[ad_1]

- Safety issues round Ethereum had been explored by analysts.

- Exercise on the Ethereum community remained excessive, and curiosity in NFTs fell.

Ethereum [ETH] is thought for its reliability and hasn’t confronted any main points. Nevertheless, questions had been raised concerning the community’s safety lately.

Wanting into the safety side

Based on the findings of crypto analyst Christine Kim, Ethereum’s safety mannequin poses sure vulnerabilities. Her evaluation delves into potential exploits that attackers may make use of towards Ethereum’s proof-of-stake consensus protocol.

It examines eventualities comparable to reorganizations and finality delays, notably regarding attackers with various proportions of the whole staked ether.

A key perception is that attackers with extra important stakes wield better affect, as their stake interprets into voting energy, enabling them to sway the contents of future blocks.

Because the attacker’s stake reaches sure thresholds, their energy escalates, resulting in outcomes like finality delays, double finality, censorship, and management over each the blockchain’s previous and future.

Nevertheless, assaults involving 34%, 51%, or 66% of staked ether may necessitate out-of-band social coordination for decision. Whereas this might pose challenges for the neighborhood, the Ethereum social layer serves as a strong protection mechanism.

Any technically profitable assault might probably be neutralized by the neighborhood’s settlement to undertake an trustworthy fork.

This dynamic creates a race between the attacker and the Ethereum neighborhood, the place swift social coordination might render the attacker’s funding futile.

How is Ethereum doing?

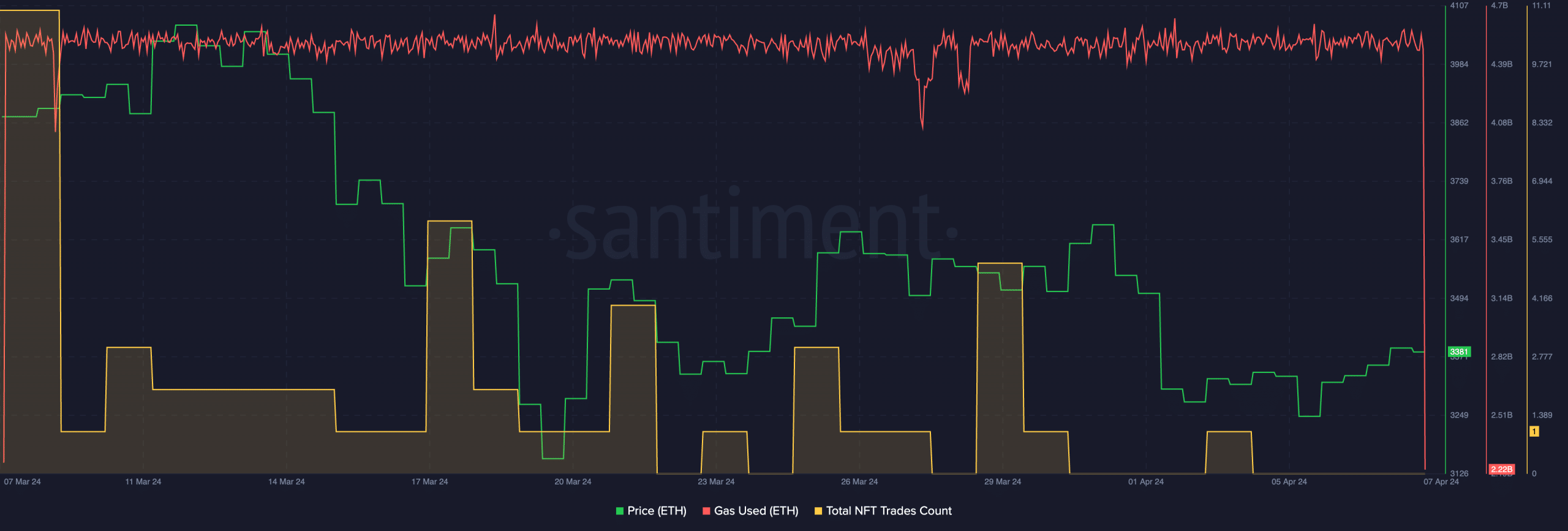

Regardless of these safety issues, it was enterprise as ordinary on the Ethereum community. AMBCrypto’s evaluation of Santiment’s knowledge revealed that the gasoline utilization on the Ethereum community had remained constant over the past month.

