[ad_1]

- Ethereum fuel utilization declined together with total exercise.

- Whales present curiosity in ETH as costs surge.

Ethereum [ETH] has been having a tricky time during the last week as its worth has declined considerably. Nonetheless, it wasn’t simply costs that had been impacted throughout this era.

Exercise on Ethereum declines

Ethereum’s median fuel plummeted to as little as 12.5 gwei, marking the bottom stage witnessed this 12 months. At press time, the community’s Fuel stood at 8 gwei, as reported by Dune Analytics.

This occurred as extra customers began preferring blockchains like Solana [SOL] and Base.

Whereas decrease fuel charges may initially appear useful for customers, it might signify decreased demand for transactions on the blockchain.

This decline in exercise might probably point out a slowdown in consumer engagement or dApp utilization, which might have unfavorable implications for Ethereum’s ecosystem.

The variety of good contracts being deployed on the Ethereum community fell as properly.

This will sign a decline in developer exercise and innovation throughout the Ethereum ecosystem, probably resulting in decreased consumer engagement and adoption.

Moreover, fewer good contracts being deployed might lead to decreased transaction quantity and community exercise, impacting Ethereum’s total transaction charges and income.

Whales present curiosity

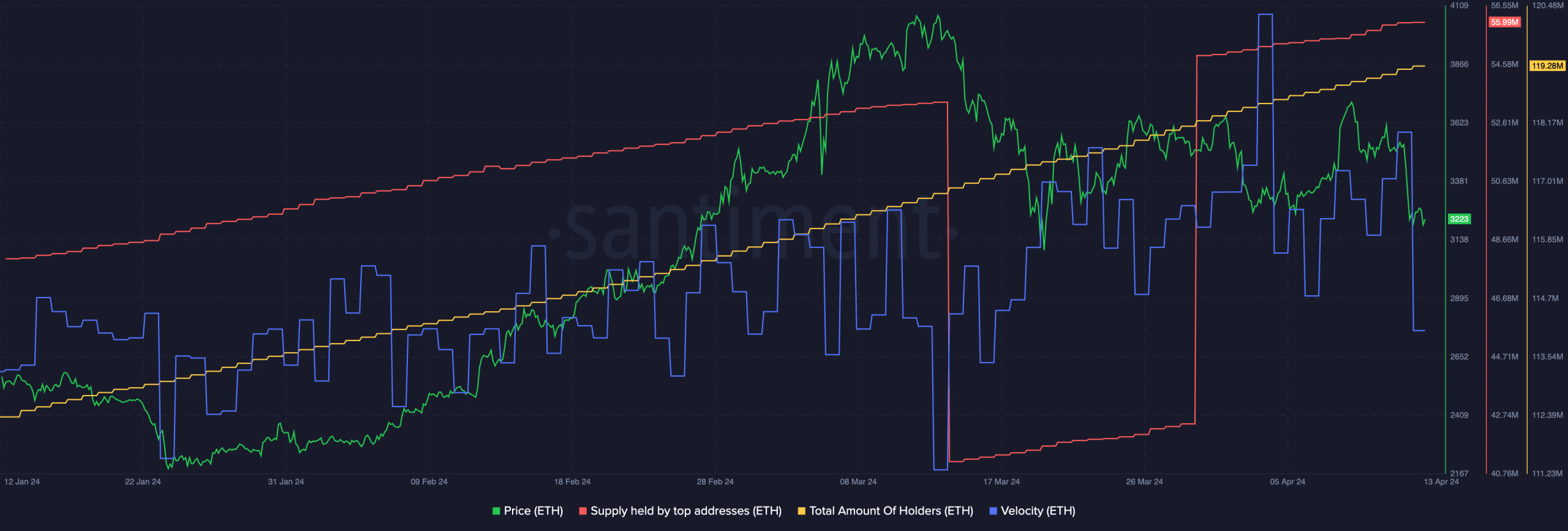

Nonetheless, the value has began to see inexperienced. Within the final 24 hours, ETH’s worth grew by 5.61%. At press time, ETH was buying and selling at $3,242.75. This surge in worth might have been brought on by whale curiosity.

AMBCrypto’s evaluation of Santiment’s information revealed that the share of huge addresses holding ETH had shot up.

Whereas a surge in Ethereum’s worth pushed by elevated whale curiosity could initially appear optimistic, it might probably have unfavorable implications for the broader Ethereum ecosystem.

The heightened focus of ETH within the fingers of huge addresses, could result in elevated market manipulation and volatility, as their buying and selling actions can considerably affect worth actions.

Learn Ethereum’s [ETH] Price Prediction 2024-25

Furthermore, the full variety of addresses holding ETH had additionally grown. This indicated that not solely whales, however even retail buyers had been displaying curiosity in ETH.

ETH’s velocity had declined, which indicated that the frequency with which ETH was buying and selling had decreased considerably. This instructed that ETH transactions had fallen, which might hinder costs sooner or later.

[ad_2]

Source link