[ad_1]

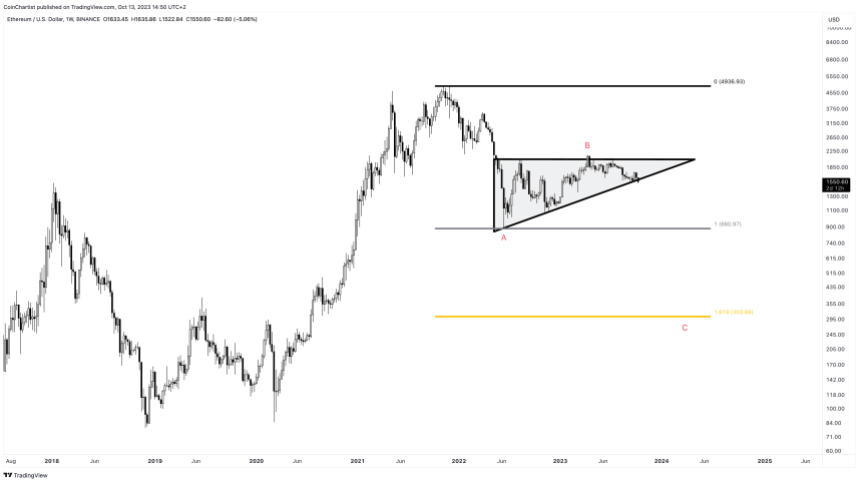

Ethereum worth is buying and selling at roughly $1,550 after failing to get again above $2,000 all through the whole thing of 2023 so far. More and more larger lows throughout the 12 months and a horizontal resistance zone had shaped an ascending triangle – a probably bullish chart sample.

This sample, nevertheless, is presumably failing. A busted sample goal may ship the worth per ETH sub-$1,000.

Is the bullish chart sample breaking down? | ETHUSD on TradingView.com

Ethereum Ascending Triangle Begins Breakdown: Goal $700

Ethereum put in its bear market low again in June of 2022 whereas Bitcoin and different cash stored falling by way of the tip of the 12 months. Regardless of the early lead in a bear market restoration, ETH has underperformed in opposition to BTC in 2023. Now it’s prone to falling to a brand new low with a goal of deep under $1,000 if a presumed bullish sample breaks down as a substitute of up.

ETHUSD has been buying and selling in what seems to be a textbook ascending triangle sample since its 2022 native low. A sequence of more and more larger highs has created an upward slowing pattern line. A horizontal resistance zone throughout $2,000 has stored worth motion at bay. Quantity has been trending downward all through the course of the sample. Value is at roughly two-thirds to the triangle apex.

Ether even had constructive information at its again: the launch of the first Ethereum Futures ETFs. But it has failed to provide any significant upside, and is now attempting to maneuver again down inflicting the bullish sample to bust. If the sample does break downward, it could have a goal of round $700 per ETH primarily based on the measure rule.

Or is the a bearish barrier triangle anyway? | ETHUSD on TradingView.com

Elliott Wave Defined: Golden Fibonacci Extension Targets $300 ETH

Though the ascending triangle is taken into account a bullish chart sample, it solely has a roughly 63% likelihood of breaking out, per the Encyclopedia of Chart Patterns by Thomas Bulkowski. The remaining 37% of the time break down. However technical evaluation is a broad examine. An ascending triangle to 1 dealer, could possibly be barrier triangle to a different.

A barrier triangle is just an ascending or descending triangle as outlined by Elliott Wave Precept. In Elliott Wave Precept, triangles are particularly telling. They solely seem earlier than the ultimate transfer in a sequence. As a result of Elliott Wave labels waves with the pattern as 1 by way of 5, triangles are corrective and seem solely within the wave 4 place – simply previous to wave 5 which ends the sequence.

In a bear market, corrective buildings are labeled ABC. Triangles themselves can seem throughout a B wave, which as soon as once more, is forward of the ultimate transfer within the ABC rely. C wave targets are sometimes discovered by projecting the 1.618 Fibonacci ratio from the A wave. This makes the goal of the busted sample someplace round $300 per ETH. Between the measure rule and the Fibonacci extension goal, Ethereum could possibly be going through sub-$1,000 costs sooner or later.

Might Ether fall sub-$1000? | ETHUSD on TradingView.com

[ad_2]

Source link