[ad_1]

Whether or not you’re younger, mid-career, or taking part in the again 9, Roth IRAs will be an essential software in your monetary objectives. 4 case research beneath will illustrate how by combining Roth IRAs with bitcoin, it can save you for retirement, optimize in your private tax scenario throughout retirement, and go away your bitcoin for the subsequent era.

These are hypothetical case research primarily based on our experiences, not actual individuals. They’re supposed that can assist you higher perceive how bitcoin Roth IRAs can match into many varieties of retirement plans. Therefore, they’re for instructional functions—you must talk about all private conditions with a monetary, tax, or authorized skilled.

- Sally the super stacker: Saving for retirement

- Rod is retirement ready: Entering retirement

- Larry wants to leave a legacy: Inheritance

- “Why Would I?” Wayne: Reasons not to Roth

1. Sally the tremendous stacker: Saving for retirement

Sally is in her early 30s and has fallen down the bitcoin rabbit gap. Sally views bitcoin as the perfect financial savings know-how given as we speak’s present macroeconomic backdrop and bitcoin’s mounted provide of 21 million and is dedicated to a disciplined accumulation technique.

She’s in search of a strategy to save her hard-earned cash with out struggling debasement over time. Finally, she wish to use her financial savings for main objectives: a dream trip, a home, beginning a household, and perhaps retiring sometime. However retirement is a distant objective, and she or he thinks the US might undergo some important modifications earlier than she’s able to calm down.

Why would she even hassle with the fiat-based American retirement system? The principles, limits, penalties, and potential modifications aren’t value it. Simply maintain your head down and stack sats, proper? Not so quick, Sally.

Significance of tax-free development

Like most bitcoiners, Sally is stacking bitcoin with cash that has already been taxed. Her payroll taxes are withheld on payday, and she or he is paid the remaining U.S. {dollars} into her checking account. She then sends cash to an change and purchases bitcoin. That is the standard means most individuals stack sats—post-tax.

Nonetheless, simply because the bitcoin is bought post-tax doesn’t imply it gained’t be taxed once more. Non-retirement bitcoin earnings are taxed as a capital achieve when bought. Over her years of stacking, she might want to maintain monitor of her value foundation and deduct that quantity from the gross proceeds when promoting.

It’s a easy formulation: (closing commerce) minus (what you paid) equals (what you made). What you make is taxed as capital beneficial properties.

Enter the Roth IRA

That is the place a Roth IRA financial savings automobile provides worth. If Sally have been to contribute to a bitcoin Roth IRA, contributions would nonetheless be made post-tax—similar as earlier than. However the important thing distinction is that certified Roth IRA distributions are tax-free. She solely pays tax as soon as, not twice.

The potential implications of tax-free bitcoin are huge. If the greenback worth of bitcoin exponentially will increase as Sally expects, then lowering her potential tax burden turns into more and more rewarding.

