[ad_1]

All Aave v2 markets at the moment are operational, the group behind the non-custodial liquidity protocol introduced in a November 13 publish on X. This a day after v3 markets have been unfrozen following the approval from the group.

Aave is a platform the place customers can provide liquidity in change for rewards whereas debtors are free to take loans whereas paying curiosity in a trustless surroundings.

Aave v2 Markets Unfrozen, Safety Is “Non-Negotiable”

Within the post, Aave stated the safety of the decentralized finance (DeFi) protocol stays a “precedence and is non-negotiable for the group.”

On November 4, Aave said they obtained a report “of a problem on a sure characteristic.” After being validated, the protocol determined to take a step and pause the operation of their v2 markets on Ethereum. On the identical time, some v2 markets on Avalanche have been frozen. Even so, the v2 markets on Polygon have been unaffected.

Aave additionally froze operations on Aave v3 on Polygon, Arbitrum, and OP Mainnet. Nonetheless, v3 markets on Ethereum, Base, and Metis have been unaffected.

Whereas Aave v2 and v3 markets have been frozen, the protocol clarified that customers supplying or borrowing affected belongings might nonetheless withdraw and repay their positions however couldn’t provide or borrow extra. With these markets unfrozen, they will now proceed because it was earlier than.

Will Bulls Ease Previous $110?

The resumption of companies, trying on the AAVE candlestick preparations within the each day chart, has not impacted costs. Nonetheless, the token is buying and selling at round 2023 highs and stays inside a bullish formation as optimistic merchants anticipate the uptrend to proceed.

Regardless of the uptrend, bulls have failed to interrupt above the $110 resistance degree. As it’s, this response degree marks August 2022 highs and has not been breached up to now 15 months.

The token has greater than doubled at spot charges, rising from $50, a crucial assist degree marking January and June 2023 lows. For pattern continuation, there have to be a strong breakout above $110 and the $60 vary from the place costs have been shifting horizontally in a multi-month accumulation.

Nonetheless, it’s unclear how the token will react within the days forward and whether or not there can be extra upside momentum as liquidity will increase as exercise resumes on Aave v2 markets.

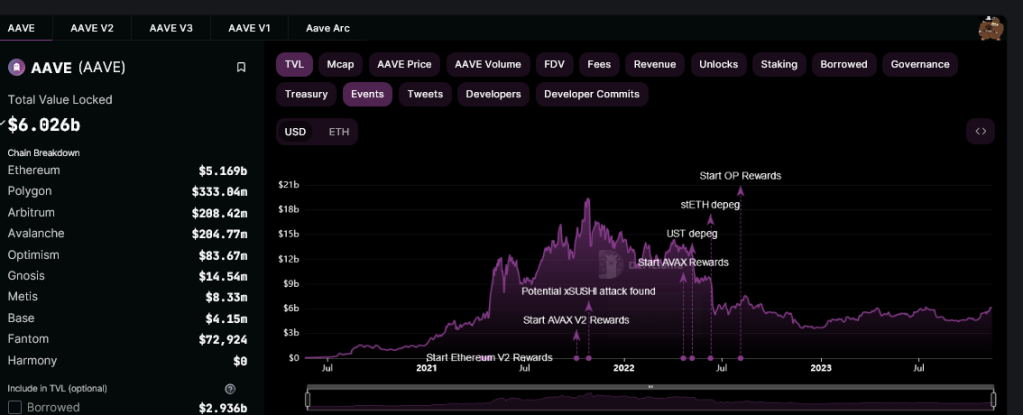

Based on DeFiLlama data, Aave is among the largest DeFi protocols, with over $6 billion in complete worth locked (TVL). Most of those belongings are locked in Ethereum, the place over $5.1 billion of tokens are underneath administration.

Characteristic picture from Canva, chart from TradingView

[ad_2]

Source link