[ad_1]

In a latest X-thread (previously Twitter) on Bitcoin’s environmental, social and governance (ESG) influence, Daniel Batten, a number one BTC environmentalist and co-founder of CH4 Capital, offered a compelling case for the cryptocurrency. With the assistance of 4 distinctive charts, Batten highlighted Bitcoin’s sustainability in comparison with different main industries. “4 charts, 4 tweets, 4 causes Bitcoin is the last word ESG asset,” said Batten.

The Final ESG Asset: Bitcoin

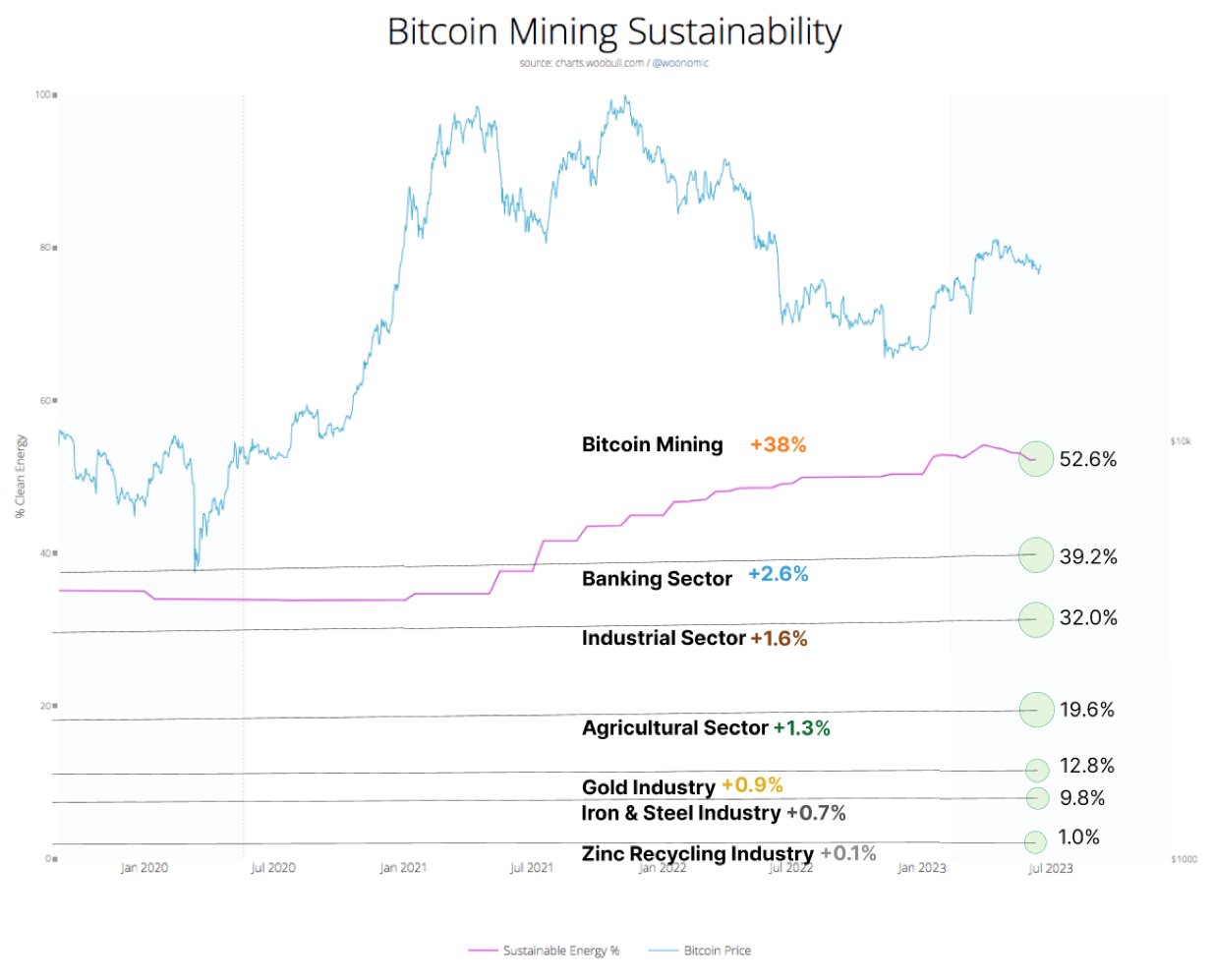

Renewable Vitality Dominance: Batten began by emphasizing how BTC mining has ascended to be the “single most sustainably-powered international trade on this planet.” Information reveals {that a} vital 52.6% of the vitality for BTC comes from renewable sources. In contrast, the banking sector lags at 39.2%, the commercial sector at 32.0%, agriculture at 19.2%, gold trade at 12.8%, and iron & metal trade at a mere 9.8%.

