[ad_1]

If the crypto funding craze of 2021 could possibly be outlined with one investor identify, that may be Andreessen Horowitz — or a16z for brief. The well-known VC agency has raised over $7.6 billion for its crypto funds.

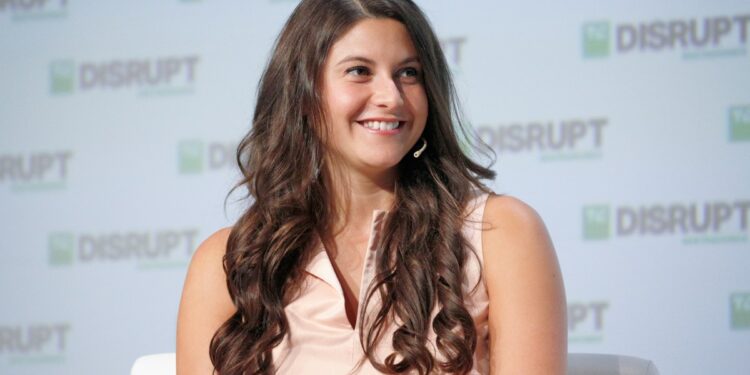

And but, crypto isn’t doing so nicely this 12 months. As TechCrunch’s Jacquelyn Melinek wrote earlier this summer season, crypto funding dropped for the fifth consecutive quarter. That’s why we invited a16z Normal Associate Arianna Simpson at TechCrunch Disrupt to take the heartbeat of the crypto ecosystem.

“I’ve been in crypto for over 10 years,” Simpson stated. “What we’ve seen is that there are very repetitive cycles. And that is by the best way not distinctive to crypto or web3, it occurs within the historical past of expertise and continues to occur any time there’s a brand new type of expertise. There’s plenty of sort of boom-and-bust moments. And you may’t count on an area to proceed with the identical form of capital funding throughout all quarters.”

In different phrases, funding and funding rounds will choose up once more sooner or later within the close to future. Nevertheless it doesn’t imply that founders ought to look ahead to crypto to be again in style once more.

“What we’ve seen is that the tempo of expertise improvement and innovation shouldn’t be correlated with the quantity of capital that’s flowing in at a given second,” she stated. “And so that you may see a interval of plenty of capital getting into the area, as clearly we noticed in 2021. However then, the following years, whenever you’re not truly seeing as many funding rounds occur, is when plenty of the precise improvement work and innovation is definitely being created.”

a16z itself hasn’t deployed all its capital in sooner or later. The explanation why the VC agency has raised a lot cash for its crypto funds is that it believes the chance is very large. However a16z has deployed lower than half of its crypto fund to this point.

Earlier this 12 months, a16z introduced its first worldwide workplace in London. Many noticed it as an indication that the regulatory setting was too unpredictable within the U.S. and that a16z was on the lookout for one other market with a extra steady regulatory framework.

“I feel the U.S. has — you already know, we’re nonetheless very a lot right here as nicely — however we expect the U.S. has some work to do to create a regulatory framework that makes founders really feel comfy and like they’re capable of truly construct nice expertise merchandise right here with out worrying about attainable repercussions,” Simpson stated.

“The shortage of particular steering right here within the U.S. is definitely pushing authentic corporations offshore, as a result of they really need to be compliant,” she added later within the dialog.

Provided that the general tech dialog has largely shifted from crypto to AI, it makes you marvel how opportunistic VC companies like a16z really feel about this development. “Yeah, nicely, I’m undoubtedly not pivoting to AI,” Simpson stated.

“AI may be very a lot by nature a centralizing power. You want plenty of capital, you want plenty of knowledge, and that sort of naturally gravitates in the direction of a extra centralized mannequin. Crypto is by nature decentralized, and I feel it could actually actually present a robust counterbalance to among the centralizing forces of AI,” she added.

“The founders which have been probably the most profitable in web3 or actually in any area is the founders that ignore the market cycles and stay actually centered on the core expertise.”

[ad_2]

Source link