[ad_1]

On-chain information exhibits the ten largest Ethereum whales have continued to increase their holdings just lately, now carrying 41 million ETH.

Ethereum Prime 10 Whales Have Set A New All-Time Excessive For Their Holdings

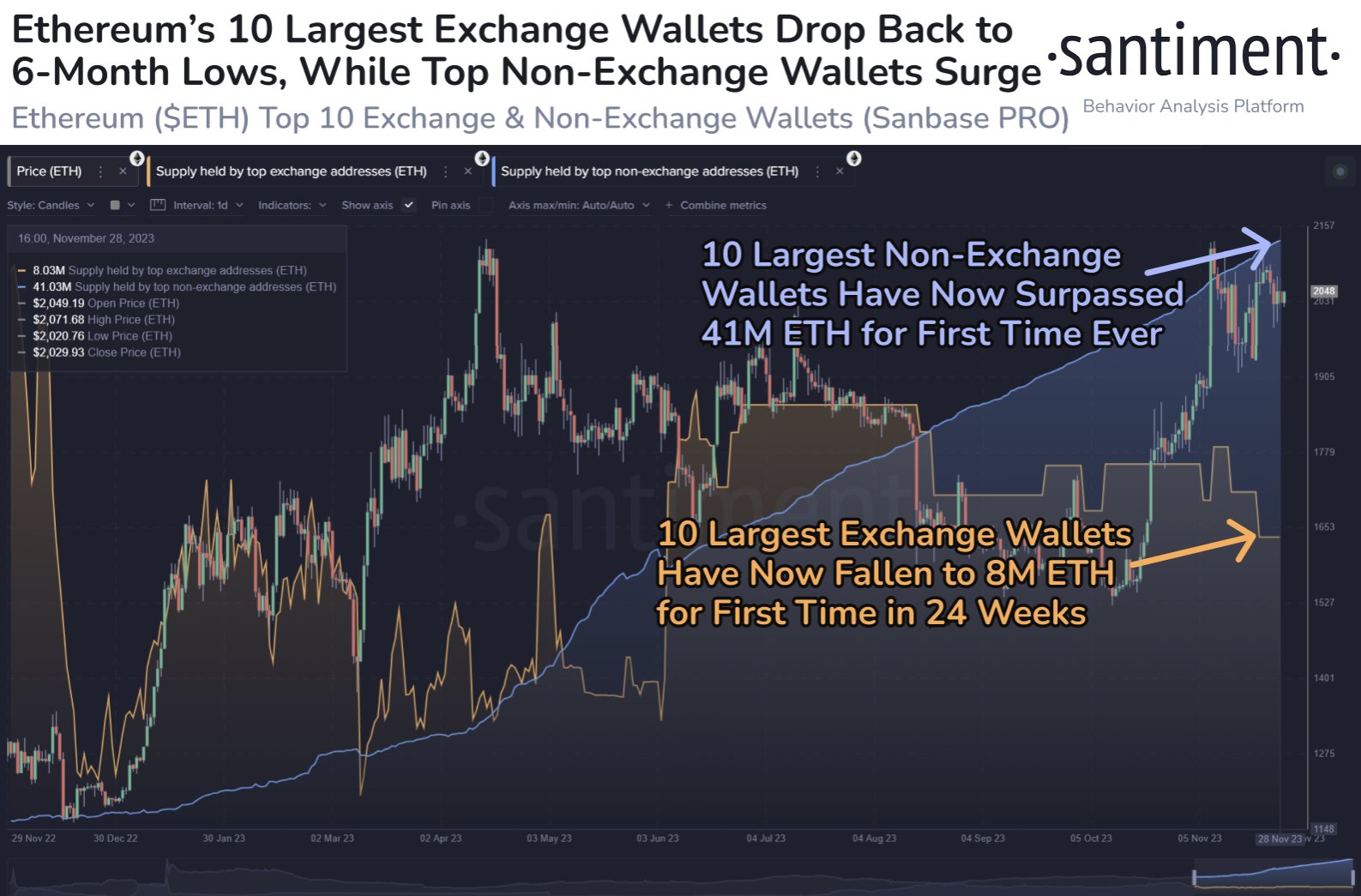

In accordance with information from the on-chain analytics agency Santiment, the most important whale wallets have continued to show an optimistic sample for the cryptocurrency. There are two indicators of curiosity right here: the provision held by high trade wallets and the provision held by high non-exchange wallets.

The previous retains observe of the entire quantity of Ethereum that the ten largest wallets connected to centralized exchanges are holding proper now. As compared, the latter measures the quantity sitting within the ten largest self-custodial wallets on the blockchain.

Each kinds of addresses would depend as “whales,” however these connected to the exchanges could be extra prone to management an entity just like the platform itself fairly than a “regular” investor, like a self-custodial pockets would almost certainly be.

The chart beneath exhibits how the Ethereum provide held by these two cohorts has modified over the previous yr.

The worth of the 2 metrics have gone reverse methods in latest days | Supply: Santiment on X

The graph exhibits that the provision held by the highest ten whales outdoors exchanges has been continuously going up throughout the previous yr, whereas the addresses connected to exchanges have been fairly up and down.

Usually, buyers maintain their cash inside self-custodial wallets every time they wish to maintain onto them for prolonged durations. So, these off-exchange whales persevering with to extend their provide is undoubtedly a constructive signal for the cryptocurrency.

As is obvious from the chart, the provision of those whales has crossed the 41 million ETH mark following the newest continuation of the uptrend, which is a brand new all-time excessive.

Whereas this rise has come, the highest ten Ethereum trade wallets have seen a plunge as an alternative, as they now maintain simply 8 million ETH, the bottom quantity in about 24 weeks.

A shift of provide in the direction of self-custody is all the time signal for the well being of the market, as bankruptcies like that of the FTX exchange already confirmed throughout this bear market what occurs when central platforms like these go bust.

The much less ETH that’s current on the exchanges, the much less the value could be affected in the event that they occur to exit of enterprise. And that’s not all; the provision on exchanges will also be thought of the obtainable promoting provide of ETH, which has additionally decreased with this drawdown.

Subsequently, this sample of the self-custodial wallets rising in dimension whereas the exchanges lose cash is an encouraging improvement for the asset. Although whereas that could be true, provide concentrating on simply ten wallets remains to be one thing unfavourable, as these humongous entities now management one-third of the provision.

ETH Value

On the time of writing, Ethereum is buying and selling slightly below the $2,100 mark, down 1% prior to now week.

ETH has general gone up throughout the previous 24 hours | Supply: ETHUSD on TradingView

Featured picture from Vivek Kumar on Unsplash.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link