ascent and curve of the bullish development! The momentum is ablaze, with an unstoppable surge towards that coveted bullish cross! #XRPArmy, HOLD STEADY! The upcoming ASO bullish cross is the spark that may ignite the upcoming XRP bull run!”

Right here’s When The Subsequent XRP Bull Run Might Begin

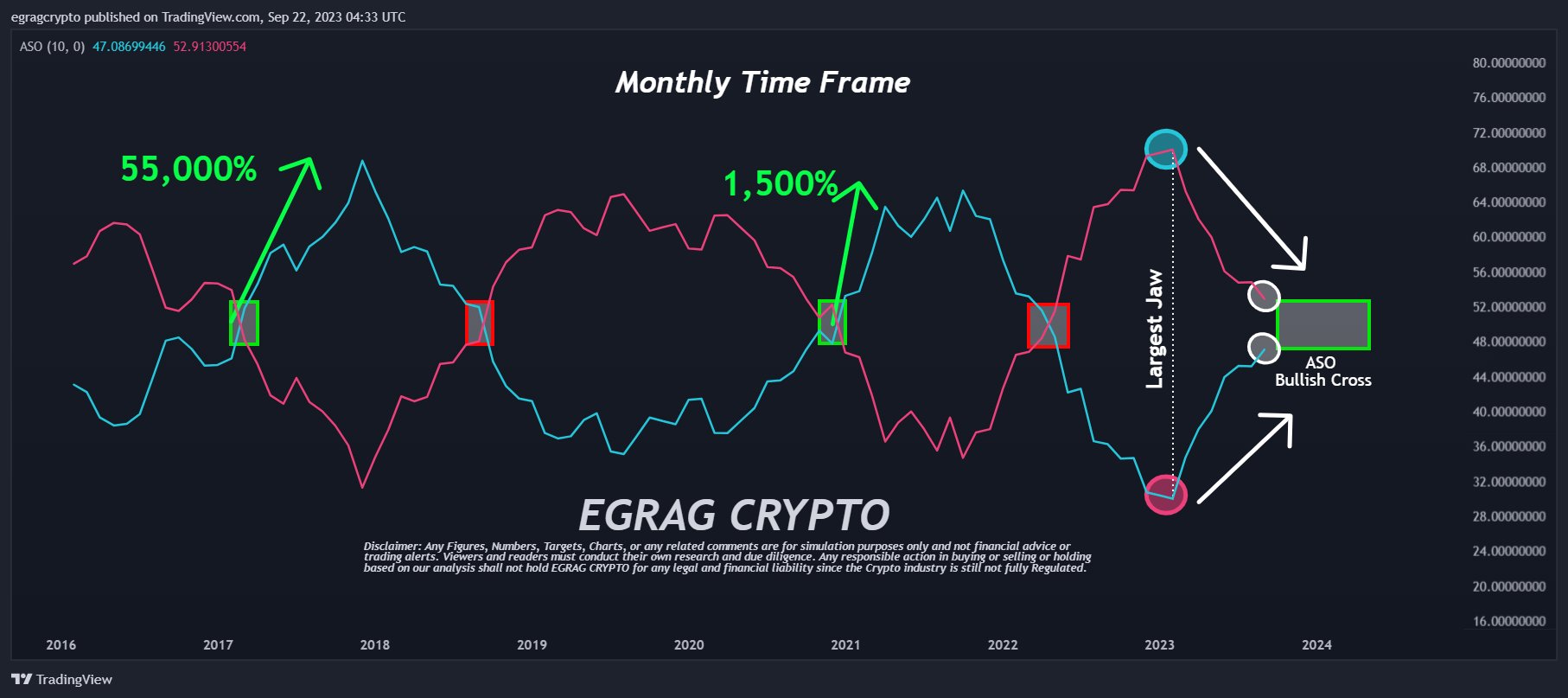

From the chart introduced by EGRAG, the convergence of the blue line (representing bulls) and the purple line (representing bears) is clear. By demarcating a yellow field on this chart, EGRAG anticipates the bullish crossover to manifest between the conclusion of 2023 and the graduation of the second half of 2024.

Historic knowledge reveals that XRP has already undergone this bullish crossover on two prior events. The primary, in 2017, witnessed a meteoric 55,000% rise in XRP’s worth. The next incidence, spanning late 2020 to April 2021, noticed XRP recognize by a commendable 1500%. EGRAG underscores the magnitude of the present scenario by noting the presence of “the biggest jaw” ever, resulting in hypothesis that the following XRP rally may dwarf earlier ones.

EGRAG’s September replace introduced substantial insights, underscoring the notable shift within the ASO and the build-up of simple momentum in the direction of the bullish cross. In his phrases, “there’s an simple momentum constructing in the direction of that coveted bullish cross.”

First, EGRAG had outlined the oscillator’s outstanding potential in March, describing it because the harbinger of a monumental bullish setup, showcasing the depth of market volatility and the contrasting power/weak spot of an asset. He emphasised, “The Mom of all #Bullish Set-Ups is upon us,” pointing to the spectacular setups constructing in each the three Weeks Time Body (TF) and Month-to-month TF.

A Deep Dive Into ASO

The ASO serves as a momentum oscillator, offering averaged percentages of bull/bear sentiment. This device is advisable for precisely gauging the sentiment throughout a selected candle interval, aiding in development filtering or figuring out entry/exit factors.

Conceptualized by Benjamin Joshua Nash and tailored from the MT4 model, the ASO employs two algorithms. Whereas the primary algorithm evaluates the bullish/bearish nature of particular person bars primarily based on OHLC costs earlier than averaging them, the second assesses the sentiment proportion by contemplating a bunch of bars as a single entity.

The ASO shows Bulls % with a blue line and Bears % with a purple line. The dominance of sentiment is represented by the elevated line. A crossover on the 50% centreline signifies an influence shift between bulls and bears, providing potential entry or exit factors. That is notably efficacious when the common quantity is critical.

Additional insights could be derived by observing the power of developments or swings. For example, a blue peak surpassing its previous purple one. Any divergence, like a second bullish peak registering diminished power on the oscillator however ascending within the worth chart, is clearly seen.

By setting thresholds on the 70% and 30% marks, the oscillator can perform equally to Stochastic or RSI for buying and selling overbought/oversold ranges. As with many indicators, a shorter interval supplies superior indicators whereas an extended interval reduces the probability of false alerts.

At press time, XRP traded at $0.5097.

Featured picture from ShutterStock, chart from TradingView.com

[ad_2]

Source link