[ad_1]

Arbitrum, a distinguished Layer-2 (L2) scaling resolution, has been on a exceptional upward trajectory because the launch of its native token, ARB, in March 2023. The previous 30 days witnessed a staggering 74% surge in ARB’s worth, underscoring the rising market curiosity within the protocol.

Notably, Arbitrum’s every day decentralized alternate (DEX) quantity has skilled a major surge, propelling the protocol to surpass Ethereum (ETH) for the primary time on this key metric.

This milestone highlights Arbitrum’s rising adoption and recognition for its scalability throughout the decentralized finance (DeFi) ecosystem.

Arbitrum Units New DEX Data

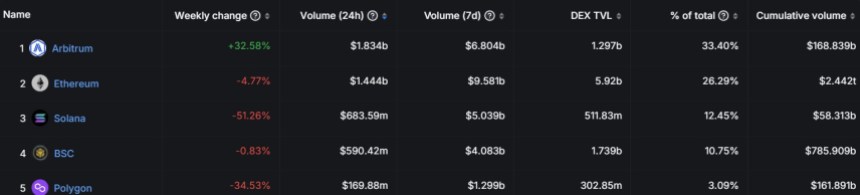

In line with data from DefiLlama, Arbitrum’s every day DEX quantity reached a powerful $1.834 billion over the previous 24 hours, surpassing Ethereum’s quantity of $1.444 billion. Analyzing DefiLlama’s knowledge, it turns into evident that Arbitrum’s development extends past every day DEX quantity alone.

The weekly change in ARB’s worth soared by 32.58%, showcasing the token’s sturdy efficiency available in the market. Furthermore, Arbitrum’s seven-day quantity reached a powerful $6.804 billion, indicating strong buying and selling exercise on the protocol.

When it comes to complete worth locked (TVL) in DEX, Arbitrum accounted for $1.297 billion, constituting 33.40% of the full TVL. Compared, Ethereum’s TVL stood at $5.92 billion, making up 26.29% of the full. This demonstrates Arbitrum’s rising prominence as customers more and more acknowledge its potential for environment friendly and safe decentralized buying and selling.

ARB’s Monetary Metrics Soar

Additional demonstrating the expansion of the protocol’s ecosystem, token terminal data exhibits that Arbitrum’s market capitalization (in circulation) has elevated by a powerful 83.84% to $2.56 billion.

The revenue generated by Arbitrum over the previous 30 days has additionally skilled exceptional development, with a 79.82% improve to succeed in $11.66 million.

Moreover, wanting on the totally diluted market capitalization, Arbitrum has witnessed an an identical 83.84% rise to succeed in $20.07 billion.

Arbitrum’s income on an annualized foundation has seen a major increase, surging by 101.67% to succeed in $141.81 million. This determine represents the projected income for a full 12 months based mostly on the present monthly revenue, underscoring the protocol’s sustained development.

When it comes to charges generated, Arbitrum’s 30-day figures have surged by 79.82% to succeed in $11.66 million, demonstrating the protocol’s skill to seize a major share of transactional charges inside its ecosystem.

On an annualized foundation, charges have soared by 101.67% to succeed in $141.81 million, additional validating the protocol’s income development and financial potential.

Nonetheless, the protocol’s native token, ARB, is buying and selling at $1.8962, down over 8% prior to now 24 hours and beneath its all-time excessive (ATH) of $2.11 set on Thursday. Regardless of this pullback, it’s nonetheless up 36% over the previous 14 days, demonstrating the token’s bullish momentum.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site fully at your personal danger.

[ad_2]

Source link