[ad_1]

- Ethereum noticed wholesome progress in on-chain exercise.

- Ethereum shrimp and plankton refused to promote their holdings.

Ethereum [ETH] rallied by 82% from 1st February to twelfth March. Since then, it has retraced as little as $3056 earlier than bouncing increased, buying and selling at $3533 at press time. This resembled the consolidation part within the second half of January.

AMBCrypto examined some related metrics and located a number of similarities. These hints highlighted a bullish bias and a wholesome community total.

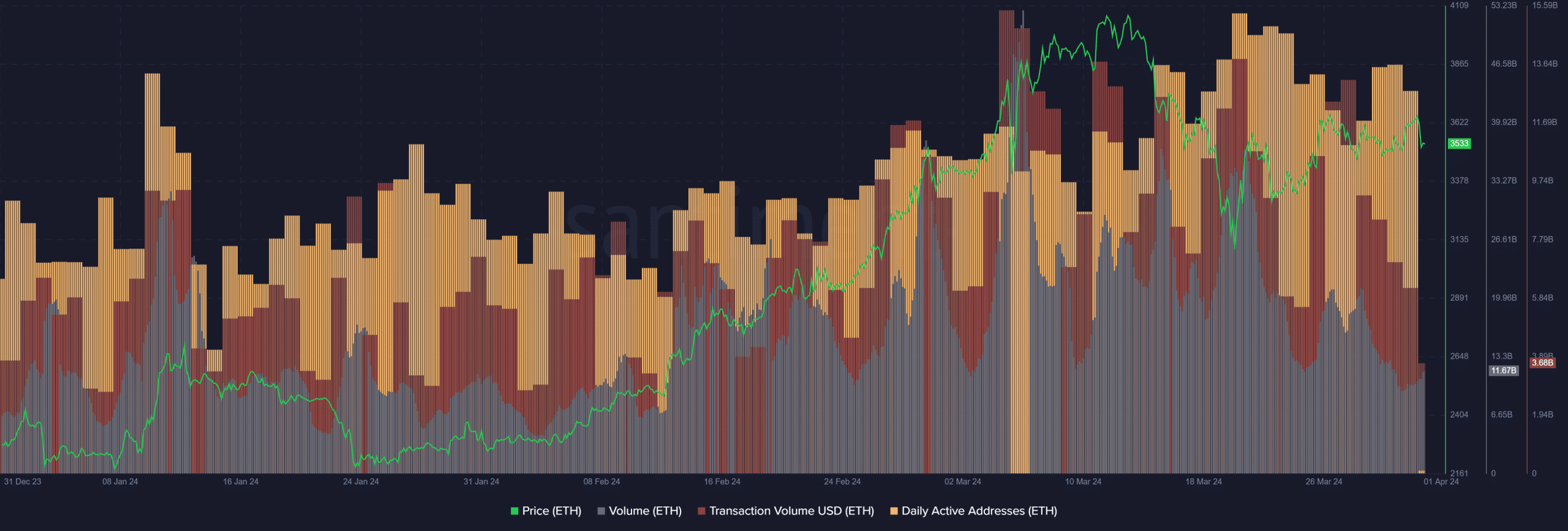

The peaks in quantity and energetic addresses

Supply: Santiment

Ethereum rallied from $1521 to $2717 from twelfth October 2023 to twelfth January, a 78% transfer. It retraced for shut to 3 weeks earlier than breaking above the decrease timeframe resistance at $2380.

Simply earlier than the ETH worth droop, the buying and selling quantity peaked to ranges not seen in over six months. The each day energetic addresses additionally shot upward, practically reaching September 2023’s highs.

The surge in exercise was comprehensible as bullish sentiment was intense. This spurred elevated demand for ETH and drew in additional participation. Throughout the retracement, the each day energetic addresses remained excessive.

The buying and selling quantity, then again, slumped drastically. This was fairly just like what occurred over the previous three weeks. In March, the each day energetic addresses made new highs even after costs plunged to the $3100 mark.

