[ad_1]

Bitcoin vs. Gold: The Digital Forex’s Journey to $40,000

2020 was pivotal for Bitcoin and gold, with fiscal and financial stimulus bolstering their attraction. Nonetheless, Bitcoin differentiates itself with its capped provide of 21 million cash, contrasting gold’s continuous however modest annual provide development.

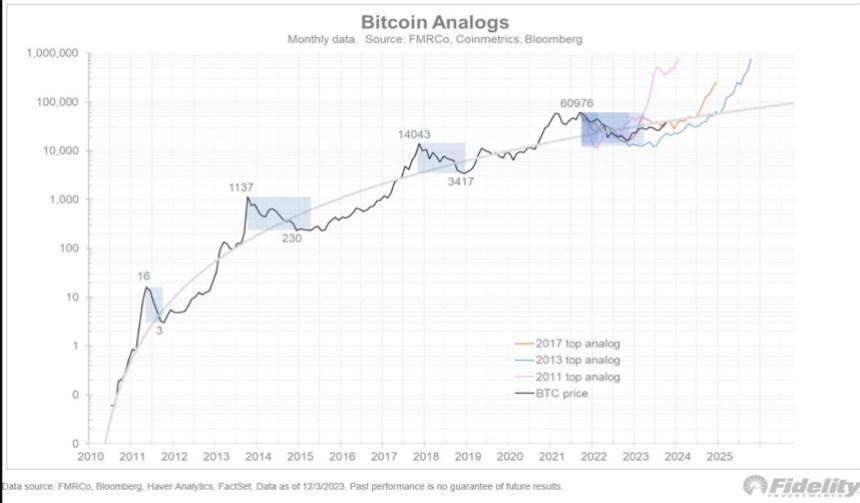

This restricted provide has propelled Bitcoin’s “stock-to-flow” (S2F) ratio considerably greater than gold’s. Furthermore, Bitcoin’s journey displays the traditional S-curve path of technological improvements. Its exponential development trajectory mirrors historic developments in expertise from railroads to cell telephones.

Nonetheless, predicting Bitcoin’s future based mostly on these S-curves is complicated, as slight deviations in these development phases can “dramatically” alter outcomes, the skilled claims.

SEC Deliberations And Institutional Curiosity Form Bitcoin’s Future

Timmer’s observations embody a possible impression of the SEC’s anticipated choices on the Bitcoin spot Change Traded Fund (ETF). He theorizes that pending product purposes might appeal to new buyers, but he stays cautious about whether or not this may set off a “sell-the-news” occasion and a big drawdown.

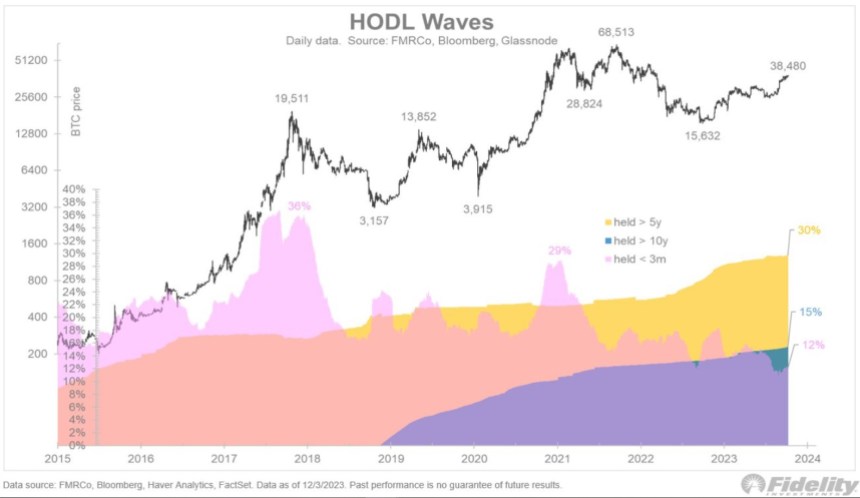

Apparently, a small proportion of Bitcoin is held for beneath three months, suggesting that the latest worth surge shouldn’t be merely “speculative,” providing assist for an extended bullish pattern.

The true believers in Bitcoin, as indicated by the rising proportion held for over 5 or ten years, are unlikely to be swayed by short-term information. Nonetheless, there’s notable exercise within the Bitcoin futures market, notably amongst asset managers, which might counsel anticipation of the SEC motion.

Any updates from the SEC would arrive in a reworked macroeconomic atmosphere. Not like the liquidity-rich interval of 2020-21, the US Federal Reserve’s (Fed) latest coverage shifts have reversed the surge in financial inflation.

This shift aligns the present scenario extra with the post-World Conflict II period than the inflationary Seventies, impacting the urgency of the worth proposition for gold and Bitcoin.

As BTC matures, its relationship with conventional monetary markets and international financial developments turns into more and more intricate. With the SEC’s choice and a shift within the macro-arena, the approaching months are poised to train affect over the premier cryptocurrency and the nascent sector.

Cowl picture from Unsplash, chart from Tradingview

[ad_2]

Source link