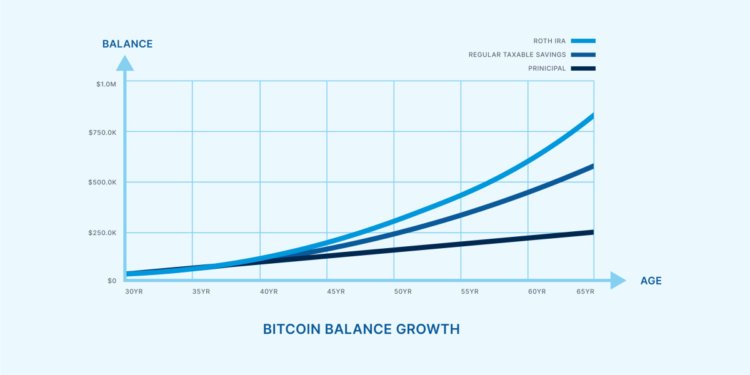

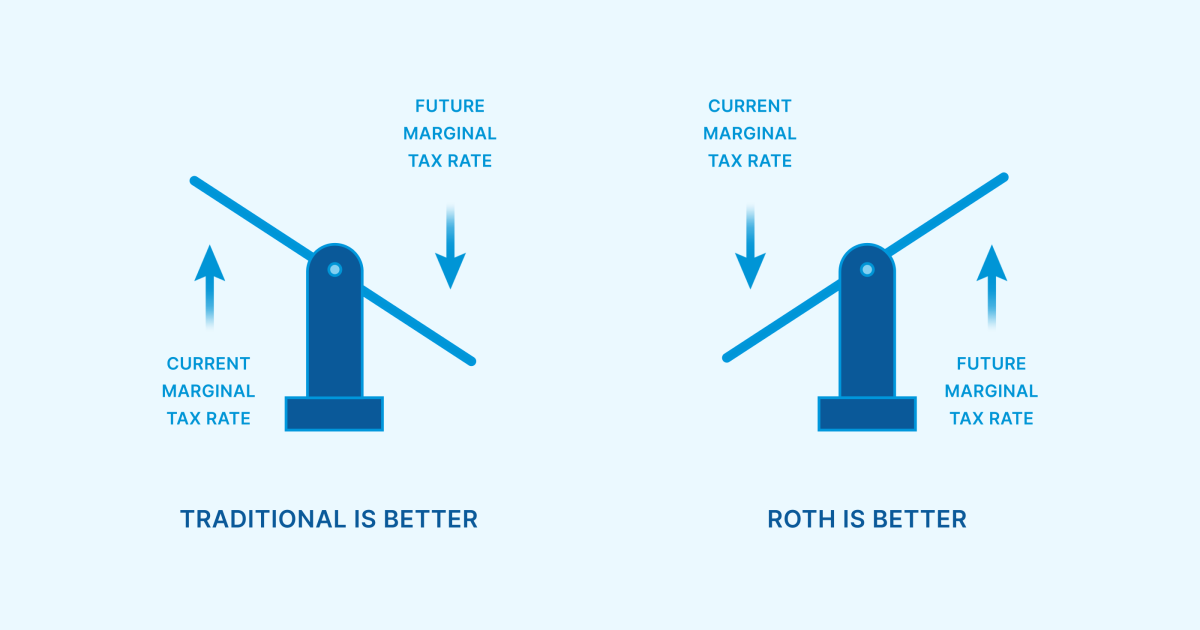

Let’s assume she begins saving $6,000 per yr at age 30 till she reaches age 65, and bitcoin grows at 6% annualized (be happy to plug in your own assumptions). At age 65, she could have amassed $822,330. And if she needed to pay an estimated 20% capital beneficial properties tax, it will quantity to a invoice over $117,000.

On this situation, a Roth IRA saves her greater than $117,000. The Roth turns into a automobile to supercharge future buying energy with out altering her present taxation. Not having to pay tax on future beneficial properties has an exponential impression over time.

Not simply retirement: Withdrawing contributions

4 years into maximizing her bitcoin Roth IRA contributions, Sally has contributed $24,000 (4 years of $6,000 max) and skilled a speedy enhance in bitcoin value—a standard expertise for a lot of bitcoiners. Let’s assume a hypothetical steadiness of $100,000. To have a good time and reward herself, she has deliberate a Miami trip. Nonetheless, she will’t determine if she ought to promote her non-retirement bitcoin and pay beneficial properties tax or take it from her retirement account and pay penalties.

With penalty-free entry to Roth contributions, Sally can take as much as $24,000 (her whole contributions) out of her Roth with out incurring penalty or tax. On this imaginary situation, let’s say she finally ends up pulling $10,000 from the Roth for her Miami trip.

Extra methods to maximise a Roth

If Sally meets somebody in Miami, she might pull $10,000 extra from the Roth for an elopement wedding ceremony. And the home with the picket fence? The Roth permits for some flexibility in that, too: Roth IRAs enable for as much as $10,000 of earnings to be withdrawn penalty-free if used for a first-time house buy. With $4,000 of contributions left and a further $10,000 in earnings for the first-time house buy, Sally might mix forces together with her equally-wise new partner—who was additionally contributing to a Roth—and compile $24,000 for a down cost.

After the tax- and penalty-free spending spree has subsided, she and her partner can proceed to repeatedly contribute once more, saving for the subsequent massive objective, and in the end for retirement.

Key takeaways

The Roth account has extra flexibility than simply saving for the traditional age 59 ½ retirement situation. Tax-free development is a robust software to develop wealth over time and needs to be strongly thought-about for any retirement plan. You’ll be able to pull contributions tax- and penalty-free at any time, and earnings are tax-free at retirement age. Sure situations even assist you to pull earnings out of your Roth and not using a penalty.

2. Rod is retirement prepared: Coming into retirement

Rod has been diligently making ready for retirement. He’s mentally there, however financially not able to take the leap. Nonetheless, bitcoin has develop into an more and more essential place in his portfolio. What began as a hedge (1-2%) has develop into a core element (+10%). He holds some bitcoin immediately however has extra publicity by way of bitcoin-adjacent belongings (GBTC, MicroStrategy, mining shares, and so on.).

