[ad_1]

In a robust turnaround from yesterday’s flash crash, the Bitcoin (BTC) worth has staged a restoration, breaching the $43,000 mark. This surge comes after yesterday’s intense volatility, the place the cryptocurrency big witnessed an over 11% flash crash following a controversial report from Matrixport.

The report recommended a possible rejection by the US Securities and Change Fee (SEC) of the much-anticipated spot Change Traded Funds (ETFs), triggering the second-largest liquidation of lengthy positions up to now 12 months. Bitcoin’s worth plummeted to as little as $41,500.

Nonetheless, Bitcoin is as we speak stabilizing above $43,000, influenced by a mixture of things. Notably, a number of consultants have disputed the Matrixport report’s validity. Including to the constructive sentiment, a major SEC associated replace has caught the market’s consideration.

Bitcoin ETF Tomorrow?

Based on a report by Fox Enterprise, SEC workers attorneys from the Division of Buying and selling and Markets have been participating in essential discussions with representatives from main exchanges such because the New York Inventory Change, Nasdaq, and the Chicago Board Choices Change on Wednesday. This engagement is critical because it pertains to the approval of a number of Bitcoin ETF purposes.

The conferences are seen as a constructive signal that the SEC is nearing approval of some or all the dozen purposes by main cash managers and crypto corporations for the product. An nameless supply aware of these developments acknowledged, “Whereas the ultimate resolution has not been made, sources near the proceedings say the SEC may start notifying issuers of approval on Friday with buying and selling starting as early as subsequent week.”

Bloomberg ETF analyst James Seyffart commented on Eleanor Terrett’s report from Fox Enterprise through X, stating: “My view is in keeping with Eleanor Terrett’s reporting. I feel the SEC may start signaling to issuers to count on approvals tho I’m nonetheless anticipating official approvals Jan 8 – 10. I additionally suppose the hole between approval orders and precise buying and selling will likely be measured in days — not weeks.”

Echoing Seyffart’s views, Eric Balchunas, his colleague at Bloomberg, commented, “Belongings you prob don’t do in case you going to disclaim or delay. Listening to related btw, and why why after we see up to date (last) 19b-4s roll in that’s signal approval imminent as SEC has been doing forwards and backwards w issuers offline to excellent their 19b-4s vs doing quite a few refilings a la S-1s.”

Scott Johnsson, a finance lawyer at Davis Polk, weighed in on Balchunas’ assertion: “In each previous ETF wave, the SEC didn’t do that. Why? As a result of (1) this takes up a ton of SEC assets and (2) makes it MUCH tougher to efficiently survive judicial scrutiny (and after Grayscale, that is like drawing blood from a stone). When you intend to disclaim, you simply deny.”

BTC Worth Stays Extremely Bullish

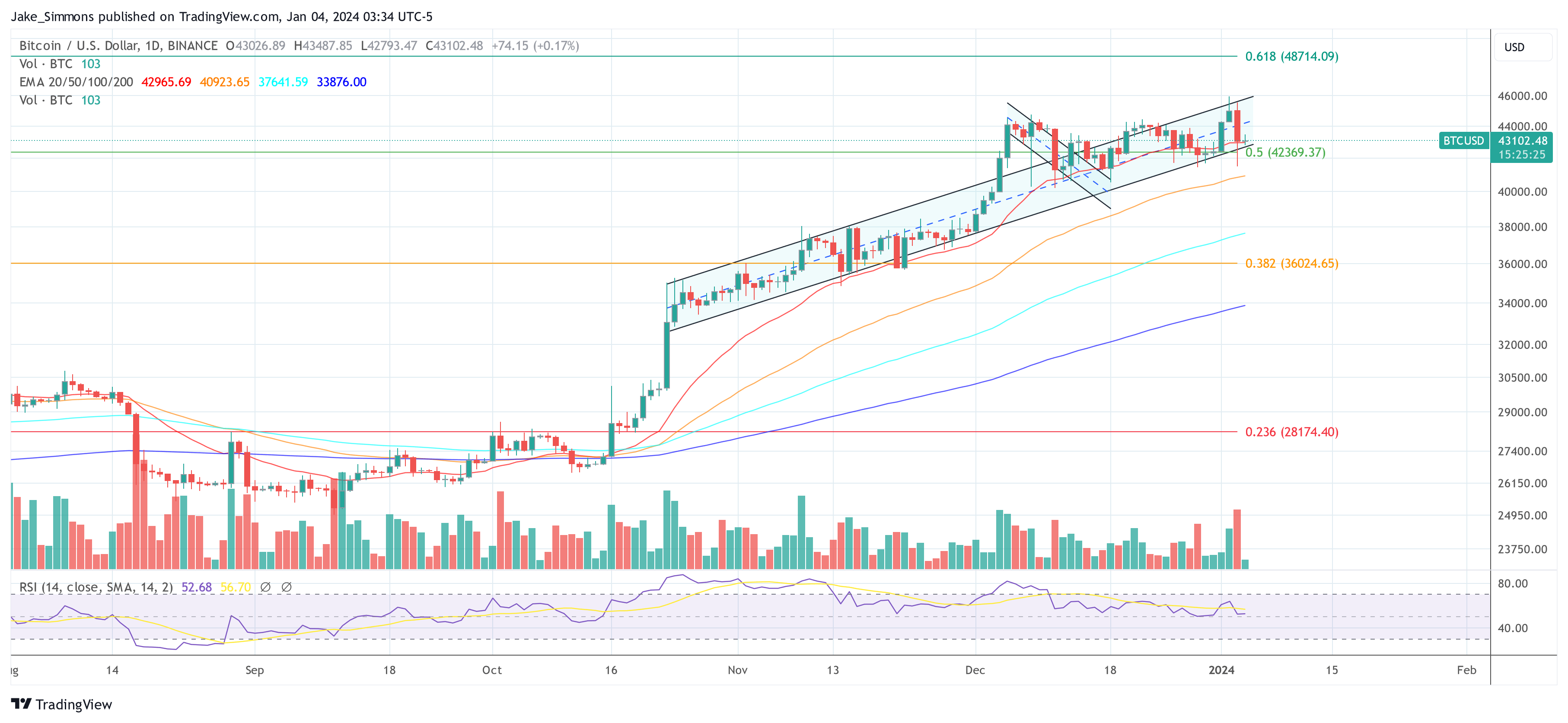

In gentle of those developments, the cryptocurrency market stays cautiously optimistic, with indicators strongly pointing in the direction of an ETF approval by January 10, doubtlessly at the same time as early as January 5. Notably, the Bitcoin worth has closed its every day candle inside the uptrend channel, established in mid-October. At press time, BTC traded at $43,102.

Featured picture from Shutterstock chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site solely at your individual danger.

[ad_2]

Source link