[ad_1]

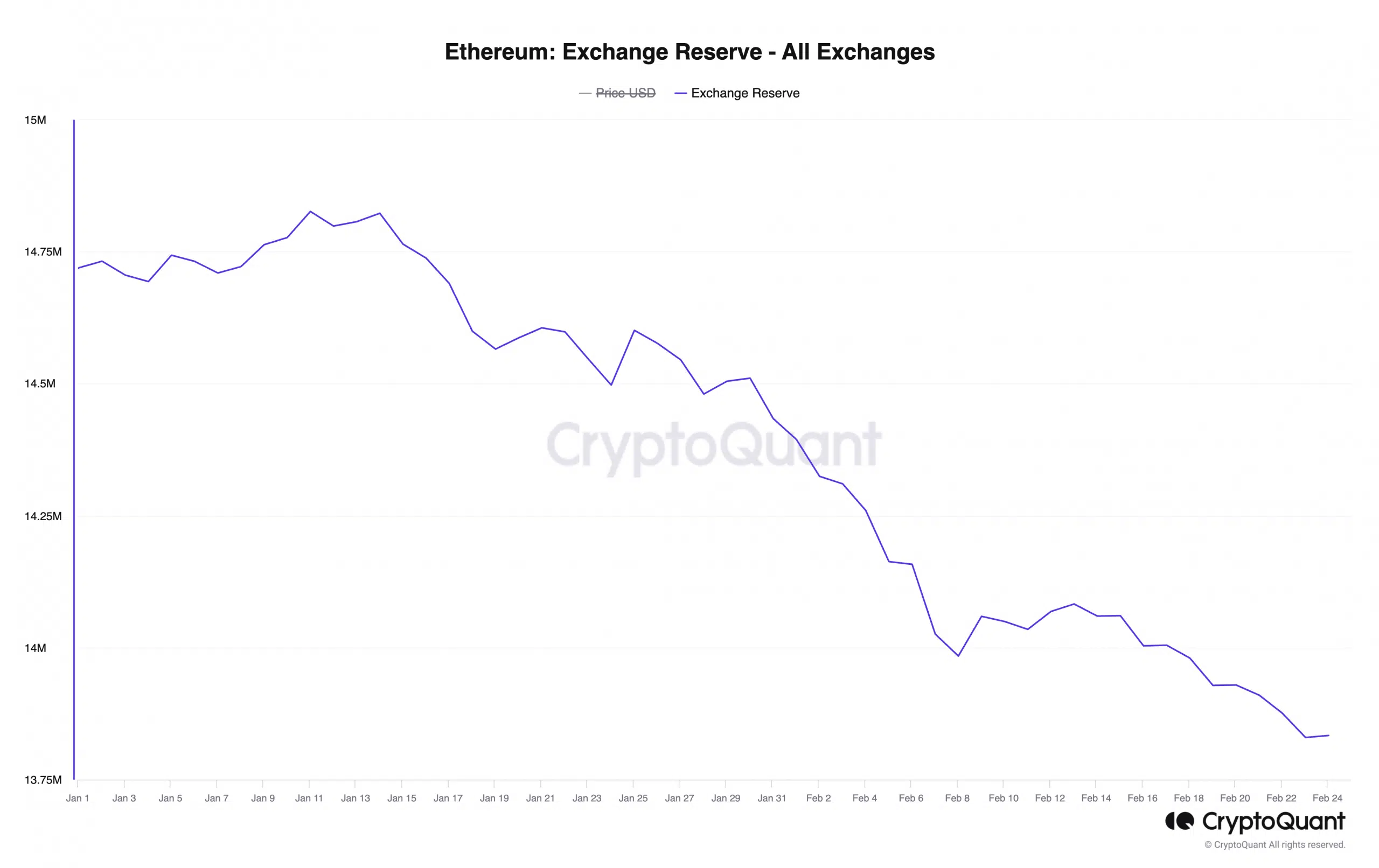

- Because the 12 months started, ETH’s alternate reserves have plummeted.

- This confirmed that purchasing exercise has since outpaced coin distribution.

Ethereum [ETH] alternate reserves have seen a major internet outflow of over 800,000 Ether, value roughly $2.4 billion because the 12 months started, in line with knowledge from CryptoQuant. This means that coin holders have been shopping for extra ETH than they’ve been promoting on exchanges since January.

At press time, data from the on-chain knowledge supplier confirmed that ETH’s alternate reverse was 13 million ETH, plummeting by 6% because the 12 months started.

Because of the excessive accumulation quantity, the 12 months to date has witnessed a formidable development in ETH’s worth. Exchanging arms at $2,950 as of this writing, the worth of the main altcoin has gone up by 32% because the 1st of January.

