[ad_1]

Token Terminal, a blockchain analytics platform, predicts Ethereum (ETH), the world’s second most dear cryptocurrency, can soar above $36,800 by the last decade’s finish primarily based on whole addressable market tasks.

In an in-depth analysis masking Ethereum on November 23, the analytics platform laid out a number of causes that may drive the coin to astronomical ranges, almost 18X from spot ranges.

Ethereum Is King, Predicted To Course of $14 Trillion In Worth By 2030

The Token Terminal report cited strengthening community results, rising token shortage, and profitable transition to proof-of-stake (PoS) consensus as attainable value drivers accelerating the rally in direction of $36,800. The primary-mover benefit and community results, amongst others, have given Ethereum a aggressive benefit over rival good contract platforms, together with Solana (SOL) and Cardano (ADA).

Customers can deploy decentralized finance (DeFi) options in these competing networks, mint non-fungible tokens (NFTs), and overly take part in web3 growth. Even so, Token Terminal observes that regardless of Ethereum’s restricted scalability and fluctuating gasoline charges, which are inclined to rise in trending markets and intense community exercise, discouraging engagement, it stands to dominate within the years forward.

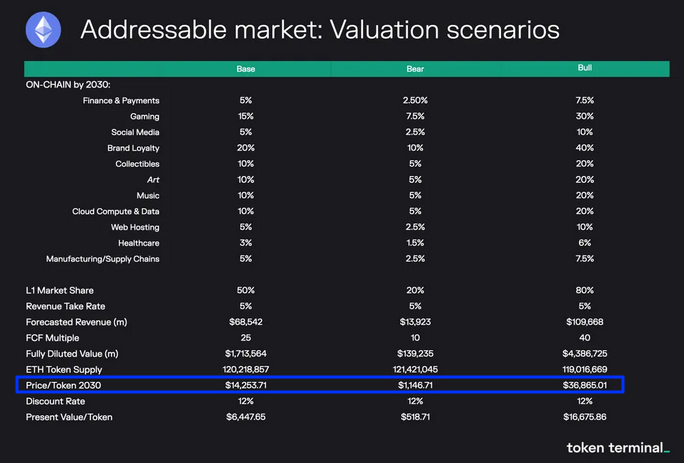

Quantifying future adoption, Token Terminal estimates that by 2030, roughly half of the finance business’s trillion-dollar income will possible be flowing by way of Ethereum. To place a determine to this, the blockchain analytics platform estimates that over $14 trillion in worth shall be settled on-chain, with Ethereum as the popular community.

The finance business generates over $28 trillion in annual income, rising at a compound annual development fee (CAGR) of seven.5%.

As it’s, this mega valuation anticipated to move by way of Ethereum is greater than 10X the overall crypto market when writing on November 2023. In accordance with CoinMarketCap, it’s barely over $1.4 trillion with Bitcoin commanding roughly 51%.

Making projections from this outlook, the blockchain analytics platform famous that the anticipated adoption through rising verticals, together with id, content material streaming, and even the Web of Issues, might see ETH soar year-over-year within the subsequent seven years.

Potential Challenges That May Sluggish Adoption

Nonetheless, the research notes that challenges sooner or later may decelerate adoption, probably stifling development and costs. Prime of the checklist is the chance related to regulation. As crypto finds adoption, the analysis notes that governments may attempt to intervene to take care of order.

On the identical time, there may very well be unexpected modifications to the community design tradeoffs, the success and subsequent dominance of layer-2s forcing enterprise capitals to prioritize funding for off-chain tasks and be aware these deploying on the mainnet.

Moreover, Token Terminal stated even a bug being found on-chain, resulting in losses and, thus, a dent in confidence, can’t be discounted within the long-term.

Characteristic picture from Canva, chart from TradingView

[ad_2]

Source link