[ad_1]

In a current statement by way of X (previously Twitter), Alex Thorn, head of agency large analysis at digital asset agency Galaxy, highlighted the potential for an additional Bitcoin gamma squeeze much like the one witnessed final week. BTC gained 15% final week. He remarked, “The Bitcoin gamma squeeze from final week may occur once more. If BTCUSD strikes increased to $35,750-36k, choices sellers might want to purchase $20m in spot BTC for each 1% upside transfer, which may trigger explosiveness if we start to maneuver up in direction of these ranges.”

Elaborating on the mechanics, Thorn defined the conduct of sellers in relation to gamma and delta. “When sellers are brief gamma and value strikes up, or when they’re lengthy gamma and value strikes down, they should purchase spot to remain delta impartial. Final week’s expiries will dampen potential explosiveness, but it surely’s nonetheless in play.” This primarily implies that the actions of choices sellers, pushed by the necessity to preserve a impartial place, can amplify value actions.

Will Bitcoin Value Rally Like Final Week?

Thorn additionally emphasised the significance of on-chain knowledge in understanding these dynamics. He talked about a continued divergence between the provision held by long-term holders and the provision that has moved in lower than 24 hours. This divergence, which has been rising over the previous 12 months, signifies a decline in on-chain liquidity, suggesting that long-term holders will not be promoting their holdings, probably resulting in a provide squeeze.

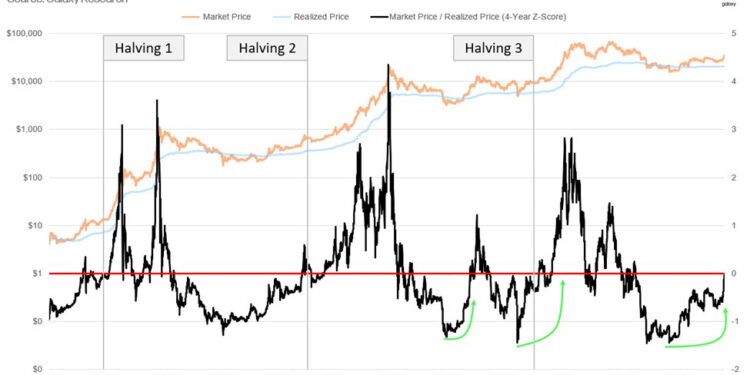

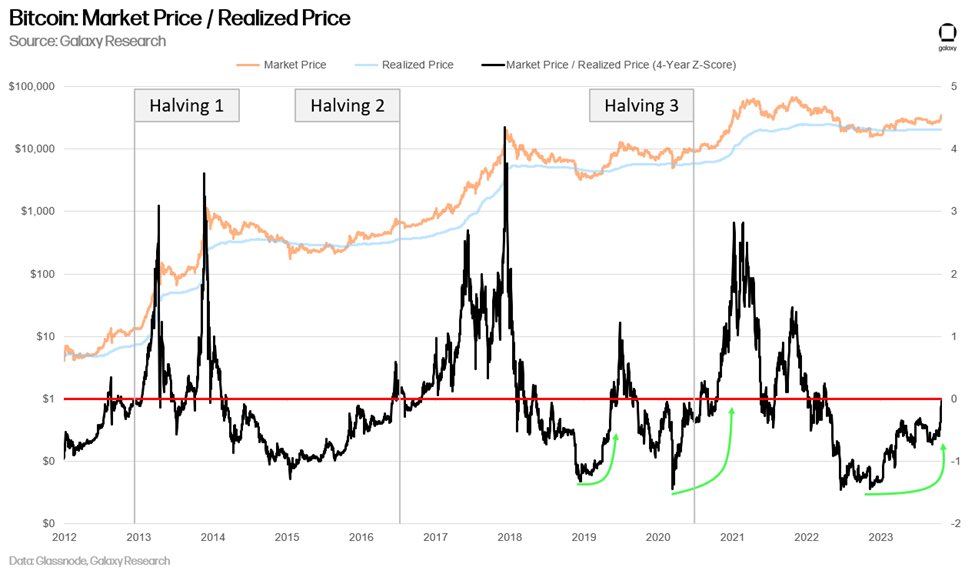

Moreover, Thorn pointed to the 4-year rolling Z-score of the ratio of market value to realized value, a variation of the MVRV ratio. This metric offers insights into Bitcoin’s valuation relative to its historic common. A excessive optimistic Z-score signifies potential overvaluation, whereas a adverse Z-score would possibly counsel undervaluation. Thorn’s commentary that the sample is starting to resemble these seen earlier than earlier bull runs is especially noteworthy.

One other essential commentary made by Thorn pertains to the compression of relative price bases. He famous a tightening sample that has traditionally been noticed throughout bear or accumulation durations that precede bull markets. This compression suggests that there’s a consensus amongst several types of holders concerning the worth of Bitcoin.

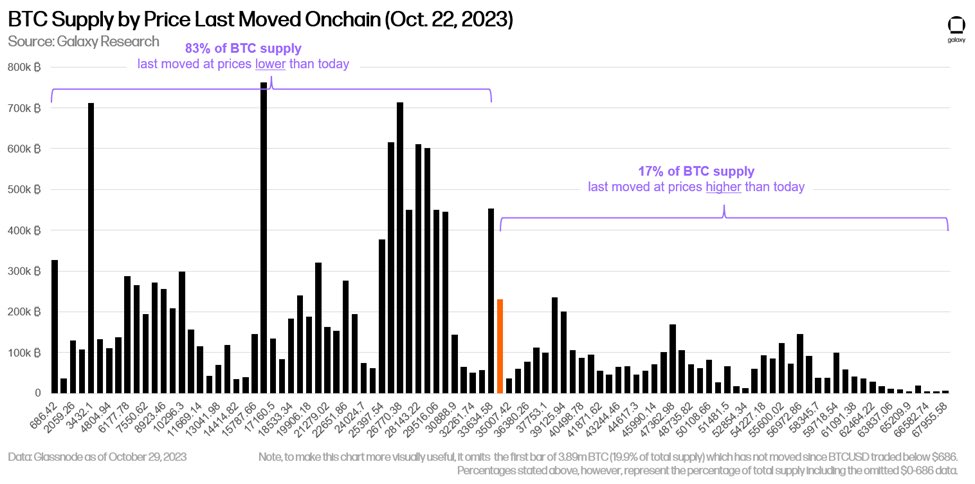

Thorn’s evaluation of the Bitcoin provide by the value at which every coin final moved is especially illuminating. He noticed a sparse price foundation between the present value of $34,591 and the $38,400-39,100 vary. Furthermore, with 83% of the provision not having moved since costs had been decrease than at this time and almost 70% of the provision stagnant for over a 12 months, it’s evident that long-term holders are in revenue and are doubtless ready for even increased costs earlier than promoting.

Final week, as reported by NewsBTC, Thorn had precisely predicted a gamma squeeze. He had emphasised the numerous position the choices market performed in influencing Bitcoin’s value trajectory. Thorn warned, “We’re approaching max ache for gamma shorts.”

In abstract, whereas Thorn doesn’t make a direct prediction about Bitcoin’s near-term value, his evaluation on X offers a complete overview of the present market dynamics. The mixture of potential gamma squeezes, declining on-chain liquidity, and historic patterns all level in direction of a good setting for Bitcoin bulls.

At press time, BTC traded at $34,249.

Featured picture from Shutterstock, chart from TradingView.com

[ad_2]

Source link