This indicated that exercise on the community had remained the identical. Nevertheless, curiosity within the NFT sector declined considerably throughout this era.

The declining NFT trades on the community prompt that the rising exercise on the Ethereum community wasn’t pushed by curiosity in NFTs on the community.

Learn Ethereum’s [ETH] Price Prediction 2024-25

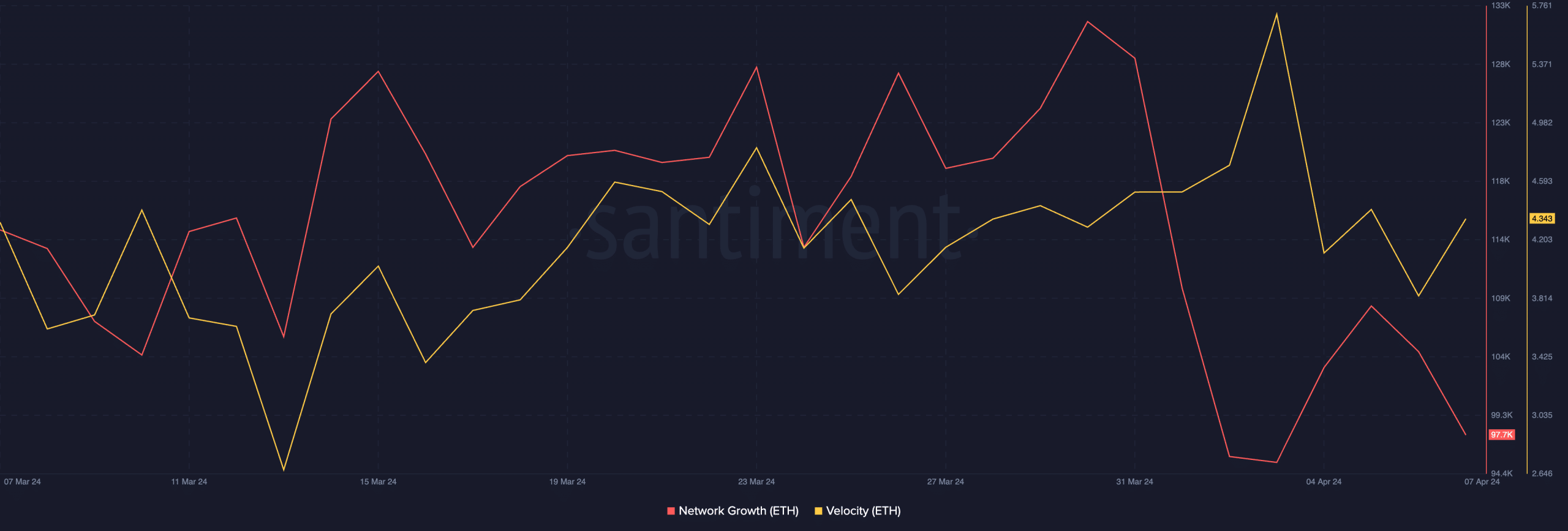

Coming to ETH’s value, it was buying and selling at $3,522.12 and its value had declined by 1.92% within the final 24 hours. Furthermore, the community development of ETH had additionally plummeted indicating that new addresses had began to lose curiosity within the token.

Moreover, the rate at which ETH was buying and selling at had additionally fallen, implying that the buying and selling frequency of ETH had decreased.

[ad_2]

Source link