ETH’s rally put many holders in revenue

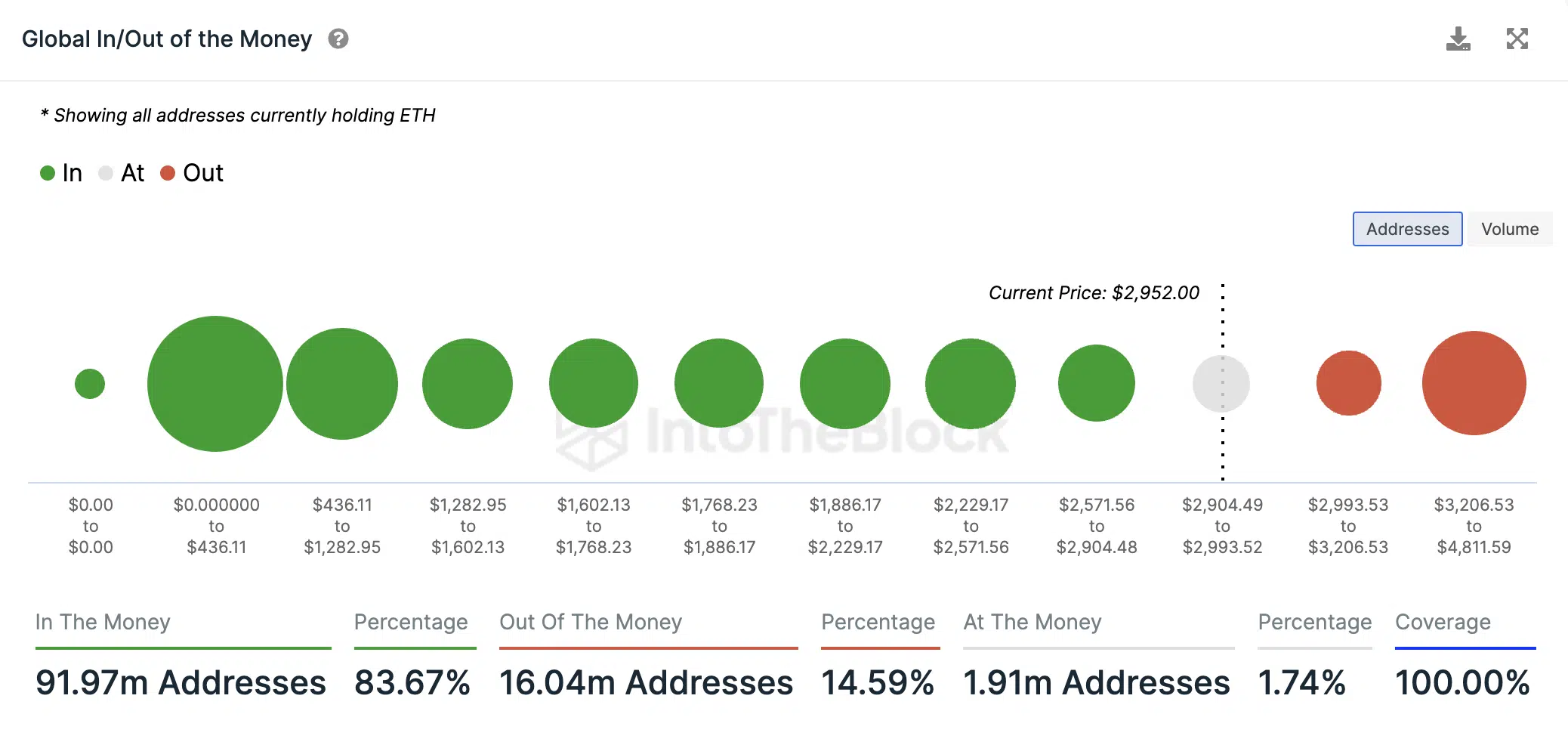

ETH’s current spike above the $2900 worth mark has put a major variety of its holders in revenue.

In accordance with knowledge from IntoTheBlock, of all of the addresses at the moment holding the altcoin, solely 2 million addresses achieve this at a loss. These addresses acquired their cash when ETH traded throughout the worth vary of $2993 and $4811 in the course of the bull market peak of 2021.

Conversely, a whopping 92 million addresses are “within the cash.” Which means if any of those addresses offered their cash at present market worth, they’d understand earnings on their investments.

To gauge the extent of profitability, AMBCrypto assessed ETH’s Market Worth to Realized Worth (MVRV) ratio on a 30-day shifting common. Per Santiment knowledge, this has climbed by 18% within the final month, shifting from 50% to 59%.

With an MVRV ratio of 59% at press time, every ETH holder was assured no less than 50% revenue in the event that they offered their cash on the present market worth.

Warning is important

As promoting strain dwindles, key momentum indicators assessed on a 24-hour chart had been noticed in overbought zones. For instance, ETH’s Relative Energy Index (RSI) and Cash Movement Index (MFI) had been 71.86 and 74.59, respectively.

At these values, a coin is deemed to be overbought. Consumers’ exhaustion is frequent at these highs, as market bulls usually discover it tough to maintain additional worth rallies. This usually leads to a brief worth downside.

As well as, the coin’s worth traded considerably near the higher band of its Bollinger Bands (BB) indicator, confirming the overbought nature of the market.

Is your portfolio inexperienced? Take a look at the ETH Profit Calculator

When an asset worth approaches or trades above this higher band, it implies that the asset’s worth has risen considerably in comparison with its current common ranges.

Merchants usually interpret this as an indication that the asset could also be reaching a short-term peak in worth, and a possible reversal could possibly be on the horizon.

[ad_2]

Source link