[ad_1]

In a daring and visionary assertion, Arthur Hayes, the founding father of BitMEX, has laid out his compelling argument for a monumental Bitcoin worth surge within the period of synthetic intelligence (AI). In his just lately revealed weblog publish titled “Massa,” Hayes shares his insights on the interaction between Bitcoin and AI, asserting that BTC will change into the foreign money of alternative for AI-powered economies.

Hayes passionately describes the profound affect of AI on humanity and envisions a future the place AI frees people to pursue their passions, resulting in a renaissance of artwork and tradition. Hayes states, “To that finish, my hope is that synthetic intelligence (AI) and robotics can be used primarily to eradicate the tedious, bullshit work wherein most of humanity presently toils, in order that an increasing number of individuals can pursue their passions similarly.”

The BitMEX founder acknowledges the exponential progress of AI, exemplified by the ChatGPT’s speedy adoption, which reached an astounding 100 million month-to-month energetic customers in simply two months. Hayes posits that this technological development will convey us to the brink of a major turning level, the place AI goes viral and revolutionizes our lives in unprecedented methods.

Hayes’ Daring Bitcoin Prediction

In his weblog publish, Hayes outlines the potential interaction between Bicoin and AI. He delves into the need of a censorship-resistant digital funds system that operates constantly, with clear and clear guidelines. In keeping with him, BTC’s attributes as a purely digital, censorship-resistant, and provably scarce foreign money are making it essentially the most appropriate alternative for AIs.

Hayes writes, “Bitcoin is thus the logical foreign money alternative for any AI. It’s purely digital, censorship-resistant, provably scarce, and its intrinsic worth is totally electricity-cost-dependent.” His compelling argument asserts that Bitcoin’s properties align completely with the necessities of AIs, making it the clear frontrunner because the foreign money of their financial actions.

Furthermore, Hayes considers the long run implications of BTC’s dominance within the AI period. He speculates on the potential surge in on-chain transaction volumes and ponders the staggering heights Bitcoin’s worth might attain if the narrative of AI + Bitcoin turns into mainstream.

Nonetheless, Hayes emphasizes the significance of market sentiment and the facility of narrative, stating, “Essentially the most cash is made when the market worth adjusts from ‘can by no means occur’ to ‘possibly might occur”, including that worth of the Bitcoin community is a guess on the long run quantity of transactions that can happen.

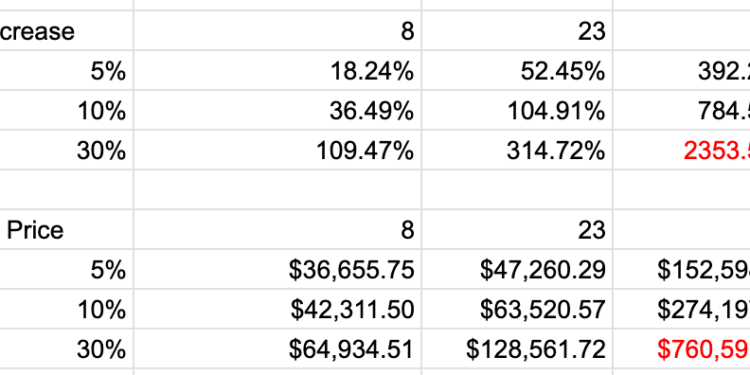

“To get a way of what’s potential, I appeared on the previous multiples beginning in 2015. I took the day by day worth of BTC transfers on the community excluding change returned to the sender. I then appeared again on the previous 365-day median to get a price that isn’t influenced by very excessive or low day by day values. Lastly, I divided the present day’s Bitcoin market cap by the day by day median worth to reach on the ahead a number of,” defined Hayes.

He then created a low (8x), median (23x) and mania (172x) estimation and assumes that the speed of Bitcoin transactions will match the entire quantity of GDP. “That intuitively is sensible, as a result of GDP is only a measure of financial exercise – so it follows that there have to be at the least that quantity of funds going forwards and backwards between financial actors,” Hayes added.

With these calculations, Hayes predicts the next outcomes: If the dimensions of the AI economic system reaches 5%, the median estimation suggests a BTC worth of $47,260, whereas in a mania state of affairs, the Bitcoin worth would surge to $152,589.

If the dimensions of the AI Financial system reaches 10%, the median estimation initiatives a BTC worth of $63,520, with a mania state of affairs probably pushing the value to $274,197. If the dimensions of AI Financial system reaches 30%, the median estimation is $128,561 per BTC, in a mania state of affairs the Bitcoin worth might attain a whopping worth of $760,591.

At press time, the Bitcoin worth stood at $30,141 after sweeping the vary low as soon as once more yesterday.

Featured picture from Forbes, chart from TradingView.com

[ad_2]

Source link