[ad_1]

- BTC’s provide absorption by spot ETFs has turned unfavorable.

- This prompt a short lived decline in curiosity in BTC spot ETFs.

The latest decline in Bitcoin’s [BTC] provide absorption by spot Bitcoin exchange-traded fund (ETF) has indicated a drop in curiosity on this asset class.

This was famous by pseudonymous CryptoQuant analyst Oinonen_t in a brand new report.

The BTC spot ETF market witnesses a slight decline

BTC’s provide absorption by BTC ETFs tracks the speed at which newly mined cash are acquired or absorbed by these funds.

This metric is necessary as a result of elevated provide absorption from spot ETFs may probably result in upward worth strain on BTC.

Conversely, a decreased demand can sign a possible decline within the main coin’s worth.

Oininen_t discovered that the coin’s provide absorption not too long ago turned unfavorable and dropped to a low of -0.38. Confirming the place above, the analyst opined,

“Regardless of the hype round upcoming halving in 21 days, bitcoin’s spot worth hasn’t moved dramatically throughout the previous 30 days. One rationalization for the stagnant worth motion is the unfavorable provide absorption of the ETFs.”

The analyst added that when spot ETFs can’t take in the newly mined cash,

“The demand for the roughly 900 bitcoins issued each day should come from different sources.”

Nonetheless, within the present market, the retail buyers who often accumulate these cash have shifted their consideration in the direction of meme cash.

Prior to now few weeks, the values of some Solana [SOL]-based meme cash have grown by triple-digits, resulting in a big uptick within the meme coin market capitalization.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

In accordance with Oininen_t,

“Though retail buyers have proven rising curiosity in the direction of bitcoin, their focus could be on the brand new Solana-based tokens and “meme cash.”

Concluding that the unfavorable provide absorption is a short lived disadvantage within the spot ETF market, the analyst stated,

“The larger image nonetheless seems promising. In a multi-year state of affairs, I see bitcoin making an attempt to achieve market capitalization parity with gold, which might imply a 1000 p.c upside to the present spot worth.”

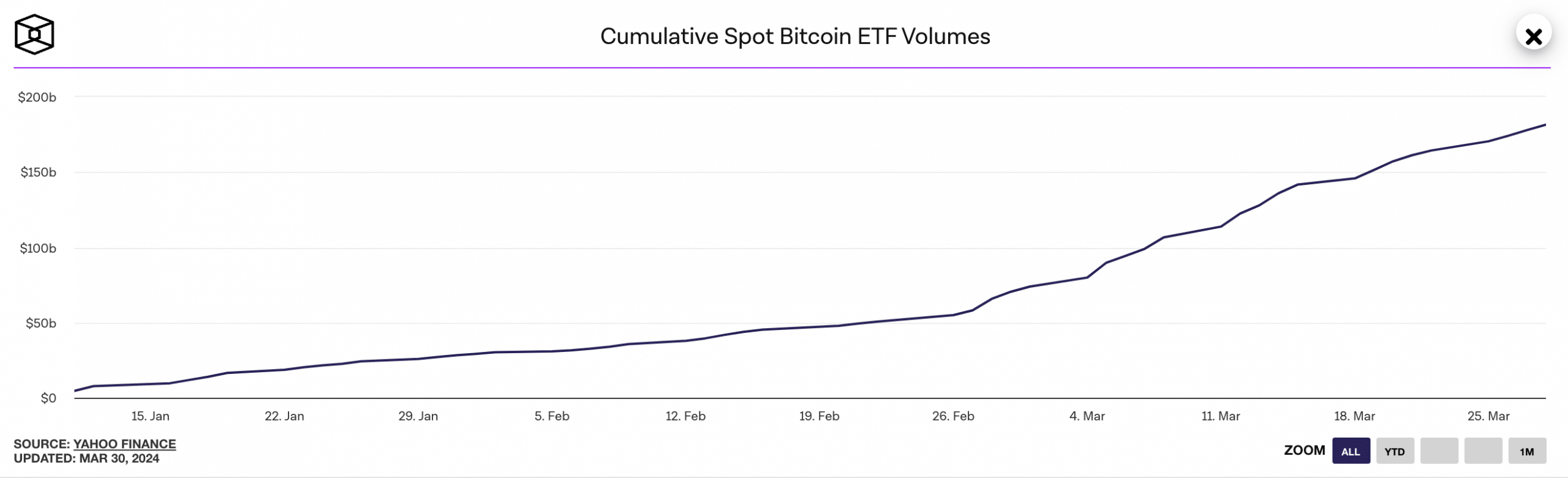

Since its launch, the quantity of Bitcoin spot ETFs have grown considerably. Sitting at $182 billion at press time, the each day cumulative quantity for this asset class has climbed by over 3500%.

With an asset underneath administration (AUM) worth of $24 billion, the Grayscale Bitcoin Belief (GBTC) at present holds the most important market share within the BTC spot ETF market.

[ad_2]

Source link