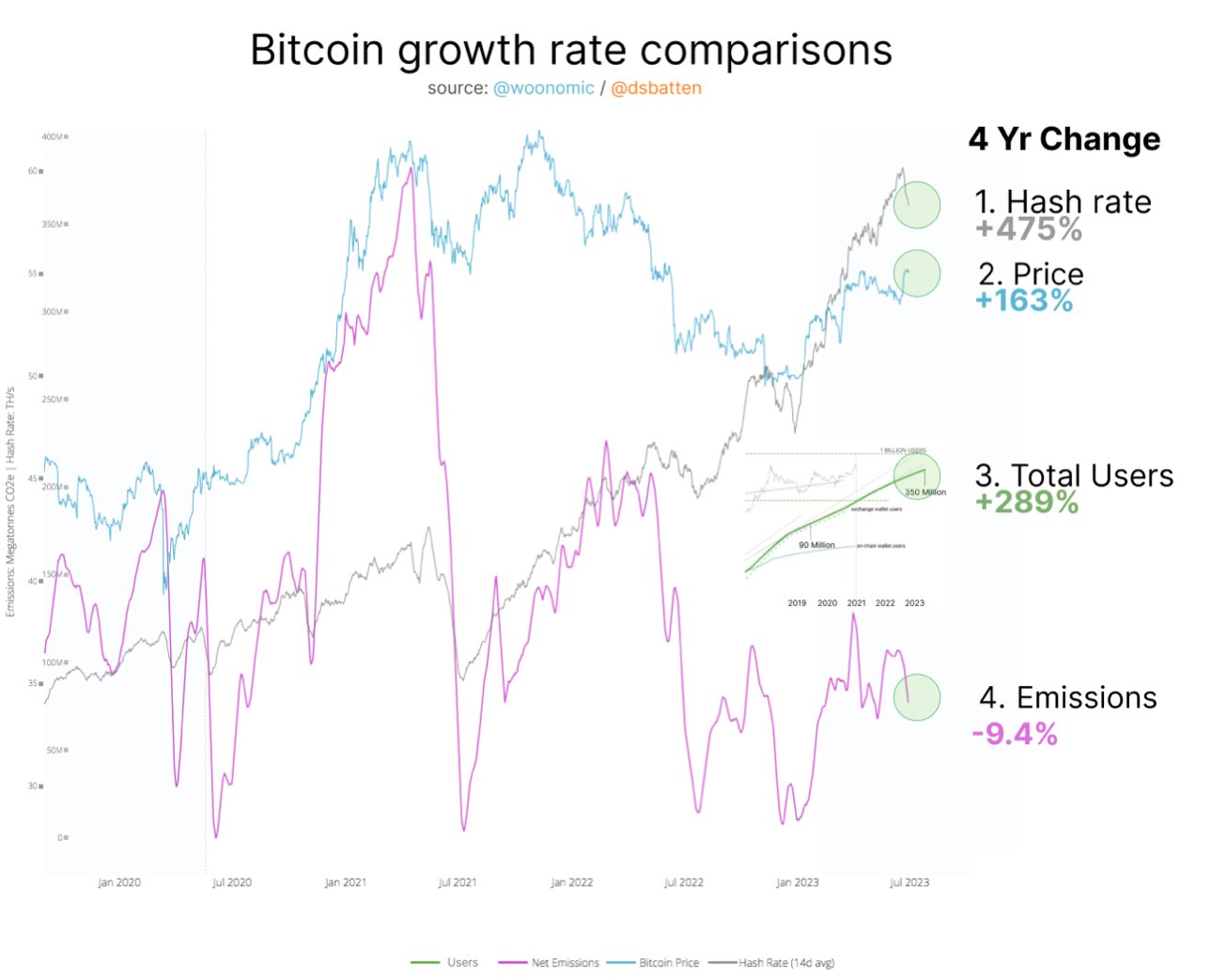

Constant Emission Ranges Amidst Development: The second chart highlights BTC’s distinctive functionality to take care of its emissions regardless of rampant development metrics. Over the previous 4 years, the community’s hash charge surged by 475%. Concurrently, its value elevated by 163%, and the whole variety of customers grew by 289%. But, its emissions decreased by -9.4%. Batten famous, “One thing no different trade has ever achieved.”