In the meantime, the on-chain transaction quantity fashioned an area peak throughout the January and March highs. The retracement interval noticed a quick decline within the transaction quantity, adopted by a fast restoration.

The transaction quantity of the previous week was low, however in any other case, the metrics carefully mirrored what occurred within the latter half of January.

This comes alongside ETH bulls forcing a fast restoration after falling to $3056. We would see a bullish continuation in April as we did in February.

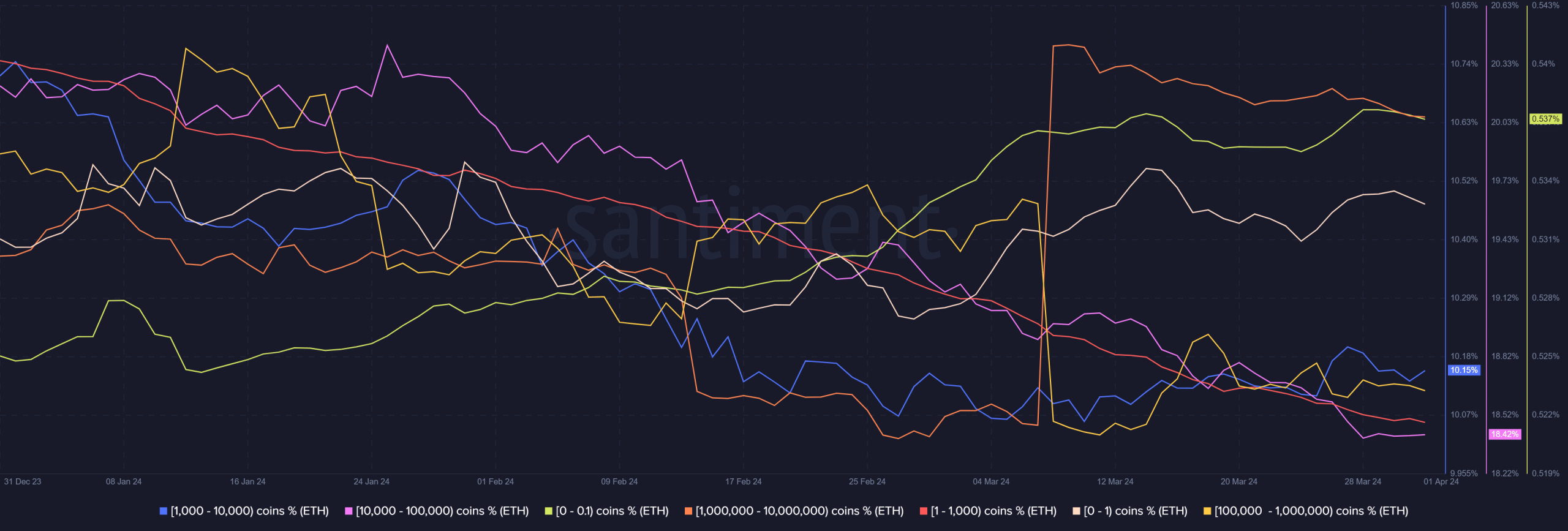

The availability distribution confirmed whales had been shopping for

Supply: Santiment

When smaller holders promote their property to whales, it’s usually a bullish signal. The Ethereum provide distribution chart confirmed this however with a caveat. Wallets with 1k to 10k ETH and 100k to 1 million ETH slowly trended increased after twelfth March.

Is your portfolio inexperienced? Test the ETH Profit Calculator

Shrimp holders additionally grew, equivalent to these with fewer than 0.1 or 1 Ethereum. The 1 to 1k bracket shrunk steadily. This confirmed that medium-sized holders had been promoting their holdings whereas whales and shrimp alike continued to build up the property.

The 10k-100k ETH bracket additionally trended downward, which went in opposition to the bullish inference. It confirmed that accumulation and distribution weren’t black and white, however small ETH holders had been more and more HODLing.

[ad_2]

Source link