[ad_1]

Bitcoin (BTC), the reigning king of cryptocurrencies, is on the cusp of an thrilling part, based on outstanding crypto dealer Jason Pizzino.

In his newest YouTube video, Pizzino delves into the intricacies of Bitcoin’s four-year cycle and shares his perception that the digital foreign money is unlikely to revisit its earlier cycle lows. This evaluation relies on historic information that reveals a compelling sample in Bitcoin’s worth actions.

One of many key elements driving Pizzino’s outlook is Bitcoin’s four-year cycle, a well-documented phenomenon on the planet of cryptocurrency. This cycle refers back to the interval between every Bitcoin halving occasion, which happens roughly each 4 years.

Throughout a halving occasion, the reward for mining new Bitcoins is decreased by half. These occasions, in flip, have a profound impression on Bitcoin’s provide dynamics and infrequently set off important worth fluctuations.

“The principle factor is it’s virtually assured that $15,500 will not be going to interrupt,” Pizzino explains. “And probably we gained’t see closes underneath the March low both, which is at $19,500, one thing that I’ve talked about for a very long time on the channel now.”

This means that Bitcoin is poised to take care of its key help ranges, marking the top of a bearish part and the beginning of a brand new bull market.

Evaluating Bitcoin To Conventional Markets

To realize a extra complete perspective on Bitcoin’s performance, Pizzino additionally compares its actions to these of conventional markets, significantly the S&P 500. He highlights that inside the four-year cycle, the S&P 500 usually reaches a brand new all-time excessive earlier than Bitcoin manages to do the identical.

Complete crypto market cap presently at $1.06 trillion. Chart: TradingView.com

This sample, noticed throughout earlier accumulation years, demonstrates Bitcoin’s resilience and potential for long-term development.

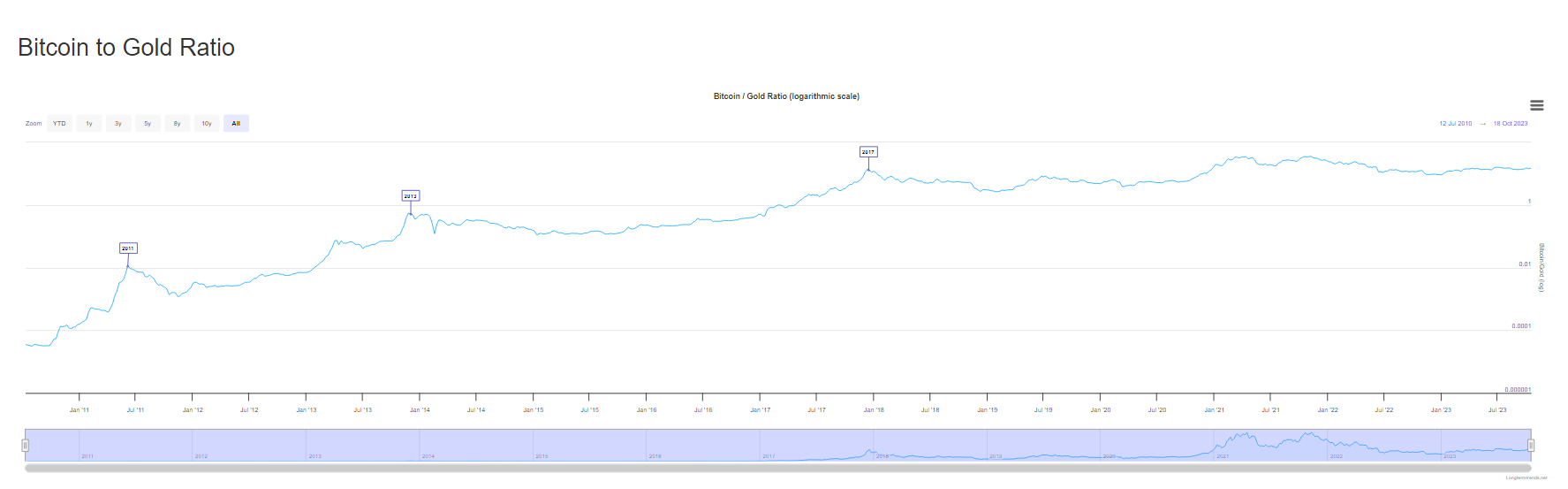

In one other notable growth, the Bitcoin-to-Gold ratio has undergone a considerable transformation over the previous two years. In 2021, Bitcoin was valued at 35 instances the value of gold, whereas in 2023, this ratio has halved to fifteen. This shift within the ratio is a important indicator of Bitcoin’s efficiency relative to a conventional retailer of worth like gold.

Supply: LongTermTrends

Bitcoin’s Present Standing

This shift is important as a result of it displays the altering dynamics of the monetary panorama. Bitcoin’s reducing ratio to gold might point out that buyers have gotten extra cautious concerning the cryptocurrency, probably as a response to regulatory considerations or elevated market maturity.

As of the most recent obtainable information, Bitcoin’s worth, based on CoinGecko, stands at $28,314.26. Over the previous 24 hours, Bitcoin skilled a minor dip of 1.4%, however it has exhibited a achieve of 5.4% within the seven-day interval. These fluctuations are typical on the planet of cryptocurrencies and spotlight the asset’s inherent volatility.

Featured picture from Forbes

[ad_2]

Source link