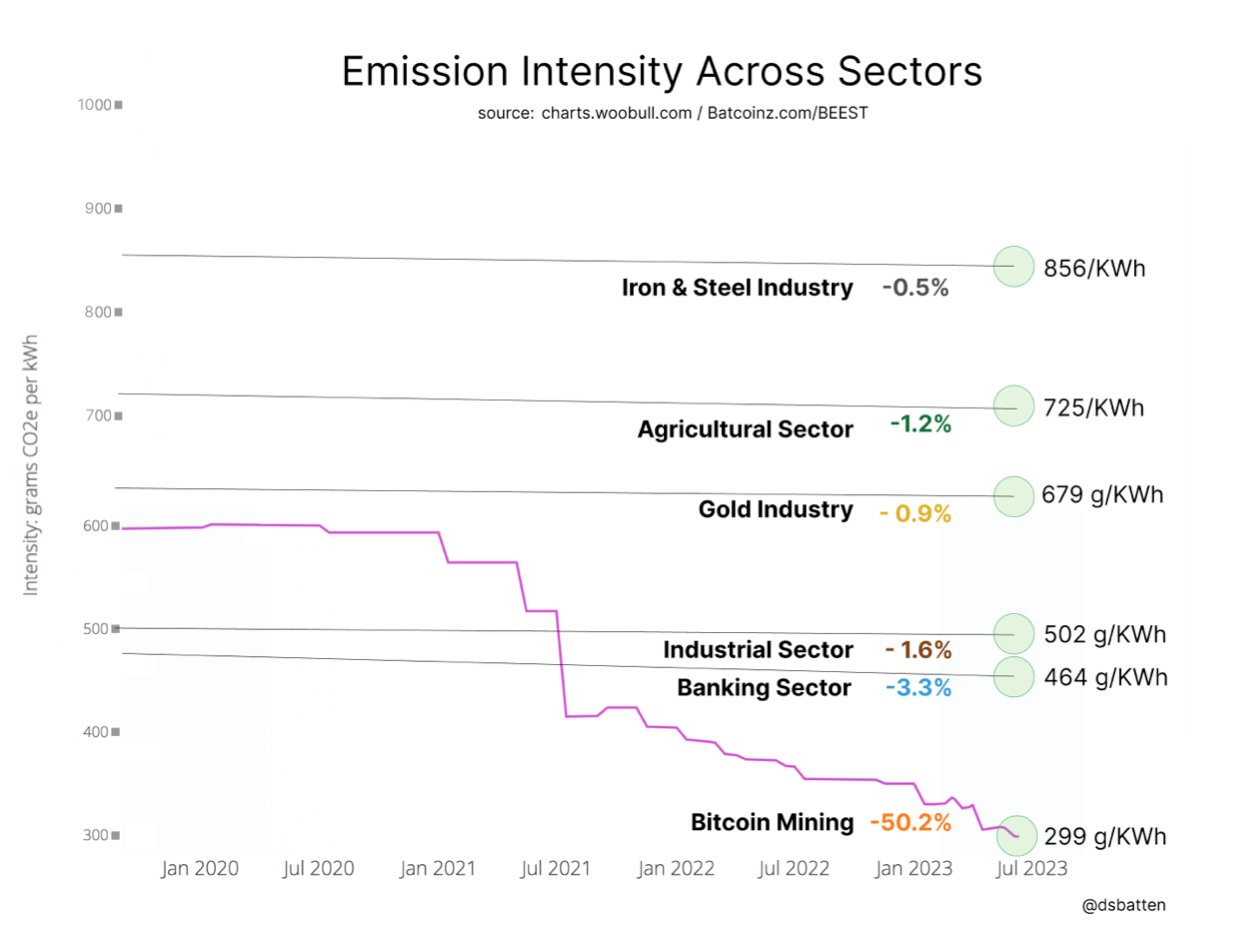

Lowest Emission Depth: Based on Batten’s third chart, “Bitcoin has halved its emission depth inside 4 years to have the bottom emission depth of any main international trade.” The information corroborates this, with Bitcoin’s emission depth standing at 299 g/KWh, notably decrease than industries like iron & metal (856 g/KWh), agricultural (725 g/KWh), gold (679 g/KWh), industrial (502 g/KWh), and banking (464 g/KWh).

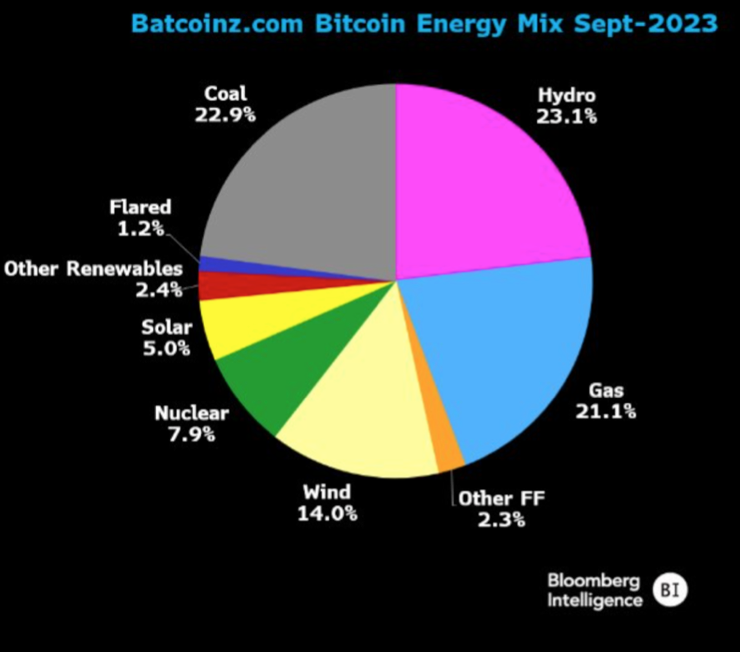

Decentralized Vitality Supply: The ultimate chart elucidates BTC’s diversified vitality composition, with hydro main at 23.6%. Bitcoin’s decentralized nature implies that in contrast to different industries, it isn’t anchored to the 36.7% coal-powered international grid. “As a result of Bitcoin mining isn’t anchored to the 36.7% coal powered international grid, it’s additionally the one main trade the place fossil gas isn’t the foremost supply of energy,” Batten affirmed.

False Data Continues To Flow into

Importantly, it’s essential to proceed fostering a deeper understanding of Bitcoin. Latest campaigns, together with Greenpeace’s “Change the code,” backed by Ripple, have propagated doubtlessly deceptive narratives. Concurrently, educational establishments and high-level analysis should be scrutinized for the accuracy of their information and underlying motivations. Whereas the latest MIT study on Bitcoin mining, revealed in June, is a commendable effort, it isn’t with out its shortcomings.

Lately, Batten supplied insights right into a latest MIT examine on mining. He acknowledged the examine’s strengths, akin to its avoidance of outdated vitality projection strategies and its real curiosity in doing goal analysis. Nonetheless, Batten raised considerations about sure inconsistencies, together with an absence of up to date information and non-representative datasets, emphasizing the necessity for extra exhaustive and correct analysis fashions.

He said, “The article exhibits potential, however has many gaps too and we don’t want one other incomplete and non-representative mining mannequin.” Batten advisable that researchers interact instantly with key trade stakeholders for a extra complete understanding of the nuances.

At press time, BTC traded at $26,102.

Featured picture from Shutterstock, chart from TradingView.com

[ad_2]

Source link