[ad_1]

Information exhibits that Bitcoin investor sentiment has cooled to the bottom stage since February, one thing that would facilitate a rebound within the value.

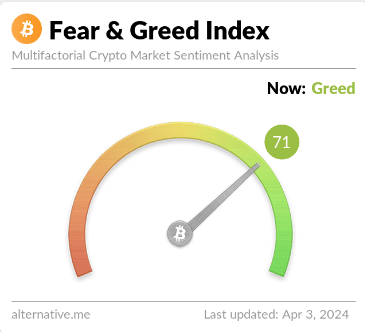

Bitcoin Concern & Greed Index Now Factors At Simply ‘Greed’

The “Fear & Greed Index” is an indicator created by Alternative that tells us concerning the normal sentiment amongst traders within the Bitcoin and broader cryptocurrency sector.

This metric makes use of a numeric scale from zero to hundred to signify the sentiment. To calculate the rating, the index considers the info of 5 elements: volatility, buying and selling quantity, social media sentiment, market cap dominance, and Google Developments.

All values of the indicator above the 53 mark counsel the presence of greed among the many traders, whereas under the 47 stage implies a fearful market. The area between these two corresponds to the impartial sentiment.

Right here is how the newest worth of the Bitcoin Concern & Greed Index seems to be:

The worth of the index seems to be 71 in the meanwhile | Supply: Alternative

As is seen above, the Bitcoin Concern & Greed Index presently has a price of 71, implying that the traders share a majority sentiment of greed. Simply yesterday, the index’s worth had been notably larger than this, implying that there was a little bit of a cooldown of sentiment previously 24 hours.

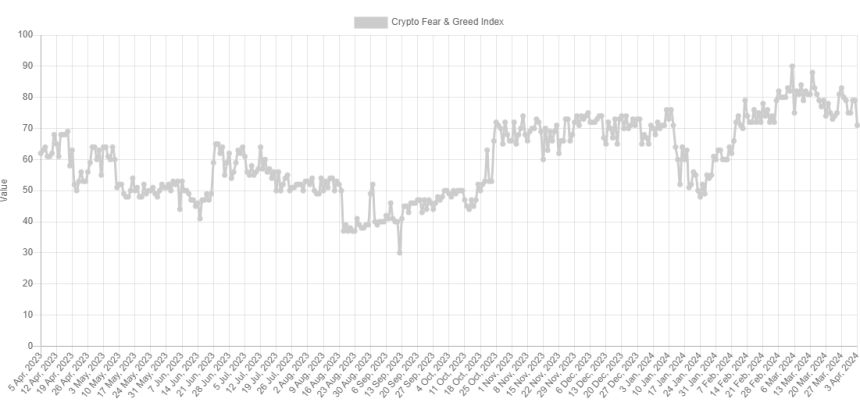

Under is a chart that exhibits the development within the index over the previous yr.

The worth of the indicator appears to have registered a plunge not too long ago | Supply: Alternative

Moreover the three core sentiments, there are additionally two “excessive” sentiments: excessive greed and excessive worry. The previous happens at values above 75, whereas the latter happens underneath 25.

The Bitcoin Concern & Greed Index was 79 yesterday, implying that the market had been extraordinarily grasping. The indicator has been often inside this zone for the previous month, so the present regular greed values go towards the development.

The sentiment amongst traders has naturally been so excessive not too long ago as a result of the BTC value has gone by a pointy rally on this interval and has explored fresh all-time highs (ATHs).

The Bitcoin value has traditionally tended to go towards the bulk’s expectations. And the stronger this expectation has been, the extra seemingly such a opposite transfer will happen.

On account of this motive, the intense sentiments have been the place reversals within the asset have been probably the most possible to happen previously. For example, the present ATH of the asset shaped when the index was at a price of 88.

With the latest value drawdown, sentiment has additionally taken a success. The truth that it has fallen out of the intense greed zone, although, could also be conducive to a backside forming. The sooner backside, round 20 March, additionally shaped when the index exited the zone.

The present stage of the Bitcoin Concern & Greed Index just isn’t solely decrease than it was then but additionally the bottom since 11 February, when the asset was nonetheless buying and selling round $48,000.

BTC Worth

Bitcoin is now right down to the $65,800 stage after going through a drawdown of greater than 7% over the previous few days.

Seems like the value of the asset has plunged to lows not too long ago | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, Various.me, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site completely at your personal threat.

[ad_2]

Source link