[ad_1]

The potential approval of a spot Bitcoin ETF in the USA has stirred appreciable consideration in current weeks. Dan Morehead, CEO and founding father of Pantera Capital, has now shared invaluable insights on this matter in his newest “Blockchain Letter”, emphasizing the distinctive circumstances surrounding this occasion.

Morehead challenges the normal Wall Avenue mantra, “Purchase the rumor, promote the information,” questioning its relevance within the present spot ETF context. He displays on how this adage performed out traditionally, particularly citing the CME Futures launch and Coinbase’s public itemizing. Each cases exhibited vital worth surges within the BTC market earlier than their respective occasions, adopted by steep downturns, aligning with the adage’s prediction.

Spot Bitcoin ETF Is A “Purchase The Rumor, Purchase The Information” Occasion

In his detailed evaluation, Morehead recounts how the Bitcoin market rallied dramatically, as much as 2,448%, main as much as the CME futures launch. Nevertheless, this bullish pattern abruptly reversed on the very day the futures have been listed, marking the beginning of an 84% decline right into a bear market. He parallels this with the Coinbase public listing situation, the place the market once more surged, this time by 848%, reaching its peak on the day of Coinbase’s itemizing, solely to be succeeded by a 76% drop.

Morehead, with a contact of humor, notes in his letter, “Will somebody please remind me the day earlier than the Bitcoin ETF formally launches? I would need to take some chips off the desk.”

Nevertheless, “this time is completely different,” states Morehead. Additional delving into the potential impression of a spot ETF, he posits that such an ETF would signify a major step within the adoption. Not like futures, which he argues have been a “step backwards,” the spot ETF may basically change entry to BTC, opening up new investor swimming pools and doubtlessly altering the demand perform for Bitcoin completely.

Not like the earlier occasions of the CME futures and Coinbase itemizing, which had little real-world impression on Bitcoin accessibility, Morehead believes the spot ETF situation is basically completely different. He asserts, “A BlackRock ETF basically adjustments entry to Bitcoin. It can have an enormous (constructive) impression.” His view is that the ETF will introduce BTC to broader investor courses, considerably altering the funding panorama.

Drawing a parallel with the history of gold ETFs, Morehead means that Bitcoin ETFs may equally revolutionize Bitcoin funding, increasing its attraction and legitimacy. He predicts a considerable shift within the demand dynamics for Bitcoin, akin to how gold ETFs altered the gold market.

In his concluding remarks, Morehead revisits the preliminary query in regards to the ETF launch being a “promote the information” occasion. He argues, “Purchase the rumor, purchase the information.” This phrase encapsulates his perception that, in contrast to previous occasions, the introduction of a Bitcoin ETF is not going to result in a sell-off however will mark the start of a brand new period in Bitcoin funding.

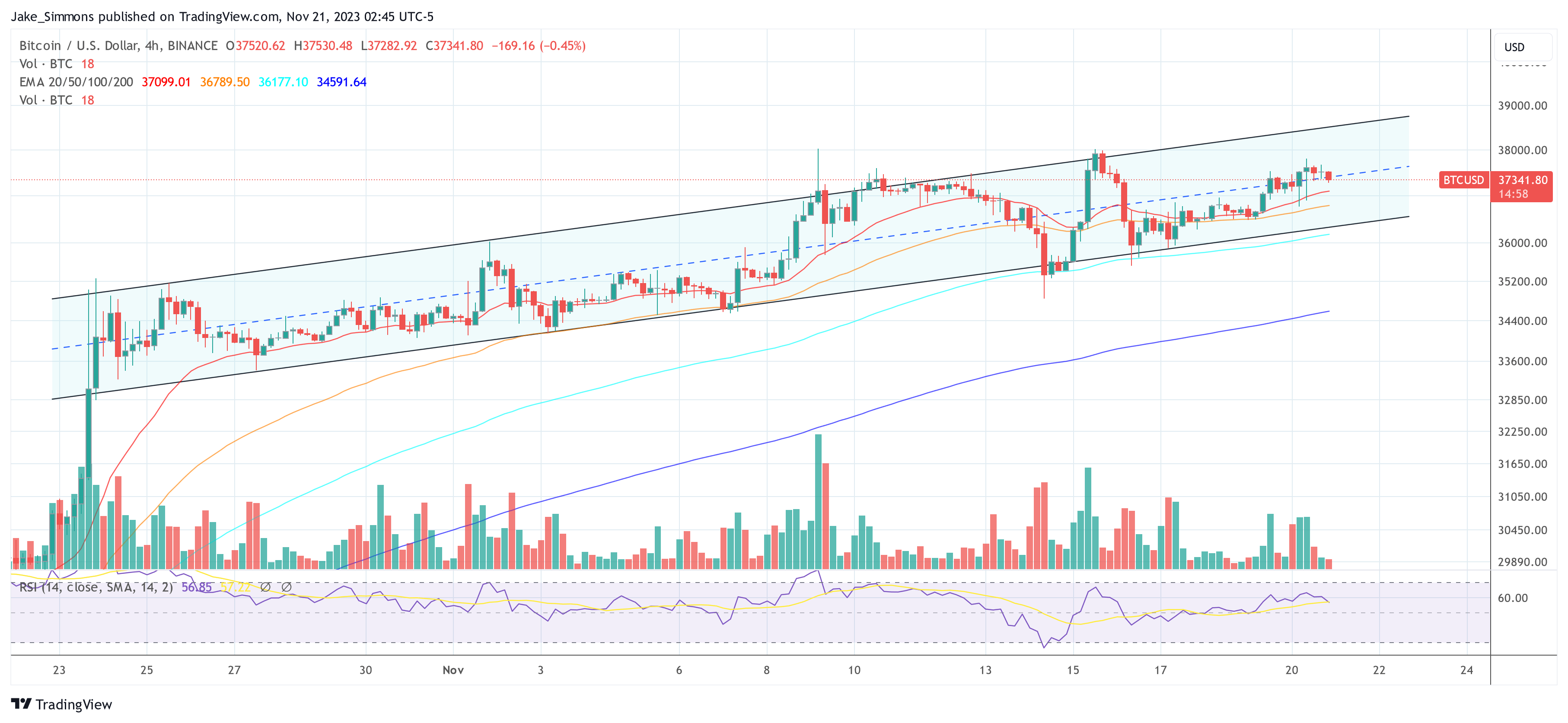

At press time, BTC traded at $37,341.

Featured picture from Shutterstock, chart from TradingView.com

[ad_2]

Source link