He’s not able to go all-in on bitcoin as a result of, though he believes in its significance, the volatility conflicts along with his need for monetary stability throughout retirement. He has labored laborious to earn his nest egg and would hate for it to vanish—particularly to taxes. Inside the subsequent 5-10 years, he’ll transition out of his profession and dwell off his 401k, funding account, actual property fairness/revenue, and bitcoin. Any social safety or pension are only a bonus.

Brackets and buckets

Rod must dive into his monetary scenario and see how his tax brackets will look. What’s going to they seem like the Monday morning after he retires? What’s going to they seem like after the pension or social safety begin? What about when the 401k required minimal distributions begin at age 72? Understanding the place the cash is coming from, when it happens, and the way it’s taxed are vital elements to retiring—and staying retired.

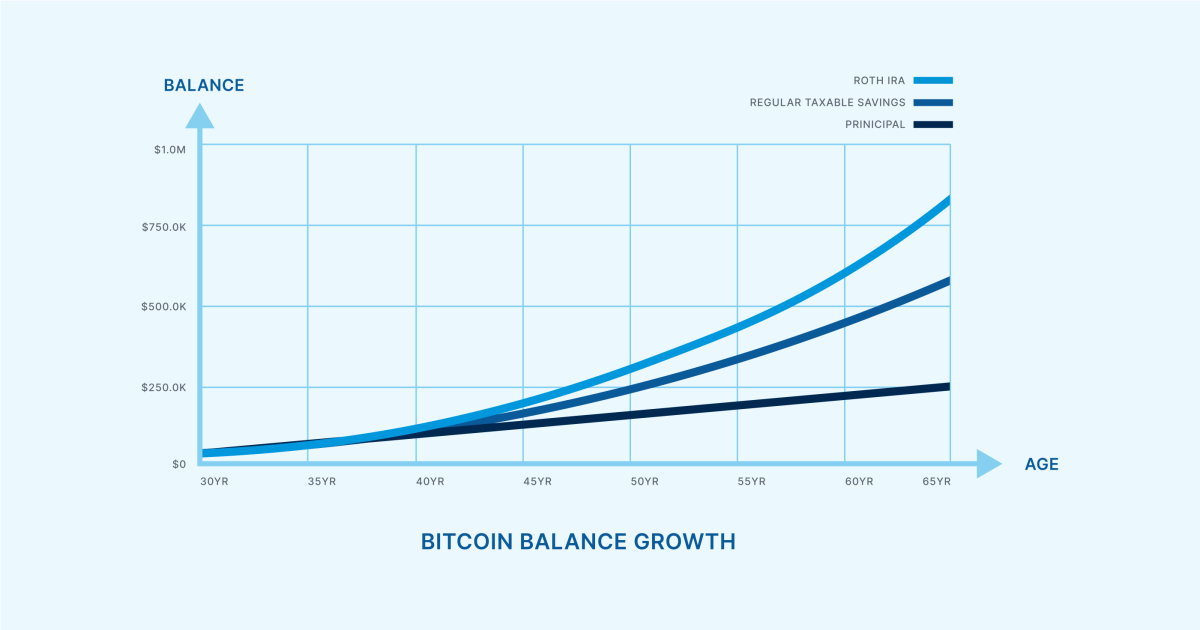

To make a plan, Rod wants to consider every account kind as being in a distinct “tax bucket”. His taxable belongings are taxed upon sale, and his tax-deferred accounts are taxed when he takes revenue from them. The Roth offers one other bucket: tax-free revenue. If Rod have been so as to add a Roth IRA, he might pull from completely different buckets relying on the plan and the necessity.

For instance, Rod can pull from the Roth in excessive tax years and maintain his bracket from climbing too rapidly. He can pull from taxable or Conventional IRAs in low tax years and speed up that revenue at a decrease marginal price. Extra subtle methods might embrace conversions, delaying revenue, gifting taxable belongings, and so on. The important thing level: Roth permits for diversification in “tax buckets” to optimize your tax bracket in retirement.

When Rod provides this tax-free bucket to his image, he decides to fill it with excessive threat/reward belongings like bitcoin. If the expansion is tax-free, then it is sensible for it to develop as a lot as attainable. He decides to promote his mining shares, GBTC, and MSTR and convert that money right into a bitcoin IRA (preferably one where he controls access to the keys).

