[ad_1]

The overall quantity of Ethereum (ETH) staked on Lido Finance, one of many many liquidity staking protocols accessible, has risen steadily over the previous few years. Surprisingly, income accrued by the platform (in comparison with staking rewards distributed) stays comparatively low.

Lido Finance Income Isn’t Rising As Quick As Anticipated

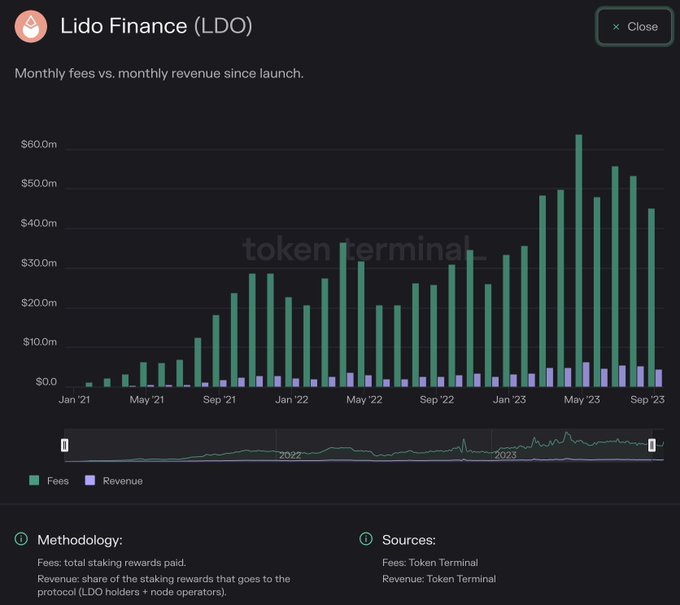

Taking a look at Token Terminal information shared on October 19, the blockchain analytic platform noticed that whereas staking rewards paid, counted as “charges” by Lido Finance grew from lower than $10 million in early 2021 to over $60 million in June 2023, income has grown at a a lot slower tempo. For example, Lido Finance’s common income is roughly lower than $5 million throughout this era.

Total, Lido Finance is a liquidity staking protocol that helps the staking of a number of proof-of-stake (PoS) cash like Ethereum (ETH) with out essentially locking them up. Customers can concurrently earn staking rewards whereas accessing their hard-earned ETH–or some other coin supported.

The protocol points one other spinoff, stETH, for each ETH staked to realize this. This token may be freely traded on exchanges. It may well even be used as collateral for customers eager on taking trustless loans on supported platforms.

Ethereum just lately shifted to be a proof-of-stake blockchain to be greener and preserve the surroundings. This transition was a boon for protocols that supported the primary sensible contract platform to verify transactions and stay safe, particularly after the activation of Shanghai in April 2023.

The Shanghai improve allowed Ethereum validators to withdraw their staked ETH for the primary time, allowing them to use options, of which Lido Finance, whole worth locked (TVL), was most well-liked. As of October 19, Lido Finance had a TVL of $13.913 billion, most of it being belongings on Ethereum.

Ethereum Centralization Considerations: How Will This Be Addressed?

Lido Finance makes staking extra accessible to everybody whereas concurrently enhancing liquidity. Nonetheless, the income generated seems low versus the quantity of staking rewards distributed to stakers, most of whom are from Ethereum. A part of the income the community generates can also be distributed to LDO holders and node operators. Whether or not the liquidity staking protocol plans to increase the ten% charge charged to extend income earned stays to be seen.

Presently, there are concerns that Lido Finance’s position on Ethereum might result in centralization. Ethereum has been accused of being “centralized,” primarily in how it’s constructed. Critics assert that the reliance on its co-founder, Vitalik Buterin, for endorsement and steerage might decelerate improvement sooner or later.

Characteristic picture from Canva, chart from TradingView

[ad_2]

Source link