[ad_1]

Bloomberg analyst Eric Balchunas has reduced the possibility of the SEC denying a spot Bitcoin ETF to simply 5%, with fellow Bloomberg reporter James Seyffart indicating solely black swan interventions from Gary Gensler or the Biden administration attainable routes to denial.

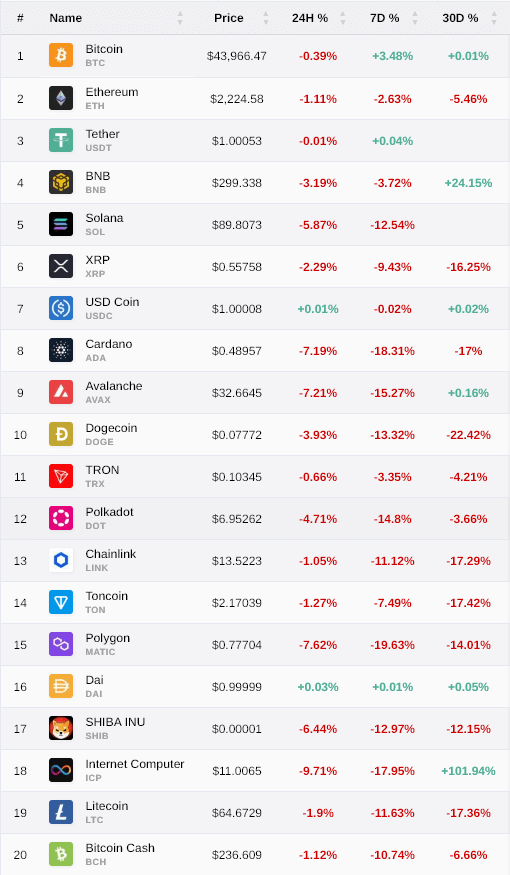

Apparently, over the weekend, with the normal markets closed, crypto continued to commerce as common, with Bitcoin buying and selling sideways and the remainder of the market recording a substantial sell-off. Bitcoin traded between $43,500 and $44,400, exhibiting a mere 2% swing. As of press time, the biggest digital asset by market cap is bang in the midst of this vary at $44,000 per CryptoSlate knowledge.

Nonetheless, altcoins similar to BNB, Solana, Cardano, Avalanche, Dogecoin, Polkadot, Polygon, Shiba Inu, and ICP are all down a minimum of 3% and as a lot as 9.7% as of press time.

Probably the most resilient altcoins look like Ethereum, XRP, Tron, Chainlink Litecoin, and Bitcoin Money, which, whereas all nonetheless down, have recorded lower than a 3% decline over the previous 24 hours.

Since Saturday, Jan. 6, Bitcoin dominance has risen by 1.5%, reaching a peak of 54% earlier than retracing barely this morning, indicating the main digital asset is solidifying its place out there forward of a possible landmark approval this week.

One of many largest losers of the weekend, Solana, fell as a lot as 13% towards Bitcoin over the weekend and remains to be down round 9%. Solana peaked at $126 on Dec. 26, 2023, but it has fallen 28% within the 13 days since to commerce, as of press time, at $90.

Bitcoin has recovered from its cycle low of 38% dominance within the crypto market in mid-2023 to claw again to 54% on the hype of a attainable spot Bitcoin ETF. This 39% surge places its dominance on the highest degree since April 2021, erasing all the floor the remainder of the altcoin market made on the asset over the past bull run.

Since Ethereum’s launch in 2015, Bitcoin dominance peaked initially of 2021 at 75% earlier than falling dramatically all through the bull market, ultimately buying and selling inside the 39% – 48% vary for round 760 days. Nonetheless, following the previous two Bitcoin halves, BTC dominance has fallen persistently, with a drop of 64% and 38%, respectively, marking bottoms after round 510 days.

Most apparently, as highlighted on the indicator on the backside of the above chart, Bitcoin dominance has had a near-perfect correlation with Bitcoin’s value because the begin of 2023, the longest interval of correlation since Ethereum’s entrance into the market.

This week is about to be one of many largest ever for Bitcoin as all eyes are on the spot Bitcoin ETF approval course of. A call both approach is bound to impact your entire market with volatility anticipated throughout the board.

[ad_2]

Source link