Key takeaways

What did your bracket seem like this yr? No, not the March Insanity one. The un-fun IRS one. All retirees should take into account their anticipated tax bracket all through retirement, and tax bracket administration is a science and an artwork. Specifics range from individual to individual, however the primary idea applies: The extra diversified your “tax buckets,” the extra flexibility and optionality you should have in any tax surroundings.

3. Larry desires to go away a legacy: Inheritance

Larry has been having fun with his time along with his spouse and grandchildren. He had a profitable profession and worthwhile investments which have sustained his way of life by way of retirement. Now, he thinks far more concerning the subsequent era and the challenges and struggles they’ll face. He desires to guard these he cares about and go away the world a greater place.

At first, bitcoin didn’t make sense to him. He thought it was simply one other get-rich-quick scheme. However given the state of the world as we speak and institutional monetary foolishness going down, he’s now open to seeing its long-term potential. Larry’s principal objective is to go away bitcoin for the children and grandkids. He thinks it might develop into significant for his or her future when he’s not with them.

Inheritance and property concerns

When Larry units up a Roth IRA, he doesn’t ever need to take Required Minimum Distributions from that account. He can go away the belongings there to develop tax-free for the long run—good for bitcoin. Larry can simply add or modify beneficiaries to that IRA at any time, and beneficiaries will obtain the Roth revenue tax-free upon his passing. He can accomplish his objective of passing bitcoin to his family members. (Property taxes should apply, Roth IRAs solely keep away from revenue tax.)

Changing to a Roth IRA

Larry was already retired when the Roth IRA got here out in 1997, so he doesn’t have an present Roth, and also you want earned revenue to contribute. However although he can’t add cash immediately to at least one, he can take into account a Roth conversion.

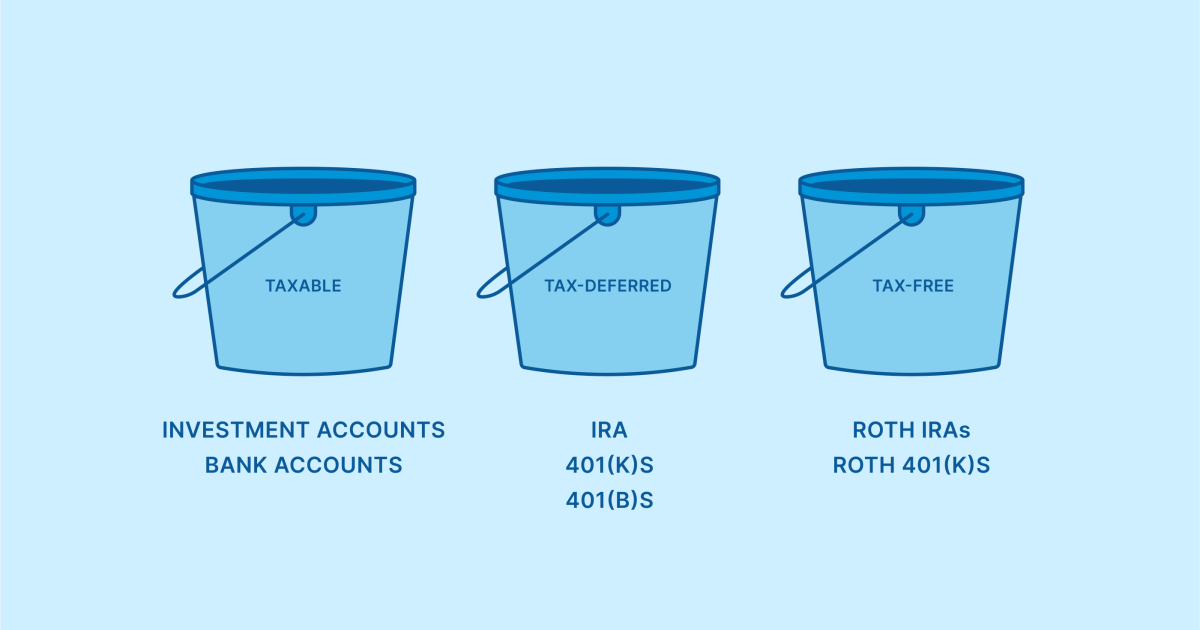

He can take pre-tax 401k/IRA funds and convert them to Roth, permitting him to pay the tax now and switch it right into a tax-free automobile for future generations. As as to if it is a good thought in your beneficiaries, the maths is pretty easy: if you happen to anticipate your tax price to be decrease than your beneficiaries’ tax price, then the Roth would make extra sense.

Key takeaways

Larry has optionality. If the maths is sensible, he might flip a portion of his portfolio right into a bitcoin Roth IRA and go away the asset for future generations. It’s value noting that holding your individual keys in an Unchained IRA requires that you just additionally do proper inheritance planning.

4. “Why Would I?” Wayne: Causes to not Roth

Wayne is in his peak incomes years and making actually good cash at his fiat job. He lives a easy life having fun with a whole lot of time outside, and expects to not want a lot revenue after he retires. He has many hobbies, one in every of which is mining bitcoin with a number of machines from his house. It’s not a large-scale operation, only a passion, however he would take into account mining bitcoin along with his retirement account if that have been an possibility. Finally, he plans to go away all belongings he owns to charities that he cares about.

Brackets and buckets pt. 2

Revisiting the brackets and buckets dialogue from above, Wayne’s present revenue (excessive bracket) is far higher than his anticipated future revenue wants (low bracket). If he have been to transform any of his present retirement belongings to Roth, he can be paying the next price than if he had simply waited to drag it in retirement. From this angle, it could be wiser to maintain the belongings in a Conventional pre-tax account and never convert to Roth.

Dying and taxes…

the saying: nothing is for certain in life however dying and taxes. If that’s true, we are able to actually add “dying taxes” to the record. “Dying tax” most likely wasn’t too widespread in opinion analysis research, so “property tax” is the politically appropriate time period nowadays. In 2022, the property tax kicks in round $12 million of web value ($24 million for married {couples}). Over time, increasingly bitcoiners might want to take into account this threshold because it turns into related to their scenario.

As Wayne considers a Roth IRA, he ought to notice Roth IRAs don’t keep away from the property tax, solely the revenue tax. Wayne plans to go away all belongings to charity. Property left to certified non-profit entities would keep away from each property and revenue tax. In his case, there isn’t a profit to the Roth over his present construction from a taxation-at-death standpoint. If it goes to charity, it avoids the dying tax—a silver lining to say the least.

Mining in a Roth?

Now, let’s re-introduce Wayne’s bitcoin mining passion. Mining bitcoin inside an IRA is technically attainable however extremely suggested towards for the common investor. He ought to concentrate on the tax nightmare usually concerned and seek the advice of a tax advisor concerning UBIT (Unrelated Business Income Tax) within IRA accounts. Moreover, if Wayne desires to carry his mined bitcoin without revealing personal information to a financial institution, Roth IRAs merely aren’t an possibility.

Key takeaways

When contemplating a monetary technique, no single software works for each particular person’s scenario. Components akin to tax bracket, web value, and charitable intent are all related concerns when evaluating a Roth IRA. Mining doesn’t are usually well-suited for bitcoin IRAs due to UBIT. On account of these components, a Roth IRA will not be the appropriate route for Wayne.

Wrapping up

Hopefully, you’ve seen how versatile, versatile, and impactful the Roth IRA automobile will be when mixed with the perfect financial savings know-how ever found: bitcoin. You’ve seen circumstances that will positively and negatively have an effect on the suitability of a bitcoin Roth IRA in your monetary image.

When contemplating bitcoin in a Roth IRA, you must all the time take into account who’s controlling the keys. There are tangible differences between the many approaches to bitcoin IRAs, and there’s no motive to let an change hack or mistake jeopardize your wealth. The Unchained IRA lets you safe your monetary future by holding your individual personal keys to your bitcoin.

Whether or not you’re planning for retirement, coming into retirement, or planning your inheritance, the Unchained IRA staff may also help. To be taught extra, sign up for an upcoming Retirement and Inheritance webinar or enter your e-mail beneath to join our e-newsletter.

This text is supplied for instructional functions solely, and can’t be relied upon as tax or funding recommendation. Unchained makes no representations concerning the tax penalties or funding suitability of any construction described herein, and all such questions needs to be directed to a tax or monetary advisor of your selection. Jessy Gilger was an Unchained worker on the time this put up was written, however he now works for Unchained’s affiliate firm, Sound Advisory.

Initially printed on Unchained.com.

Unchained Capital is the official US Collaborative Custody accomplice of Bitcoin Journal and an integral sponsor of associated content material printed by way of Bitcoin Journal. For extra data on providers supplied, custody merchandise, and the connection between Unchained and Bitcoin Journal, please go to our website.

[ad_2]

Source link